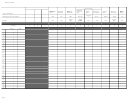

Form Rp-6633 - Assessor'S Report Part 4 - Local Options Adopted For Various Exemptions

ADVERTISEMENT

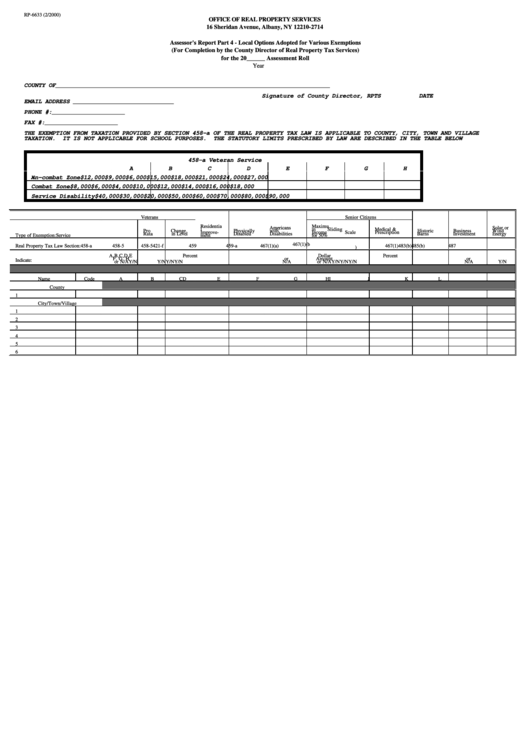

RP-6633 (2/2000)

OFFICE OF REAL PROPERTY SERVICES

16 Sheridan Avenue, Albany, NY 12210-2714

Assessor's Report Part 4 - Local Options Adopted for Various Exemptions

(For Completion by the County Director of Real Property Tax Services)

for the 20______ Assessment Roll

Year

COUNTY OF

_______________________________

__________________________________

______________

Signature of County Director, RPTS

DATE

EMAIL ADDRESS _____________________________

PHONE #:

_____________________

FAX #:

_____________________

THE EXEMPTION FROM TAXATION PROVIDED BY SECTION 458-a OF THE REAL PROPERTY TAX LAW IS APPLICABLE TO COUNTY, CITY, TOWN AND VILLAGE

TAXATION.

IT IS NOT APPLICABLE FOR SCHOOL PURPOSES.

THE STATUTORY LIMITS PRESCRIBED BY LAW ARE DESCRIBED IN THE TABLE BELOW

458-a Veteran Service

A

B

C

D

E

F

G

H

Non-combat Zone

$12,000

$9,000

$6,000

$15,000

$18,000

$21,000

$24,000

$27,000

Combat Zone

$8,000

$6,000

$4,000

$10,000

$12,000

$14,000

$16,000

$18,000

Service Disability

$40,000

$30,000

$20,000

$50,000

$60,000

$70,000

$80,000

$90,000

Veterans

Senior Citizens

Residentia

Maximu

Americans

Solar or

l

m

Sliding

Medical &

Pro

Change

Physically

with

Historic

Business

Wind

Improve-

Income

Scale

Prescription

Rata

in Level

Disabled

Disabilities

Barns

Investment

Energy

Type of Exemption:

Service

ment

for 50%

467(1)(b

Real Property Tax Law Section:

458-a

458-5

458-5

421-f

459

459-a

467(1)(a)

467(1)

483(b)

485(b)

487

)

A,B,C,D,E

Percent

Dollar

Percent

F, G. H

or

Amount

or

Indicate:

or N/A

Y/N

Y/N

Y/N

Y/N

N/A

or N/A

Y/N

Y/N

Y/N

N/A

Y/N

Name

Code

A

B

C

D

E

F

G

H

I

J

K

L

County

1

City/Town/Village

1

2

3

4

5

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6