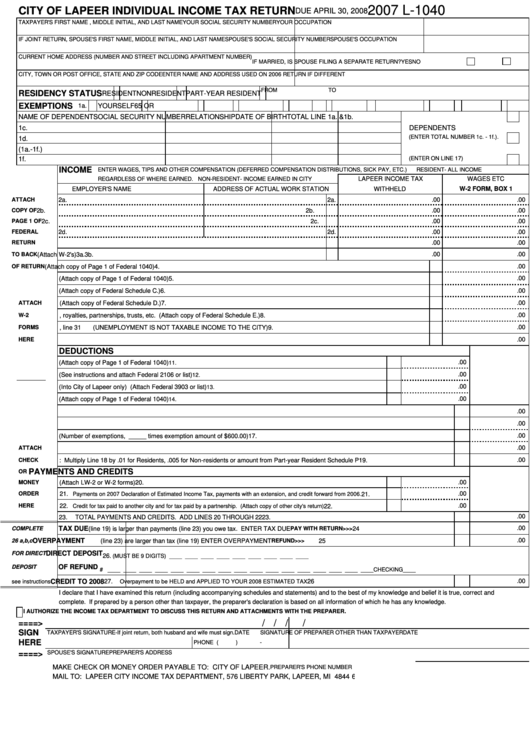

Form L-1040 - Individual Income Tax Return - City Of Lapeer - 2007

ADVERTISEMENT

2007 L-1040

CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN

DUE APRIL 30, 2008

TAXPAYER'S FIRST NAME , MIDDLE INITIAL, AND LAST NAME

YOUR SOCIAL SECURITY NUMBER

YOUR OCCUPATION

IF JOINT RETURN, SPOUSE'S FIRST NAME, MIDDLE INITIAL, AND LAST NAME

SPOUSE'S SOCIAL SECURITY NUMBER

SPOUSE'S OCCUPATION

CURRENT HOME ADDRESS (NUMBER AND STREET INCLUDING APARTMENT NUMBER)

IF MARRIED, IS SPOUSE FILING A SEPARATE RETURN?

YES

NO

CITY, TOWN OR POST OFFICE, STATE AND ZIP CODE

ENTER NAME AND ADDRESS USED ON 2006 RETURN IF DIFFERENT

FROM

TO

RESIDENCY STATUS

RESIDENT

NONRESIDENT

PART-YEAR RESIDENT

EXEMPTIONS

1a.

YOURSELF

65 OR OVER

BLIND

DISABLED

DEAF 1b.

SPOUSE

65 OR OVER

BLIND

DISABLED

DEAF

NAME OF DEPENDENT

SOCIAL SECURITY NUMBER

RELATIONSHIP

DATE OF BIRTH

TOTAL LINE 1a. &1b.

1c.

DEPENDENTS

(ENTER TOTAL NUMBER 1c. - 1f.).

1d.

1e.

TOTAL EXEMPTIONS (1a.-1f.)

(ENTER ON LINE 17)

1f.

INCOME

ENTER WAGES, TIPS AND OTHER COMPENSATION (DEFERRED COMPENSATION DISTRIBUTIONS, SICK PAY, ETC.)

RESIDENT- ALL INCOME

LAPEER INCOME TAX

WAGES ETC

REGARDLESS OF WHERE EARNED. NON-RESIDENT- INCOME EARNED IN CITY

ADDRESS OF ACTUAL WORK STATION

WITHHELD

W-2 FORM, BOX 1

EMPLOYER'S NAME

ATTACH

2a.

2a.

.00

.00

2b.

2b.

.00

.00

COPY OF

.00

.00

PAGE 1 OF

2c.

2c.

2d.

2d.

.00

.00

FEDERAL

2e. Total for additional employers from attached sheet.

2e.

.00

.00

RETURN

TO BACK

3.

TOTAL COMPENSATION AND LAPEER TAX WITHHELD (Attach W-2's)

3a.

.00

3b.

.00

.00

OF RETURN

4.

Taxable interest. (Attach copy of Page 1 of Federal 1040)

4.

.00

5.

