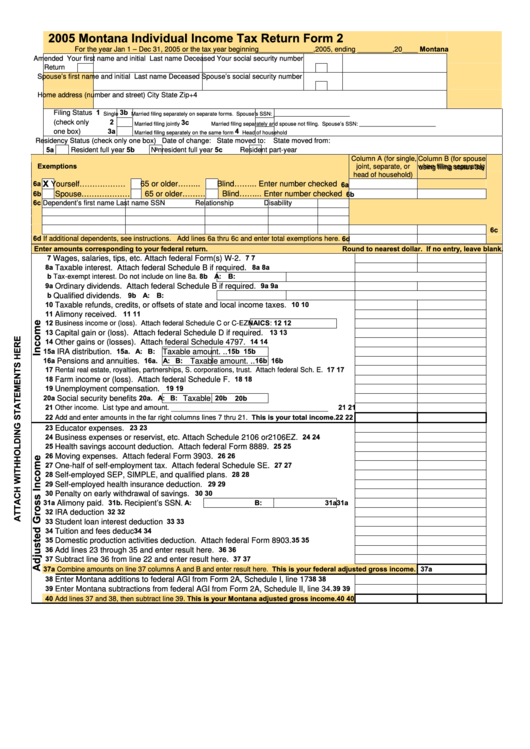

2005

Montana Individual Income Tax Return

Form 2

Montana

For the year Jan 1 – Dec 31, 2005 or the tax year beginning______________,2005, ending _________,20____

Amended

Your first name and initial

Last name

Deceased Your social security number

Return

Spouse’s first name and initial

Last name

Deceased Spouse’s social security number

Home address (number and street)

City

State

Zip+4

1

3b

Filing Status

Single

Married filing separately on separate forms.

Spouse’s SSN: __________________________

2

3c

(check only

Married filing jointly

Married filing separately and spouse not filing.

Spouse’s SSN: __________________________

3a

4

one box)

Married filing separately on the same form

Head of household

Residency Status (check only one box)

Date of change: State moved to:

State moved from:

5a

5b

5c

Resident full year

Nonresident full year

Resident part-year

Column A (for single,

Column B (for spouse

Exemptions

joint, separate, or

when filing separately

head of household)

using filing status 3a)

X

6a

6a

Yourself………………

65 or older……...

Blind……...

Enter number checked

6b

6b

Spouse.………………

65 or older………

Blind……...

Enter number checked

6c

Dependent’s first name

Last name

SSN

Relationship

Disability

6c

6d If additional dependents, see instructions. Add lines 6a thru 6c and enter total exemptions here.

6d

Enter amounts corresponding to your federal return.

Round to nearest dollar. If no entry, leave blank.

7

7

7

Wages, salaries, tips, etc. Attach federal Form(s) W-2. .........................................

8a

8a

8a

Taxable interest. Attach federal Schedule B if required. .......................................

b Tax-exempt interest. Do not include on line 8a. 8b A:

B:

9a

9a

9a

Ordinary dividends. Attach federal Schedule B if required. ...................................

b

9b A:

B:

Qualified dividends. ................................

10

10

10

Taxable refunds, credits, or offsets of state and local income taxes. .....................

11

11

11

Alimony received. ..................................................................................................

12 Business income or (loss). Attach federal Schedule C or C-EZ NAICS:

12

12

13

13

13

Capital gain or (loss). Attach federal Schedule D if required. ...............................

14

14

14

Other gains or (losses). Attach federal Schedule 4797. ........................................

15a

15a. A:

B:

15b

15b

IRA distribution. ............

Taxable amount. ..

16a

16a. A:

B:

16b

16b

Pensions and annuities.

Taxable amount. ..

17 Rental real estate, royalties, partnerships, S. corporations, trust. Attach federal Sch. E. ....

17

17

18

18

18

Farm income or (loss). Attach federal Schedule F. ...............................................

19

19

19

Unemployment compensation. ..............................................................................

20a

20a. A:

B:

20b

20b

Social security benefits

Taxable amount....

21 Other income. List type and amount.

21

21

____________________________________

22 Add and enter amounts in the far right columns lines 7 thru 21. This is your total income. 22

22

23

23

23

Educator expenses. ...............................................................................................

24

24

24

Business expenses or reservist, etc. Attach Schedule 2106 or 2106EZ. ...............

25

25

25

Health savings account deduction. Attach federal Form 8889. .............................

26

26

26

Moving expenses. Attach federal Form 3903. ......................................................

27

27

27

One-half of self-employment tax. Attach federal Schedule SE. ............................

28

28

28

Self-employed SEP, SIMPLE, and qualified plans. ................................................

29

29

29

Self-employed health insurance deduction. ...........................................................

30

30

30

Penalty on early withdrawal of savings. .................................................................

31a

31b.

. A:

B:

31a

31a

Alimony paid. .......

Recipient’s SSN

32

32

32

IRA deduction .........................................................................................................

33

33

33

Student loan interest deduction ..............................................................................

34

34

34

Tuition and fees deduction......................................................................................

35

35

35

Domestic production activities deduction. Attach federal Form 8903. ...................

36

36

36

Add lines 23 through 35 and enter result here. ......................................................

37

37

37

Subtract line 36 from line 22 and enter result here. ...............................................

37a Combine amounts on line 37 columns A and B and enter result here. This is your federal adjusted gross income.

37a

38

38

38

Enter Montana additions to federal AGI from Form 2A, Schedule I, line 17

............

39

39

39

Enter Montana subtractions from federal AGI from Form 2A, Schedule II, line 34.

40 Add lines 37 and 38, then subtract line 39. This is your Montana adjusted gross income. 40

40

1

1 2

2