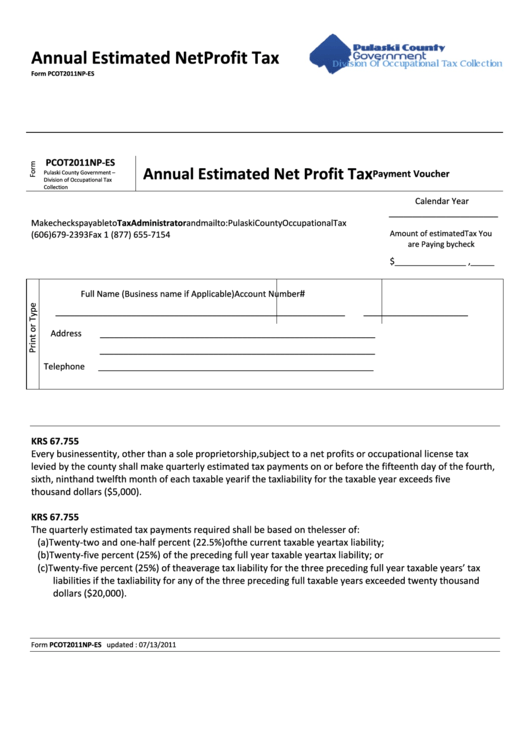

Form Pcot2011np-Es - Annual Estimated Net Profit Tax - Payment Voucher - 2011

ADVERTISEMENT

Annual Estimated Net Profit Tax

Form PCOT2011NP-ES

PCOT2011NP-ES

Annual Estimated Net Profit Tax

Payment Voucher

Pulaski County Government –

Division of Occupational Tax

Collection

Calendar Year

_______________________

Make checks payable to Tax Administrator and mail to: Pulaski County Occupational Tax

Amount of estimated Tax You

Office P.O. Box 658 Somerset KY 42501 Phone (606) 679-2393 Fax 1 (877) 655-7154

are Paying by check

$_______________ ,_____

Fed.ID or SS #

Full Name (Business name if Applicable)

Account Number

___________________________________________

__________________

______________________

Address

__________________________________________________________

__________________________________________________________

Telephone

__________________________________________________________

KRS 67.755

Every business entity, other than a sole proprietorship, subject to a net profits or occupational license tax

levied by the county shall make quarterly estimated tax payments on or before the fifteenth day of the fourth,

sixth, ninth and twelfth month of each taxable year if the tax liability for the taxable year exceeds five

thousand dollars ($5,000).

KRS 67.755

The quarterly estimated tax payments required shall be based on the lesser of:

(a) Twenty-two and one-half percent (22.5%) of the current taxable year tax liability;

(b) Twenty-five percent (25%) of the preceding full year taxable year tax liability; or

(c) Twenty-five percent (25%) of the average tax liability for the three preceding full year taxable years’ tax

liabilities if the tax liability for any of the three preceding full taxable years exceeded twenty thousand

dollars ($20,000).

Form PCOT2011NP-ES updated : 07/13/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1