Form Sd-1 - Declaration Of Estimated Spencerville Income Tax - 2006

ADVERTISEMENT

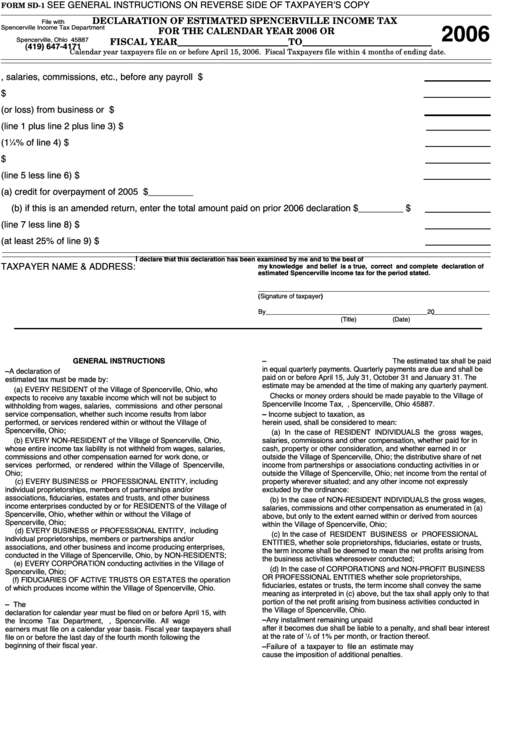

FORM SD-1

SEE GENERAL INSTRUCTIONS ON REVERSE SIDE OF TAXPAYER’S COPY

DECLARATION OF ESTIMATED SPENCERVILLE INCOME TAX

FORM SD-1

File with

FOR THE CALENDAR YEAR 2006 OR

Spencerville Income Tax Department

2006

P.O. Box 57

FISCAL YEAR________________________TO____________________________

Spencerville, Ohio 45887

(419) 647-4171

Calendar year taxpayers file on or before April 15, 2006. Fiscal Taxpayers file within 4 months of ending date.

1. Estimated income from wages, salaries, commissions, etc., before any payroll deductions.............. $

2. Estimated net rentals including farm rentals and other income.......................................................... $

3. Estimated net profit (or loss) from business or profession.................................................................. $

4. Total estimated income subject to tax (line 1 plus line 2 plus line 3)................................................... $

5. Estimated tax (1

1

⁄

% of line 4).............................................................................................................. $

4

6. Estimated Spencerville tax withheld or to be withheld during year by your employer......................... $

7. Estimated Spencerville tax per this declaration (line 5 less line 6)..................................................... $

8. Less (a) credit for overpayment of 2005 return.............................................................. $_________

(b) if this is an amended return, enter the total amount paid on prior 2006 declaration $_________ $

9. Balance of estimated tax (line 7 less line 8)........................................................................................ $

10. Amount paid with this declaration (at least 25% of line 9)................................................................. $

I

declare that this declaration has been examined by me and to the best of

TAXPAYER NAME & ADDRESS:

my knowledge and belief is a true, correct and complete declaration of

estimated Spencerville income tax for the period stated.

(Signature of taxpayer)

By_____________________________________________20

(Title)

(Date)

GENERAL INSTRUCTIONS

3. PAYMENT OF ESTIMATED TAX – The estimated tax shall be paid

in equal quarterly payments. Quarterly payments are due and shall be

1.

WHO MUST MAKE A DECLARATION – A declaration of

paid on or before April 15, July 31, October 31 and January 31. The

estimated tax must be made by:

estimate may be amended at the time of making any quarterly payment.

(a) EVERY RESIDENT of the Village of Spencerville, Ohio, who

Checks or money orders should be made payable to the Village of

expects to receive any taxable income which will not be subject to

Spencerville Income Tax, P.O. Box 57, Spencerville, Ohio 45887.

withholding from wages, salaries, commissions and other personal

service compensation, whether such income results from labor

4.

WHAT IS TAXABLE INCOME – Income subject to taxation, as

performed, or services rendered within or without the Village of

herein used, shall be considered to mean:

Spencerville, Ohio;

(a) In the case of RESIDENT INDIVIDUALS the gross wages,

(b) EVERY NON-RESIDENT of the Village of Spencerville, Ohio,

salaries, commissions and other compensation, whether paid for in

whose entire income tax liability is not withheld from wages, salaries,

cash, property or other consideration, and whether earned in or

commissions and other compensation earned for work done, or

outside the Village of Spencerville, Ohio; the distributive share of net

services performed, or rendered within the Village of Spencerville,

income from partnerships or associations conducting activities in or

Ohio;

outside the Village of Spencerville, Ohio; net income from the rental of

(c) EVERY BUSINESS or PROFESSIONAL ENTITY, including

property wherever situated; and any other income not expressly

individual

proprietorships,

members

of

partnerships

and/or

excluded by the ordinance:

associations, fiduciaries, estates and trusts, and other business

(b) In the case of NON-RESIDENT INDIVIDUALS the gross wages,

income enterprises conducted by or for RESIDENTS of the Village of

salaries, commissions and other compensation as enumerated in (a)

Spencerville, Ohio, whether within or without the Village of

above, but only to the extent earned within or derived from sources

Spencerville, Ohio;

within the Village of Spencerville, Ohio;

(d) EVERY BUSINESS or PROFESSIONAL ENTITY, including

(c) In the case of RESIDENT BUSINESS or PROFESSIONAL

individual

proprietorships,

members

or

partnerships

and/or

ENTITIES, whether sole proprietorships, fiduciaries, estate or trusts,

associations, and other business and income producing enterprises,

the term income shall be deemed to mean the net profits arising from

conducted in the Village of Spencerville, Ohio, by NON-RESIDENTS;

the business activities wheresoever conducted;

(e) EVERY CORPORATION conducting activities in the Village of

(d) In the case of CORPORATIONS and NON-PROFIT BUSINESS

Spencerville, Ohio;

OR PROFESSIONAL ENTITIES whether sole proprietorships,

(f) FIDUCIARIES OF ACTIVE TRUSTS OR ESTATES the operation

fiduciaries, estates or trusts, the term income shall convey the same

of which produces income within the Village of Spencerville, Ohio.

meaning as interpreted in (c) above, but the tax shall apply only to that

portion of the net profit arising from business activities conducted in

2. WHEN AND WHERE TO FILE DECLARATION

–

The

the Village of Spencerville, Ohio.

declaration for calendar year must be filed on or before April 15, with

5.

INTEREST AND PENALTIES – Any installment remaining unpaid

the Income Tax Department, P.O. Box 57, Spencerville. All wage

after it becomes due shall be liable to a penalty, and shall bear interest

earners must file on a calendar year basis. Fiscal year taxpayers shall

at the rate of

1

/

of 1% per month, or fraction thereof.

file on or before the last day of the fourth month following the

2

beginning of their fiscal year.

6.

VIOLATIONS – Failure of a taxpayer to file an estimate may

cause the imposition of additional penalties.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1