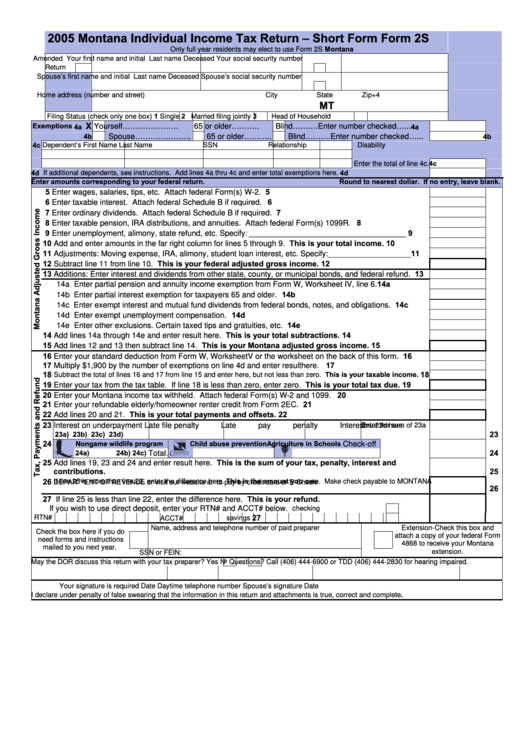

2005

Montana Individual Income Tax Return – Short Form

Form 2S

Montana

Only full year residents may elect to use Form 2S

Amended

Your first name and initial

Last name

Deceased Your social security number

Return

Spouse’s first name and initial

Last name

Deceased Spouse’s social security number

Home address (number and street)

City

State

Zip+4

MT

1

2

3

Filing Status (check only one box)

Single

Married filing jointly

Head of Household

X

Exemptions

4a

4a

Yourself………………….

65 or older………..

Blind………. Enter number checked…...

4b

4b

Spouse………………….

65 or older………..

Blind………. Enter number checked…...

4c Dependent’s First Name

Last Name

SSN

Relationship Disability

4c

Enter the total of line 4c.

4d If additional dependents, see instructions. Add lines 4a thru 4c and enter total exemptions here.

4d

........................................

Enter amounts corresponding to your federal return.

Round to nearest dollar. If no entry, leave blank.

5 Enter wages, salaries, tips, etc. Attach federal Form(s) W-2. ...........................................................................

5

6 Enter taxable interest. Attach federal Schedule B if required. ..........................................................................

6

7 Enter ordinary dividends. Attach federal Schedule B if required. .....................................................................

7

8 Enter taxable pension, IRA distributions, and annuities. Attach federal Form(s) 1099R. .................................

8

9 Enter unemployment, alimony, state refund, etc. Specify: ____________________________________ .......

9

10 Add and enter amounts in the far right column for lines 5 through 9. This is your total income. ...................

10

11 Adjustments: Moving expense, IRA, alimony, student loan interest, etc. Specify:___________________ .......

11

12 Subtract line 11 from line 10. This is your federal adjusted gross income. .................................................

12

13 Additions: Enter interest and dividends from other state, county, or municipal bonds, and federal refund.

13

14a

14a Enter partial pension and annuity income exemption from Form W, Worksheet IV, line 6. ......................

14b

14b Enter partial interest exemption for taxpayers 65 and older. ....................................................................

14c

14c Enter exempt interest and mutual fund dividends from federal bonds, notes, and obligations. ................

14d

14d Enter exempt unemployment compensation. ...........................................................................................

14e

14e Enter other exclusions. Certain taxed tips and gratuities, etc. .................................................................

14 Add lines 14a through 14e and enter result here. This is your total subtractions. .......................................

14

15 Add lines 12 and 13 then subtract line 14. This is your Montana adjusted gross income. ..........................

15

16 Enter your standard deduction from Form W, Worksheet V or the worksheet on the back of this form. ...........

16

17 Multiply $1,900 by the number of exemptions on line 4d and enter result here. ...............................................

17

18

18

Subtract the total of lines 16 and 17 from line 15 and enter here, but not less than zero. This is your taxable income.

....

19 Enter your tax from the tax table. If line 18 is less than zero, enter zero. This is your total tax due. ............

19

20 Enter your Montana income tax withheld. Attach federal Form(s) W-2 and 1099. ...........................................

20

21 Enter your refundable elderly/homeowner renter credit from Form 2EC. ..........................................................

21

22 Add lines 20 and 21. This is your total payments and offsets. ....................................................................

22

23 Interest on underpayment

Late file penalty

Late pay penalty

Interest

Enter the sum of 23a

23

23a)

23b)

23c)

23d)

..........

thru 23d here.

24

Nongame wildlife program

Child abuse prevention

Agriculture in Schools

Check-off

24

24a)

24b)

24c)

Total. ...........

25 Add lines 19, 23 and 24 and enter result here. This is the sum of your tax, penalty, interest and

contributions. ..................................................................................................................................................

25

26

If line 25 is more than line 22, enter the difference here. This is the amount you owe. Make check payable to MONTANA

26

..................

DEPARTMENT OF REVENUE or visit our website at to pay by credit card or E-Check.

27 If line 25 is less than line 22, enter the difference here. This is your refund.

If you wish to use direct deposit, enter your RTN# and ACCT# below.

checking

27

savings

RTN#

ACCT#

Name, address and telephone number of paid preparer

Extension-Check this box and

Check the box here if you do

attach a copy of your federal Form

need forms and instructions

4868 to receive your Montana

mailed to you next year.

extension.

SSN or FEIN:

May the DOR discuss this return with your tax preparer? Yes

No

Questions? Call (406) 444-6900 or TDD (406) 444-2830 for hearing impaired.

Your signature is required

Date

Daytime telephone number

Spouse’s signature

Date

I declare under penalty of false swearing that the information in this return and attachments is true, correct and complete.

1

1 2

2