Form Ftb 1144 - Declaration For The Franchise Tax Board

ADVERTISEMENT

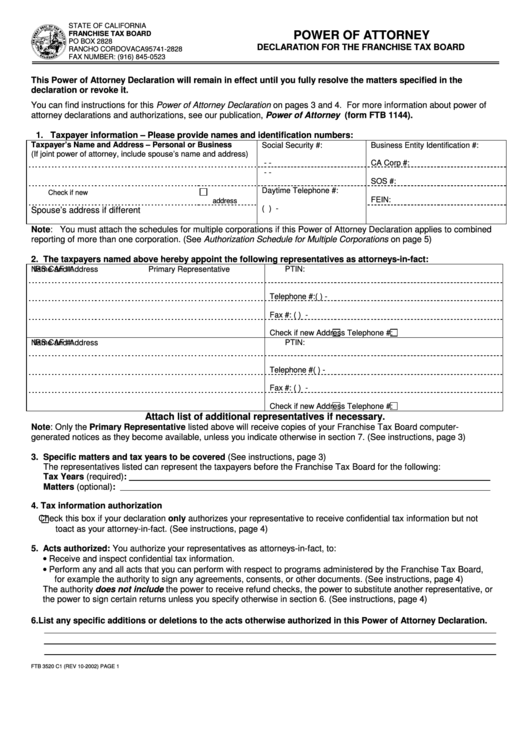

STATE OF CALIFORNIA

FRANCHISE TAX BOARD

POWER OF ATTORNEY

PO BOX 2828

DECLARATION FOR THE FRANCHISE TAX BOARD

RANCHO CORDOVA CA 95741-2828

FAX NUMBER: (916) 845-0523

This Power of Attorney Declaration will remain in effect until you fully resolve the matters specified in the

declaration or revoke it.

You can find instructions for this Power of Attorney Declaration on pages 3 and 4. For more information about power of

attorney declarations and authorizations, see our publication, Power of Attorney (form FTB 1144).

1. Taxpayer information – Please provide names and identification numbers:

Taxpayer’s Name and Address – Personal or Business

Social Security #:

Business Entity Identification #:

(If joint power of attorney, include spouse’s name and address)

-

-

CA Corp #:

-

-

SOS #:

Daytime Telephone #:

Check if new

FEIN:

address

(

)

-

Spouse’s address if different

Note: You must attach the schedules for multiple corporations if this Power of Attorney Declaration applies to combined

reporting of more than one corporation. (See Authorization Schedule for Multiple Corporations on page 5)

2. The taxpayers named above hereby appoint the following representatives as attorneys-in-fact:

Name and Address

Primary Representative

IRS CAF #:

PTIN:

Telephone #:

(

)

-

Fax #:

(

)

-

Check if new

Address

Telephone #:

Name and Address

IRS CAF #:

PTIN:

Telephone #

(

)

-

Fax #:

(

)

-

Check if new

Address

Telephone #:

Attach list of additional representatives if necessary.

Note: Only the Primary Representative listed above will receive copies of your Franchise Tax Board computer-

generated notices as they become available, unless you indicate otherwise in section 7. (See instructions, page 3)

3. Specific matters and tax years to be covered (See instructions, page 3)

The representatives listed can represent the taxpayers before the Franchise Tax Board for the following:

Tax Years (required):

Matters (optional):

4. Tax information authorization

Check this box if your declaration only authorizes your representative to receive confidential tax information but not

to act as your attorney-in-fact. (See instructions, page 4)

5. Acts authorized: You authorize your representatives as attorneys-in-fact, to:

• Receive and inspect confidential tax information.

• Perform any and all acts that you can perform with respect to programs administered by the Franchise Tax Board,

for example the authority to sign any agreements, consents, or other documents. (See instructions, page 4)

The authority does not include the power to receive refund checks, the power to substitute another representative, or

the power to sign certain returns unless you specify otherwise in section 6. (See instructions, page 4)

6. List any specific additions or deletions to the acts otherwise authorized in this Power of Attorney Declaration.

FTB 3520 C1 (REV 10-2002) PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3