Form 4211 - Annual Gross Products Take In-Kind Balance Sheet For Gas

ADVERTISEMENT

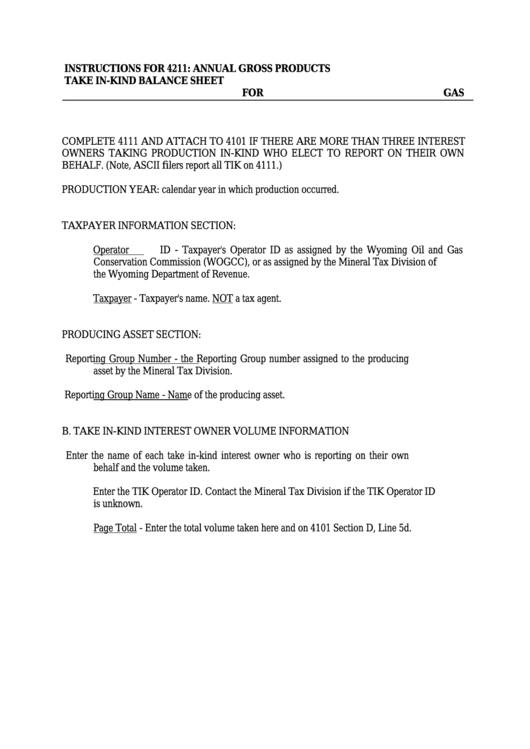

INSTRUCTIONS FOR 4211: ANNUAL GROSS PRODUCTS

TAKE IN-KIND BALANCE SHEET

FOR GAS

COMPLETE 4111 AND ATTACH TO 4101 IF THERE ARE MORE THAN THREE INTEREST

OWNERS TAKING PRODUCTION IN-KIND WHO ELECT TO REPORT ON THEIR OWN

BEHALF. (Note, ASCII filers report all TIK on 4111.)

PRODUCTION YEAR: calendar year in which production occurred.

TAXPAYER INFORMATION SECTION:

Operator ID - Taxpayer's Operator ID as assigned by the Wyoming Oil and Gas

Conservation Commission (WOGCC), or as assigned by the Mineral Tax Division of

the Wyoming Department of Revenue.

Taxpayer - Taxpayer's name. NOT a tax agent.

PRODUCING ASSET SECTION:

Reporting Group Number - the Reporting Group number assigned to the producing

asset by the Mineral Tax Division.

Reporting Group Name - Name of the producing asset.

B. TAKE IN-KIND INTEREST OWNER VOLUME INFORMATION

Enter the name of each take in-kind interest owner who is reporting on their own

behalf and the volume taken.

Enter the TIK Operator ID. Contact the Mineral Tax Division if the TIK Operator ID

is unknown.

Page Total - Enter the total volume taken here and on 4101 Section D, Line 5d.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5