Form R-20082 - Louisiana Taxpayer'S Bill Of Rights October 1998

ADVERTISEMENT

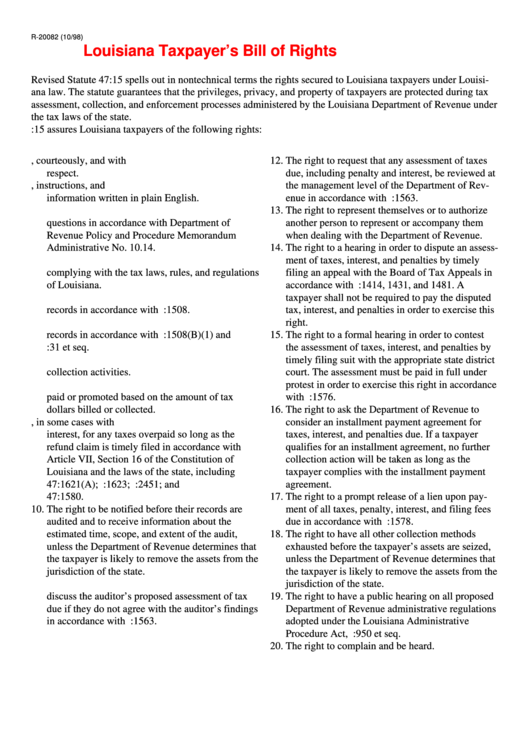

R-20082 (10/98)

Louisiana Taxpayer’s Bill of Rights

Revised Statute 47:15 spells out in nontechnical terms the rights secured to Louisiana taxpayers under Louisi-

ana law. The statute guarantees that the privileges, privacy, and property of taxpayers are protected during tax

assessment, collection, and enforcement processes administered by the Louisiana Department of Revenue under

the tax laws of the state.

R.S. 47:15 assures Louisiana taxpayers of the following rights:

1. The right to be treated fairly, courteously, and with

12. The right to request that any assessment of taxes

respect.

due, including penalty and interest, be reviewed at

2. The right to have all tax forms, instructions, and

the management level of the Department of Rev-

information written in plain English.

enue in accordance with R.S. 47:1563.

3. The right to prompt and accurate answers to their

13. The right to represent themselves or to authorize

questions in accordance with Department of

another person to represent or accompany them

Revenue Policy and Procedure Memorandum

when dealing with the Department of Revenue.

Administrative No. 10.14.

14. The right to a hearing in order to dispute an assess-

4. The right to ask for and receive assistance in

ment of taxes, interest, and penalties by timely

complying with the tax laws, rules, and regulations

filing an appeal with the Board of Tax Appeals in

of Louisiana.

accordance with R.S. 47:1414, 1431, and 1481. A

5. The right to strict confidentiality of their tax

taxpayer shall not be required to pay the disputed

records in accordance with R.S. 47:1508.

tax, interest, and penalties in order to exercise this

6. The right to review and receive a copy of their tax

right.

records in accordance with R.S. 47:1508(B)(1) and

15. The right to a formal hearing in order to contest

R.S. 44:31 et seq.

the assessment of taxes, interest, and penalties by

7. The right to be free from harassment in audits and

timely filing suit with the appropriate state district

collection activities.

court. The assessment must be paid in full under

8. The right to be served by employees who are not

protest in order to exercise this right in accordance

paid or promoted based on the amount of tax

with R.S. 47:1576.

dollars billed or collected.

16. The right to ask the Department of Revenue to

9. The right to receive a refund, in some cases with

consider an installment payment agreement for

interest, for any taxes overpaid so long as the

taxes, interest, and penalties due. If a taxpayer

refund claim is timely filed in accordance with

qualifies for an installment agreement, no further

Article VII, Section 16 of the Constitution of

collection action will be taken as long as the

Louisiana and the laws of the state, including R.S.

taxpayer complies with the installment payment

47:1621(A); R.S. 47:1623; R.S. 47:2451; and R.S.

agreement.

47:1580.

17. The right to a prompt release of a lien upon pay-

10. The right to be notified before their records are

ment of all taxes, penalty, interest, and filing fees

audited and to receive information about the

due in accordance with R.S. 47:1578.

estimated time, scope, and extent of the audit,

18. The right to have all other collection methods

unless the Department of Revenue determines that

exhausted before the taxpayer’s assets are seized,

the taxpayer is likely to remove the assets from the

unless the Department of Revenue determines that

jurisdiction of the state.

the taxpayer is likely to remove the assets from the

11. The right to request a meeting with the auditor to

jurisdiction of the state.

discuss the auditor’s proposed assessment of tax

19. The right to have a public hearing on all proposed

due if they do not agree with the auditor’s findings

Department of Revenue administrative regulations

in accordance with R.S. 47:1563.

adopted under the Louisiana Administrative

Procedure Act, R.S. 49:950 et seq.

20. The right to complain and be heard.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1