Form Ftb 1131 - Privacy Notice - California Franchise Tax Board

ADVERTISEMENT

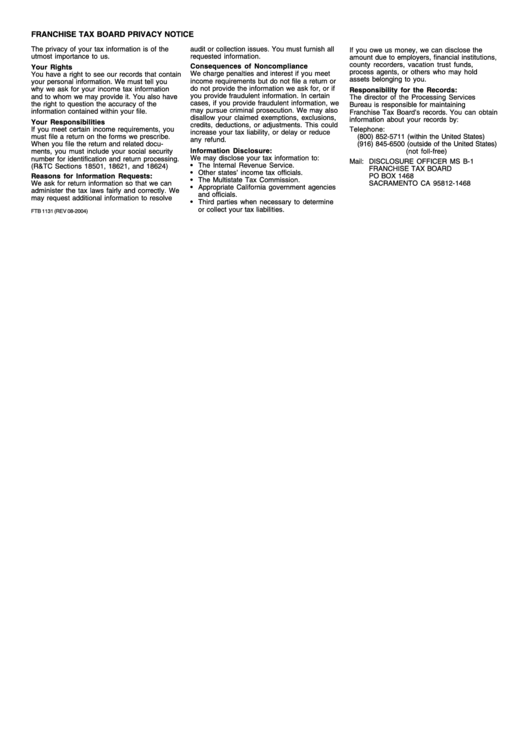

FRANCHISE TAX BOARD PRIVACY NOTICE

The privacy of your tax information is of the

audit or collection issues. You must furnish all

If you owe us money, we can disclose the

utmost importance to us.

requested information.

amount due to employers, financial institutions,

county recorders, vacation trust funds,

Consequences of Noncompliance

Your Rights

process agents, or others who may hold

We charge penalties and interest if you meet

You have a right to see our records that contain

assets belonging to you.

income requirements but do not file a return or

your personal information. We must tell you

do not provide the information we ask for, or if

why we ask for your income tax information

Responsibility for the Records:

you provide fraudulent information. In certain

and to whom we may provide it. You also have

The director of the Processing Services

cases, if you provide fraudulent information, we

the right to question the accuracy of the

Bureau is responsible for maintaining

may pursue criminal prosecution. We may also

information contained within your file.

Franchise Tax Board’s records. You can obtain

disallow your claimed exemptions, exclusions,

information about your records by:

Your Responsibilities

credits, deductions, or adjustments. This could

If you meet certain income requirements, you

Telephone:

increase your tax liability, or delay or reduce

must file a return on the forms we prescribe.

(800) 852-5711 (within the United States)

any refund.

When you file the return and related docu-

(916) 845-6500 (outside of the United States)

Information Disclosure:

ments, you must include your social security

(not foll-free)

We may disclose your tax information to:

number for identification and return processing.

Mail: DISCLOSURE OFFICER MS B-1

• The Internal Revenue Service.

(R&TC Sections 18501, 18621, and 18624)

FRANCHISE TAX BOARD

• Other states’ income tax officials.

Reasons for Information Requests:

PO BOX 1468

• The Multistate Tax Commission.

We ask for return information so that we can

SACRAMENTO CA 95812-1468

• Appropriate California government agencies

administer the tax laws fairly and correctly. We

and officials.

may request additional information to resolve

• Third parties when necessary to determine

or collect your tax liabilities.

FTB 1131 (REV 08-2004)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1