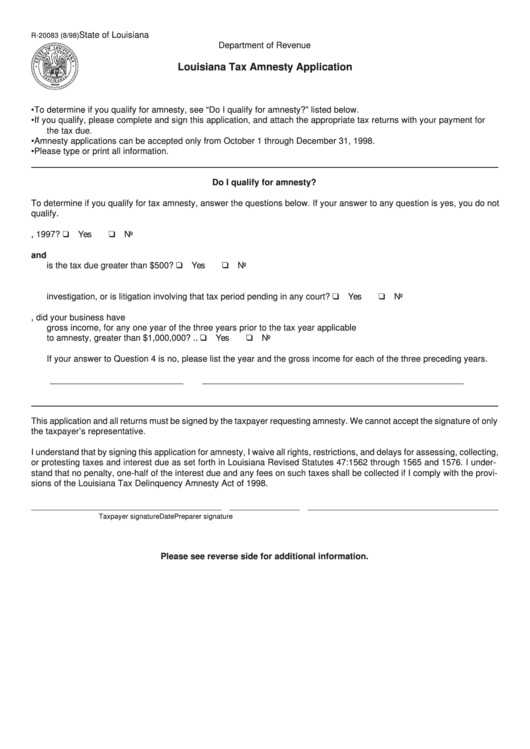

State of Louisiana

R-20083 (8/98)

Department of Revenue

Louisiana Tax Amnesty Application

•

To determine if you qualify for amnesty, see “Do I qualify for amnesty?” listed below.

•

If you qualify, please complete and sign this application, and attach the appropriate tax returns with your payment for

the tax due.

•

Amnesty applications can be accepted only from October 1 through December 31, 1998.

•

Please type or print all information.

Do I qualify for amnesty?

To determine if you qualify for tax amnesty, answer the questions below. If your answer to any question is yes, you do not

qualify.

1. Does the tax period for which amnesty is being requested end after July 1, 1997? .......................

Yes

No

2. Have you been contacted by the Department about your tax delinquency and

is the tax due greater than $500? ....................................................................................................

Yes

No

3. Is the tax period for which amnesty is being requested included in any civil or criminal

investigation, or is litigation involving that tax period pending in any court? ...................................

Yes

No

4. If you are applying for amnesty on behalf of a business, did your business have

gross income, for any one year of the three years prior to the tax year applicable

to amnesty, greater than $1,000,000? .............................................................................................

Yes

No

If your answer to Question 4 is no, please list the year and the gross income for each of the three preceding years.

____________________________

____________________________

___________________________

This application and all returns must be signed by the taxpayer requesting amnesty. We cannot accept the signature of only

the taxpayer’s representative.

I understand that by signing this application for amnesty, I waive all rights, restrictions, and delays for assessing, collecting,

or protesting taxes and interest due as set forth in Louisiana Revised Statutes 47:1562 through 1565 and 1576. I under-

stand that no penalty, one-half of the interest due and any fees on such taxes shall be collected if I comply with the provi-

sions of the Louisiana Tax Delinquency Amnesty Act of 1998.

Taxpayer signature

Date

Preparer signature

Please see reverse side for additional information.

1

1 2

2