Form Ct- 4802 - Transmittal Of Informational Returns Reported On Compact Disc

ADVERTISEMENT

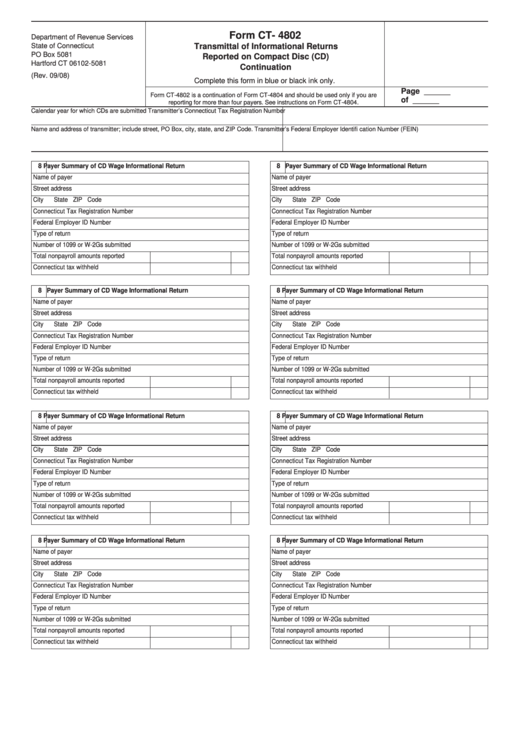

Form CT- 4802

Department of Revenue Services

State of Connecticut

Transmittal of Informational Returns

PO Box 5081

Reported on Compact Disc (CD)

Hartford CT 06102-5081

Continuation

(Rev. 09/08)

Complete this form in blue or black ink only.

Page ______

Form CT-4802 is a continuation of Form CT-4804 and should be used only if you are

of

______

reporting for more than four payers. See instructions on Form CT-4804.

Calendar year for which CDs are submitted

Transmitter’s Connecticut Tax Registration Number

Name and address of transmitter; include street, PO Box, city, state, and ZIP Code.

Transmitter’s Federal Employer Identifi cation Number (FEIN)

8 Payer Summary of CD Wage Informational Return

8 Payer Summary of CD Wage Informational Return

Name of payer

Name of payer

Street address

Street address

City

State

ZIP Code

City

State

ZIP Code

Connecticut Tax Registration Number

Connecticut Tax Registration Number

Federal Employer ID Number

Federal Employer ID Number

Type of return

Type of return

Number of 1099 or W-2Gs submitted

Number of 1099 or W-2Gs submitted

Total nonpayroll amounts reported

Total nonpayroll amounts reported

Connecticut tax withheld

Connecticut tax withheld

8 Payer Summary of CD Wage Informational Return

8 Payer Summary of CD Wage Informational Return

Name of payer

Name of payer

Street address

Street address

City

State

ZIP Code

City

State

ZIP Code

Connecticut Tax Registration Number

Connecticut Tax Registration Number

Federal Employer ID Number

Federal Employer ID Number

Type of return

Type of return

Number of 1099 or W-2Gs submitted

Number of 1099 or W-2Gs submitted

Total nonpayroll amounts reported

Total nonpayroll amounts reported

Connecticut tax withheld

Connecticut tax withheld

8 Payer Summary of CD Wage Informational Return

8 Payer Summary of CD Wage Informational Return

Name of payer

Name of payer

Street address

Street address

City

State

ZIP Code

City

State

ZIP Code

Connecticut Tax Registration Number

Connecticut Tax Registration Number

Federal Employer ID Number

Federal Employer ID Number

Type of return

Type of return

Number of 1099 or W-2Gs submitted

Number of 1099 or W-2Gs submitted

Total nonpayroll amounts reported

Total nonpayroll amounts reported

Connecticut tax withheld

Connecticut tax withheld

8 Payer Summary of CD Wage Informational Return

8 Payer Summary of CD Wage Informational Return

Name of payer

Name of payer

Street address

Street address

City

State

ZIP Code

City

State

ZIP Code

Connecticut Tax Registration Number

Connecticut Tax Registration Number

Federal Employer ID Number

Federal Employer ID Number

Type of return

Type of return

Number of 1099 or W-2Gs submitted

Number of 1099 or W-2Gs submitted

Total nonpayroll amounts reported

Total nonpayroll amounts reported

Connecticut tax withheld

Connecticut tax withheld

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1