Town Of Brookhaven - Application For School Tax Relief (Star) Exemption

ADVERTISEMENT

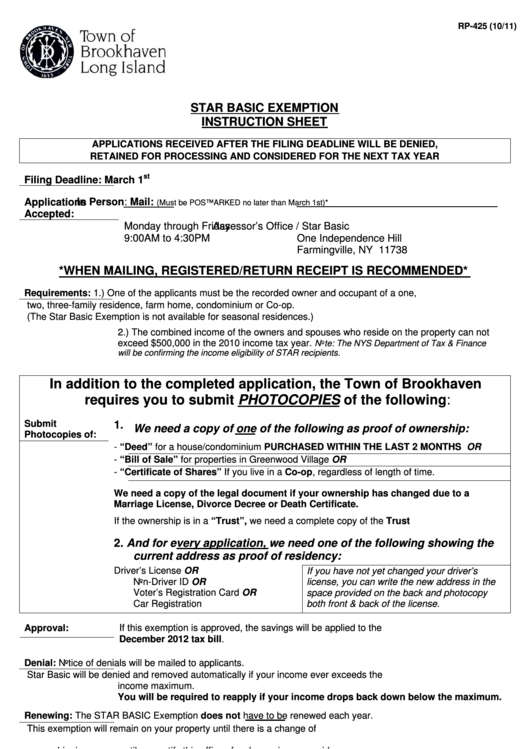

RP-425 (10/11)

STAR BASIC EXEMPTION

INSTRUCTION SHEET

APPLICATIONS RECEIVED AFTER THE FILING DEADLINE WILL BE DENIED,

RETAINED FOR PROCESSING AND CONSIDERED FOR THE NEXT TAX YEAR

st

Filing Deadline:

March 1

Applications

In Person:

Mail:

(Must be POSTMARKED no later than March 1st)*

Accepted:

Monday through Friday

Assessor’s Office / Star Basic

9:00AM to 4:30PM

One Independence Hill

Farmingville, NY 11738

*WHEN MAILING, REGISTERED/RETURN RECEIPT IS RECOMMENDED*

Requirements:

1.) One of the applicants must be the recorded owner and occupant of a one,

two, three-family residence, farm home, condominium or Co-op.

(The Star Basic Exemption is not available for seasonal residences.)

2.) The combined income of the owners and spouses who reside on the property can not

exceed $500,000 in the 2010 income tax year.

Note: The NYS Department of Tax & Finance

will be confirming the income eligibility of STAR recipients.

In addition to the completed application, the Town of Brookhaven

requires you to submit PHOTOCOPIES of the following:

Submit

1. We need a copy of one of the following as proof of ownership:

Photocopies of:

- “Deed” for a house/condominium PURCHASED WITHIN THE LAST 2 MONTHS OR

- “Bill of Sale” for properties in Greenwood Village OR

- “Certificate of Shares” If you live in a Co-op, regardless of length of time.

We need a copy of the legal document if your ownership has changed due to a

Marriage License, Divorce Decree or Death Certificate.

If the ownership is in a “Trust”, we need a complete copy of the Trust

2. And for every application, we need one of the following showing the

current address as proof of residency:

Driver’s License OR

If you have not yet changed your driver’s

Non-Driver ID OR

license, you can write the new address in the

Voter’s Registration Card OR

space provided on the back and photocopy

Car Registration

both front & back of the license.

If this exemption is approved, the savings will be applied to the

Approval:

December 2012 tax bill.

Denial:

Notice of denials will be mailed to applicants.

Star Basic will be denied and removed automatically if your income ever exceeds the

income maximum.

You will be required to reapply if your income drops back down below the maximum.

Renewing:

The STAR BASIC Exemption does not have to be renewed each year.

This exemption will remain on your property until there is a change of

ownership, income or until you notify this office of a change in your residency.

Receipt:

Please complete and return the attached post card “Receipt” with your

application. It will be “Date Stamped” and returned to you.

Your “Date Stamped” Receipt is your ONLY evidence of filing your exemption.

631-451-9017

631-451-9075

631-451-6287

Questions:

631-451-9051

631-451-6205

631-451-6443

631-451-9053

631-451-6250

631-451-6307 (Co-ops)

631-451-6320 (Fax)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3