Est Quarterly Payment Of Estimated Net Profit Tax - State Of Ohio - 2007

ADVERTISEMENT

1. Your Four (4) 2007 Estimated Declaration Vouchers are included in this package.

Voucher #1, Due April 16, 2007 is at the bottom of this sheet. Voucher #2, Due July 31, 2007, Voucher #3, Due

October 31, 2007 and Voucher #4, Due January 31, 2008 are on the next page.

(Fiscal Year Basis Taxpayers – Please substitute your appropriate dates on vouchers.)

2. Estimated Tax is to be paid in quarterly installments on all earned income with no city withholding tax. No estimated tax

payments are necessary if annual tax due is less than $100.

3. Make sure your Remittance for each quarter is included with your Estimate Voucher. Make your checks payable to: City of Sylvania.

Every taxpayer who anticipates any taxable income from any source whatsoever, including business enterprise, subject to the tax imposed by

Chapter 171 Sylvania Codified Ordinances 1999 as amended, shall file a declaration setting forth such estimated profit or loss from such

business activity together with the estimated tax due thereon, if any.

(a) Such declaration shall be filed on or before April 16 and thereafter of each succeeding year during the life of this chapter or

within three (3) months after the date the taxpayer becomes subject to the tax hereunder for the first time.

(b) Exception: if a taxpayer’s taxable income is wholly from wages from which the tax of 1-1/2% thereon will be withheld and remitted to the

City of Sylvania or other city, such taxpayer need not file a declaration. If total yearly tax will be less than $100.00, the taxpayer need not

file a declaration.

(c) The filing of the Declaration of Estimated Sylvania Income Tax requires the taxpayer to pay the tax in quarterly installments with the first

payment due April 16 and a similar amount shall be paid for each quarter thereafter, as indicated on each quarterly voucher attached. In case

an amended declaration has been duly filed, or the taxpayer is taxable for a portion of the year only, the unpaid balance shall be paid in equal

installments on or before the remaining quarterly payment dates for the calendar year.

(d) If the books are kept on a fiscal year basis differing from the calendar year show the number of months you are reporting and the date on

which your fiscal year ends. Such declaration shall be filed within four (4) months after the start of each fiscal year or period.

(e) Such declaration shall be filed upon a form furnished by, or obtainable upon request from the Commissioner of Taxation.

(f)

The original declaration, or any subsequent amendment thereof, may be increased or decreased on or before any subsequent quarterly

payment date provided for herein.

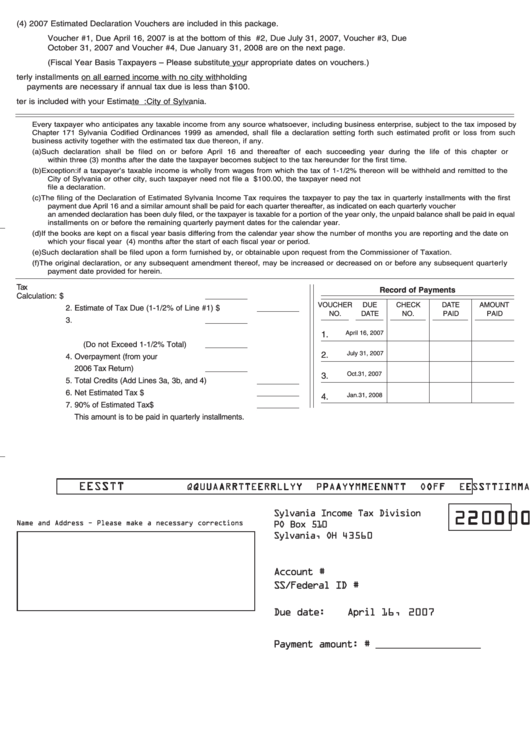

Tax

Record of Payments

Calculation:

1. Estimate of Taxable Income ............$

VOUCHER

DUE

CHECK

DATE

AMOUNT

2. Estimate of Tax Due (1-1/2% of Line #1)..................$

NO.

DATE

NO.

PAID

PAID

3. a. Sylvania Tax Withheld ....................

b. Other City Tax Withheld

April 16, 2007

1.

(Do not Exceed 1-1/2% Total) ........

July 31, 2007

2.

4. Overpayment (from your

2006 Tax Return) ................................

Oct. 31, 2007

3.

5. Total Credits (Add Lines 3a, 3b, and 4) ......................

6. Net Estimated Tax ....................................................$

Jan. 31, 2008

4.

7. 90% of Estimated Tax ..............................................$

This amount is to be paid in quarterly installments.

E E S S T T

Q Q U U A A R R T T E E R R L L Y Y P P A A Y Y M M E E N N T T O O F F E E S S T T I I M M A A T T E E D D N N E E T T P P R R O O F F I I T T T T A A X X

Sylvania Income Tax Division

2 2 0 0 0 0 7 7

Name and Address

Please make a necessary corrections

PO Box 510

Sylvania, OH 43560

Account #

SS/Federal ID #

Due date:

April 16, 2007

Payment amount: # _____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2