Form R-I - City Of Dayton, Ohio Income Tax Return Form Individual Or Joint Filing 2006 Page 2

ADVERTISEMENT

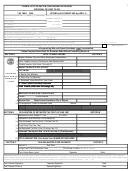

Tax Year ____________ Worksheet

Account Name_______________________ Account # or SS#__________________________________

SECTION D Retired and Taxpayers with NO TAXABLE INCOME check appropriate explanation(s)

[ ] Retired with No Taxable Income

[ ] All Tax Withheld @ 2.25% By My Employer

[ ] Lived and Worked Outside Of Dayton

[ ] Active Duty Military

[ ] Business or Rental Sold on __________________ to _________________ or Closed on ______________

[ ] I certify that I had NO Schedules E, C, K1, 2106, 4797, or 1099-MISC. income or losses reported on my Federal Tax Return.

SECTION A

TOTAL W-2 WAGES

Employer's Name

Work Address

Dayton tax

Other City Tax Total Taxable Wages*

Total Taxable Wages

*Total Taxable Wages: Box 5 is usually, but not always, the highest gross wage. Use the largest amount from boxes

1, 3, 5, or 18, of your W-2 tax forms. Please provide a written explanation if Box 5 is not the highest wage figure.

SECTION E

OTHER INCOME OR LOSS AND FORM 2106 EXPENSE

List all income as reported to the IRS on each of the following attached Schedules or Forms.

Profit and/or Loss

Profit and/or Loss

Profit and/or Loss

Schedule C

Form 4797

Schedule K-1

Schedule C

Schedule K-1

Form 1099-MISC

Schedule E

Form 1099-MISC

Other

Schedule E

Form 1099-MISC

Other

Total to Line 2

Total to Line 2

Total to Line 2

Please note losses are not deductible against W-2 wages.

T otal to Line 2. Form 2106 expenses are deductible from wages.

Form 2106 Expenses: _______________________________

SCHEDULE Y

ALLOCATION OF PROFITS

A. Located everywhere

Schedule Y

B. Located in Dayton

C. Percentage (b/a)

1. Original Cost of Real and Tangible Personal Property

Gross Annual Rentals Paid Multiplied by 8

Total Step 1

2. Gross Receipts from Sales Made and/or Work or Services Performed

3. Wages, Salaries and Other Compensation Paid

4. Total Percentages

5. Average Percentage (Total Percentages/Number of Percentages Used)

Additional addresses or comments:

Important Information: Mail Return with:

PAYMENT DUE to:

City Of Dayton

Dayton, Oh 45401-8746

Division of Revenue and Taxation

PO Box 8746

NON-PAYMENT to:

City Of Dayton

Dayton, Oh 45401-1830

Division of Revenue and Taxation

PO Box 1830

REFUND REQUEST to:

City Of Dayton

Dayton, Oh 45401-1823

Division of Revenue and Taxation

PO Box 1823

Completed Tax Returns will be accepted through the Fax as an original document. All necessary information and

attachments must be included. Income tax preparation service will be provided only to those households earning $35,000 or less.

In the event your check is returned unpaid for insufficient funds or uncollected funds, we may electronically debit your account

for the principal amount of the check.

A return check fee as set forth by the Director of Finance will be assessed. Currently the return check fee is $25.00.

Forms are available at

Online tax preparation tool:

Forms line 937-333-3501

E-mail for forms:

Forms Available: Office Hours: Monday through Friday 8:00 AM to 5:00 PM City Hall, First Floor Lobby, 101 W Third St. Dayton, Ohio 45402

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2