Ordinary dividends. (Attach copy of Page 1 of Federal 1040)

5.

.00

6.

Business Income. (Attach copy of Federal Schedule C.)

6.

7.

Capital gains or losses. (Attach copy of Federal Schedule D.)

7.

.00

ATTACH

8.

Rental real estate, royalties, partnerships, trusts, etc. (Attach copy of Federal Schedule E.)

8.

.00

W-2

9.

Other income. Total from Page 2, line 31

(UNEMPLOYMENT IS NOT TAXABLE INCOME TO THE CITY)

9.

.00

FORMS

HERE

10.

TOTAL INCOME. ADD LINES 3b. THROUGH 9

10.

.00

DEDUCTIONS

.00

11. Individual Retirement Account. (Attach copy of Page 1 of Federal 1040)

11.

.00

12. Employee business expenses. (See instructions and attach Federal 2106 or list)

12.

.00

13. Moving expenses. (Into City of Lapeer only) (Attach Federal 3903 or list)

13.

.00

14. Alimony paid. DO NOT INCLUDE CHILD SUPPORT (Attach copy of Page 1 of Federal 1040)

14.

.00

15.

TOTAL DEDUCTIONS. ADD LINES 11 THROUGH 14

15.

.00

16.

TOTAL INCOME AFTER DEDUCTIONS. SUBTRACT LINE 15 FROM LINE 10

16.

.00

17. Amount for exemptions. (Number of exemptions, _____ times exemption amount of $600.00)

17.

.00

ATTACH

18.

TOTAL INCOME SUBJECT TO TAX. SUBTRACT LINE 17 FROM LINE 16

18.

.00

CHECK

19. City of Lapeer Tax: Multiply Line 18 by .01 for Residents, .005 for Non-residents or amount from Part-year Resident Schedule P

19.

PAYMENTS AND CREDITS

OR

.00

MONEY

20. Tax withheld by your employer from line 3a above. (Attach LW-2 or W-2 forms)

20.

.00

ORDER

21.

21.

Payments on 2007 Declaration of Estimated Income Tax, payments with an extension, and credit forward from 2006.

22.

22.

.00

HERE

Credit for tax paid to another city and for tax paid by a partnership. (Attach copy of other city's return)

.00

23.

TOTAL PAYMENTS AND CREDITS. ADD LINES 20 THROUGH 22

23.

.00

TAX DUE

24.

If tax (line 19) is larger than payments (line 23) you owe tax. ENTER TAX DUE

PAY WITH RETURN>>>

24

COMPLETE

.00

26 a,b,c

OVERPAYMENT

25.

If payments (line 23) are larger than tax (line 19) ENTER OVERPAYMENT

REFUND>>>

25

DIRECT DEPOSIT

FOR DIRECT

26.

a.

ROUTING NUMBER (MUST BE 9 DIGITS) ____ ____ ____ ____ ____ ____ ____ ____ ____

b. SAVINGS

____

DEPOSIT

OF REFUND

c.

ACCT # ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____

CHECKING

____

.00

CREDIT TO 2008

27.

26

see instructions

Overpayment to be HELD and APPLIED TO YOUR 2008 ESTIMATED TAX

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct and

complete. If prepared by a person other than taxpayer, the preparer's declaration is based on all information of which he has any knowledge.

I AUTHORIZE THE INCOME TAX DEPARTMENT TO DISCUSS THIS RETURN AND ATTACHMENTS WITH THE PREPARER.

/ /

/

/

====>

SIGN

TAXPAYER'S SIGNATURE-If joint return, both husband and wife must sign.

DATE

SIGNATURE OF PREPARER OTHER THAN TAXPAYER

DATE

HERE

PHONE (

)

-

SPOUSE'S SIGNATURE

PREPARER'S ADDRESS

====>

MAKE CHECK OR MONEY ORDER PAYABLE TO: CITY OF LAPEER.

PREPARER'S PHONE NUMBER

MAIL TO: LAPEER CITY INCOME TAX DEPARTMENT, 576 LIBERTY PARK, LAPEER, MI 48446

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2