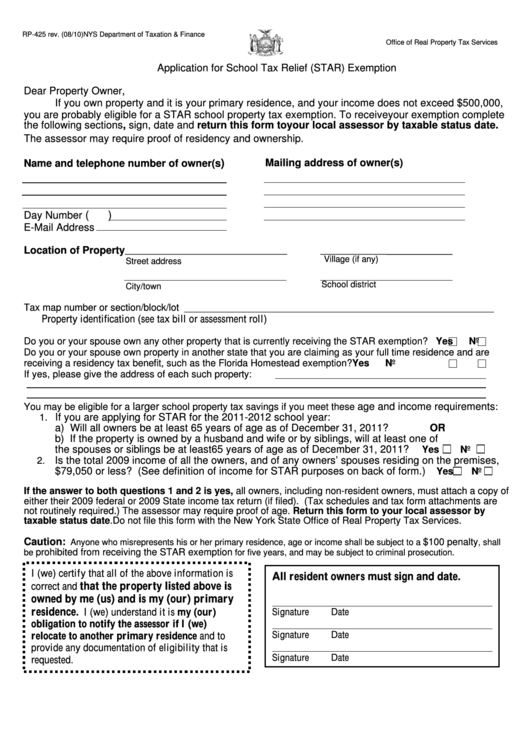

Form Rp-425 - Application For School Tax Relief (Star) Exemption - 2010

ADVERTISEMENT

RP-425 rev. (08/10)

NYS Department of Taxation & Finance

Office of Real Property Tax Services

Application for School Tax Relief (STAR) Exemption

Dear Property Owner,

If you own property and it is your primary residence, and your income does not exceed $500,000,

you are probably eligible for a STAR school property tax exemption. To receive your exemption complete

the following sections, sign, date and return this form to your local assessor by taxable status date.

The assessor may require proof of residency and ownership.

Mailing address of owner(s)

)

Name and telephone number of owner(s

(

)

Day Number

E-Mail Address

Location of Property

Village (if any)

Street address

School district

City/town

Tax map number or section/block/lot __________________________________________________________

Property identification (see tax bill or assessment roll)

Do you or your spouse own any other property that is currently receiving the STAR exemption? Yes

No

Do you or your spouse own property in another state that you are claiming as your full time residence and are

receiving a residency tax benefit, such as the Florida Homestead exemption?

Yes

No

If yes, please give the address of each such property:

larger

age and income requirements

You may be eligible for a

school property tax savings if you meet these

:

If you are applying for STAR for the 2011-2012 school year:

1.

a) Will all owners be at least 65 years of age as of December 31, 2011?

OR

b) If the property is owned by a husband and wife or by siblings, will at least one of

the spouses or siblings be at least 65 years of age as of December 31, 2011?

Yes

No

Is the total 2009 income of all the owners, and of any owners’ spouses residing on the premises,

2.

$79,050 or less? (See definition of income for STAR purposes on back of form.)

Yes

No

If the answer to both questions 1 and 2 is yes, all owners, including non-resident owners, must attach a copy of

either their 2009 federal or 2009 State income tax return (if filed). (Tax schedules and tax form attachments are

not routinely required.) The assessor may require proof of age. Return this form to your local assessor by

taxable status date. Do not file this form with the New York State Office of Real Property Tax Services.

Caution:

$100 penalty

Anyone who misrepresents his or her primary residence, age or income shall be subject to a

, shall

prohibited from receiving the STAR exemption

be

for five years, and may be subject to criminal prosecution.

I (we) certify that all of the above information is

All resident owners must sign and date.

that the property listed above is

correct and

owned by me (us) and is my (our) primary

residence

. I (we) understand it is my (our)

Signature

Date

obligation to notify the assessor if I (we)

Signature

Date

relocate to another primary residence and to

provide any documentation of eligibility that is

Signature

Date

requested.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2