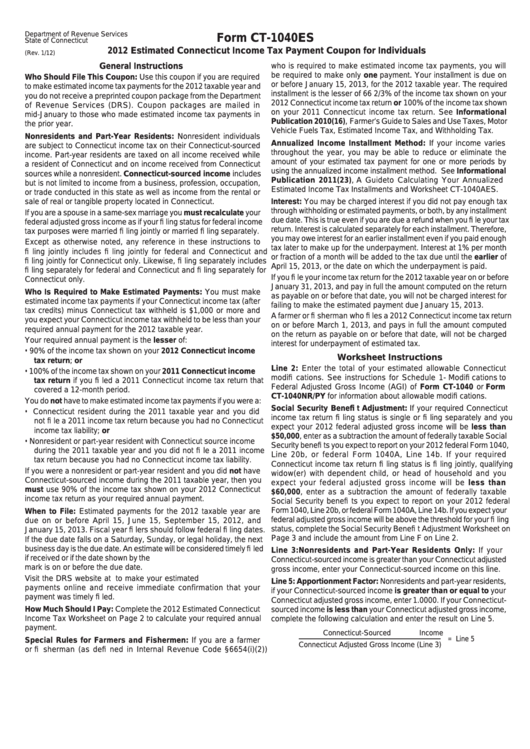

Department of Revenue Services

Form CT-1040ES

State of Connecticut

2012 Estimated Connecticut Income Tax Payment Coupon for Individuals

(Rev. 1/12)

General Instructions

who is required to make estimated income tax payments, you will

be required to make only one payment. Your installment is due on

Who Should File This Coupon: Use this coupon if you are required

or before January 15, 2013, for the 2012 taxable year. The required

to make estimated income tax payments for the 2012 taxable year and

installment is the lesser of 66 2/3% of the income tax shown on your

you do not receive a preprinted coupon package from the Department

2012 Connecticut income tax return or 100% of the income tax shown

of Revenue Services (DRS). Coupon packages are mailed in

on your 2011 Connecticut income tax return. See Informational

mid-January to those who made estimated income tax payments in

Publication 2010(16), Farmer’s Guide to Sales and Use Taxes, Motor

the prior year.

Vehicle Fuels Tax, Estimated Income Tax, and Withholding Tax.

Nonresidents and Part-Year Residents: Nonresident individuals

Annualized Income Installment Method: If your income varies

are subject to Connecticut income tax on their Connecticut-sourced

throughout the year, you may be able to reduce or eliminate the

income. Part-year residents are taxed on all income received while

amount of your estimated tax payment for one or more periods by

a resident of Connecticut and on income received from Connecticut

using the annualized income installment method. See Informational

sources while a nonresident. Connecticut-sourced income includes

Publication 2011(23), A Guide to Calculating Your Annualized

but is not limited to income from a business, profession, occupation,

Estimated Income Tax Installments and Worksheet CT-1040AES.

or trade conducted in this state as well as income from the rental or

sale of real or tangible property located in Connecticut.

Interest: You may be charged interest if you did not pay enough tax

through withholding or estimated payments, or both, by any installment

If you are a spouse in a same-sex marriage you must recalculate your

due date. This is true even if you are due a refund when you fi le your tax

federal adjusted gross income as if your fi ling status for federal income

return. Interest is calculated separately for each installment. Therefore,

tax purposes were married fi ling jointly or married fi ling separately.

you may owe interest for an earlier installment even if you paid enough

Except as otherwise noted, any reference in these instructions to

tax later to make up for the underpayment. Interest at 1% per month

fi ling jointly includes fi ling jointly for federal and Connecticut and

or fraction of a month will be added to the tax due until the earlier of

fi ling jointly for Connecticut only. Likewise, fi ling separately includes

April 15, 2013, or the date on which the underpayment is paid.

fi ling separately for federal and Connecticut and fi ling separately for

If you fi le your income tax return for the 2012 taxable year on or before

Connecticut only.

