Clear This Page

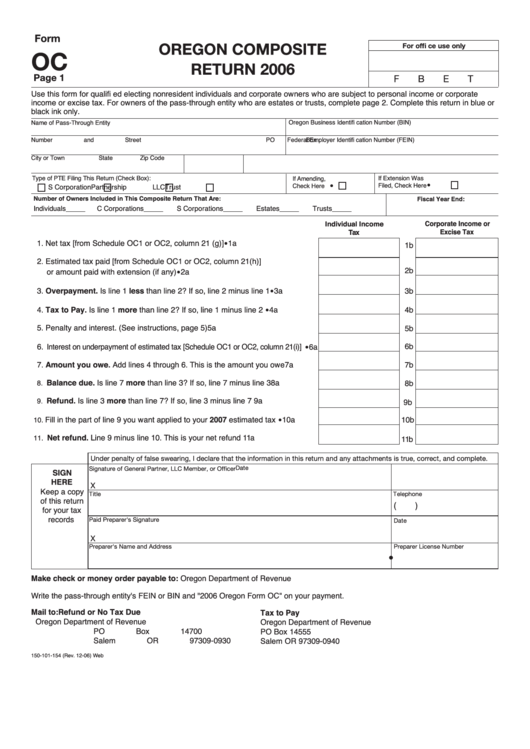

Form

OREGON COMPOSITE

For offi ce use only

OC

RETURN 2006

Page 1

F

B

E

T

Use this form for qualifi ed electing nonresident individuals and corporate owners who are subject to personal income or corporate

income or excise tax. For owners of the pass-through entity who are estates or trusts, complete page 2. Complete this return in blue or

black ink only.

Name of Pass-Through Entity

Oregon Business Identifi cation Number (BIN)

Number and Street

PO Box

Federal Employer Identifi cation Number (FEIN)

City or Town

State

Zip Code

Type of PTE Filing This Return (Check Box):

If Extension Was

If Amending,

•

•

Check Here

Filed, Check Here

Trust

S Corporation

Partnership

LLC

Number of Owners Included in This Composite Return That Are:

Fiscal Year End:

Individuals_____

C Corporations_____

S Corporations_____

Estates_____

Trusts_____

Individual Income

Corporate Income or

Excise Tax

Tax

•

1. Net tax [from Schedule OC1 or OC2, column 21 (g)]

1a

........................................

1b

2. Estimated tax paid [from Schedule OC1 or OC2, column 21(h)]

•

2b

or amount paid with extension (if any)

2a

.................................................................

•

3. Overpayment. Is line 1 less than line 2? If so, line 2 minus line 1

3a

3b

................

•

4. Tax to Pay. Is line 1 more than line 2? If so, line 1 minus line 2

4a

4b

...................

5. Penalty and interest. (See instructions, page 5)

5a

...................................................

5b

•

6b

6. Interest on underpayment of estimated tax [Schedule OC1 or OC2, column 21(i)]

6a

7. Amount you owe. Add lines 4 through 6. This is the amount you owe

7a

7b

..........

Balance due. Is line 7 more than line 3? If so, line 7 minus line 3

8a

8.

..................

8b

Refund. Is line 3 more than line 7? If so, line 3 minus line 7

9a

9.

............................

9b

•

Fill in the part of line 9 you want applied to your 2007 estimated tax

10a

10b

10.

..........

Net refund. Line 9 minus line 10. This is your net refund

11a

11.

................................

11b

Under penalty of false swearing, I declare that the information in this return and any attachments is true, correct, and complete.

Date

Signature of General Partner, LLC Member, or Officer

SIGN

HERE

X

Keep a copy

Title

Telephone

of this return

(

)

for your tax

records

Paid Preparer's Signature

Date

X

Preparer License Number

Preparer's Name and Address

•

Make check or money order payable to:

Oregon Department of Revenue

Write the pass-through entity's FEIN or BIN and "2006 Oregon Form OC" on your payment.

Mail to:

Refund or No Tax Due

Tax to Pay

Oregon Department of Revenue

Oregon Department of Revenue

PO Box 14700

PO Box 14555

Salem OR 97309-0930

Salem OR 97309-0940

150-101-154 (Rev. 12-06) Web

1

1 2

2 3

3 4

4 5

5