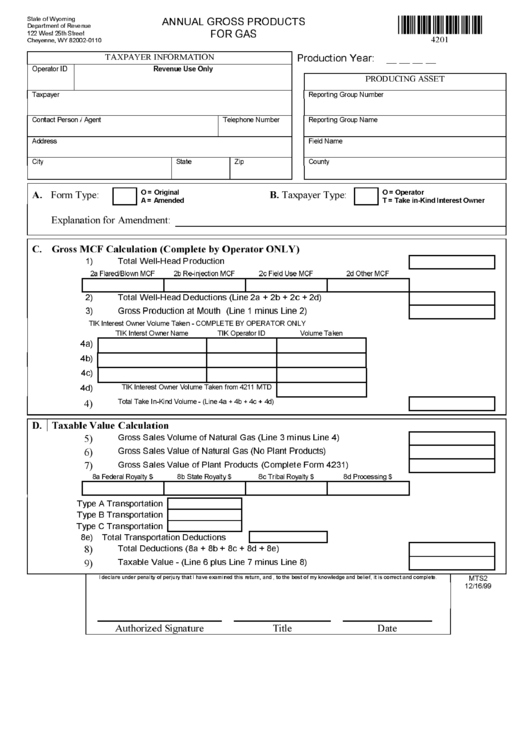

Form Mts2 - Annual Gross Products For Gas

ADVERTISEMENT

ANNUAL GROSS PRODUCTS

State of Wyoming

FOR GAS

Department of Revenue

122 West 25th Street

4201

Cheyenne, WY 82002-0110

TAXPAYER INFORMATION

__ __ __ __

Production Year:

Revenue Use Only

Operator ID

PRODUCING ASSET

Taxpayer

Reporting Group Number

Contact Person / Agent

Telephone Number

Reporting Group Name

Address

Field Name

City

State

Zip

County

O = Original

O = Operator

A.

Form Type:

B.

Taxpayer Type:

A = Amended

T = Take in-Kind Interest Owner

Explanation for Amendment:

C.

Gross MCF Calculation (Complete by Operator ONLY)

Total Well-Head Production

2a Flared/Blown MCF

2b Re-injection MCF

2c Field Use MCF

2d Other MCF

2)

Total Well-Head Deductions (Line 2a + 2b + 2c + 2d)

3)

Gross Production at Mouth (Line 1 minus Line 2)

TIK Interest Owner Volume Taken - COMPLETE BY OPERATOR ONLY

TIK Interst Owner Name

TIK Operator ID

Volume Taken

"=

">

"?

TIK Interest Owner Volume Taken from 4211 MTD

"@

Total Take In-Kind Volume - (Line 4a + 4b + 4c + 4d)

"

D.

Taxable Value Calculation

#

Gross Sales Volume of Natural Gas (Line 3 minus Line 4)

Gross Sales Value of Natural Gas (No Plant Products)

$

Gross Sales Value of Plant Products (Complete Form 4231)

%

8a Federal Royalty $

8b State Royalty $

8c Tribal Royalty $

8d Processing $

Type A Transportation

Type B Transportation

Type C Transportation

8e)

Total Transportation Deductions

Total Deductions (8a + 8b + 8c + 8d + 8e)

&

Taxable Value - (Line 6 plus Line 7 minus Line 8)

'

MTS2

I declare under penalty of perjury that I have examined this return, and , to the best of my knowledge and belief, it is correct and complete.

12/16/99

Authorized Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1