January 31, 2013, and pay in full the amount computed on the return

Who Is Required to Make Estimated Payments: You must make

as payable on or before that date, you will not be charged interest for

estimated income tax payments if your Connecticut income tax (after

failing to make the estimated payment due January 15, 2013.

tax credits) minus Connecticut tax withheld is $1,000 or more and

A farmer or fi sherman who fi les a 2012 Connecticut income tax return

you expect your Connecticut income tax withheld to be less than your

on or before March 1, 2013, and pays in full the amount computed

required annual payment for the 2012 taxable year.

on the return as payable on or before that date, will not be charged

Your required annual payment is the lesser of:

interest for underpayment of estimated tax.

• 90% of the income tax shown on your 2012 Connecticut income

Worksheet Instructions

tax return; or

Line 2: Enter the total of your estimated allowable Connecticut

• 100% of the income tax shown on your 2011 Connecticut income

modifi cations. See instructions for Schedule 1 - Modifi cations to

tax return if you fi led a 2011 Connecticut income tax return that

Federal Adjusted Gross Income (AGI) of Form CT-1040 or Form

covered a 12-month period.

CT-1040NR/PY for information about allowable modifi cations.

You do not have to make estimated income tax payments if you were a:

Social Security Benefi t Adjustment: If your required Connecticut

• Connecticut resident during the 2011 taxable year and you did

income tax return fi ling status is single or fi ling separately and you

not fi le a 2011 income tax return because you had no Connecticut

expect your 2012 federal adjusted gross income will be less than

income tax liability; or

$50,000, enter as a subtraction the amount of federally taxable Social

• Nonresident or part-year resident with Connecticut source income

Security benefi ts you expect to report on your 2012 federal Form 1040,

during the 2011 taxable year and you did not fi le a 2011 income

Line 20b, or federal Form 1040A, Line 14b. If your required

tax return because you had no Connecticut income tax liability.

Connecticut income tax return fi ling status is fi ling jointly, qualifying

If you were a nonresident or part-year resident and you did not have

widow(er) with dependent child, or head of household and you

Connecticut-sourced income during the 2011 taxable year, then you

expect your federal adjusted gross income will be less than

must use 90% of the income tax shown on your 2012 Connecticut

$60,000, enter as a subtraction the amount of federally taxable

income tax return as your required annual payment.

Social Security benefi ts you expect to report on your 2012 federal

Form 1040, Line 20b, or federal Form 1040A, Line 14b. If you expect your

When to File: Estimated payments for the 2012 taxable year are

federal adjusted gross income will be above the threshold for your fi ling

due on or before April 15, June 15, September 15, 2012, and

status, complete the Social Security Benefi t Adjustment Worksheet on

January 15, 2013. Fiscal year fi lers should follow federal fi ling dates.

Page 3 and include the amount from Line F on Line 2.

If the due date falls on a Saturday, Sunday, or legal holiday, the next

business day is the due date. An estimate will be considered timely fi led

Line 3: Nonresidents and Part-Year Residents Only: If your

if received or if the date shown by the U.S. Postal Service cancellation

Connecticut-sourced income is greater than your Connecticut adjusted

mark is on or before the due date.

gross income, enter your Connecticut-sourced income on this line.

Visit the DRS website at to make your estimated

Line 5: Apportionment Factor: Nonresidents and part-year residents,

payments online and receive immediate confirmation that your

if your Connecticut-sourced income is greater than or equal to your

payment was timely fi led.

Connecticut adjusted gross income, enter 1.0000. If your Connecticut-

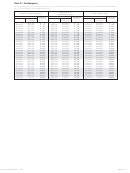

How Much Should I Pay: Complete the 2012 Estimated Connecticut

sourced income is less than your Connecticut adjusted gross income,

Income Tax Worksheet on Page 2 to calculate your required annual

complete the following calculation and enter the result on Line 5.

payment.

Connecticut-Sourced Income

= Line 5

Special Rules for Farmers and Fishermen: If you are a farmer

Connecticut Adjusted Gross Income (Line 3)

or fi sherman (as defi ned in Internal Revenue Code §6654(i)(2))

1

1 2

2 3

3 4

4 5

5 6

6