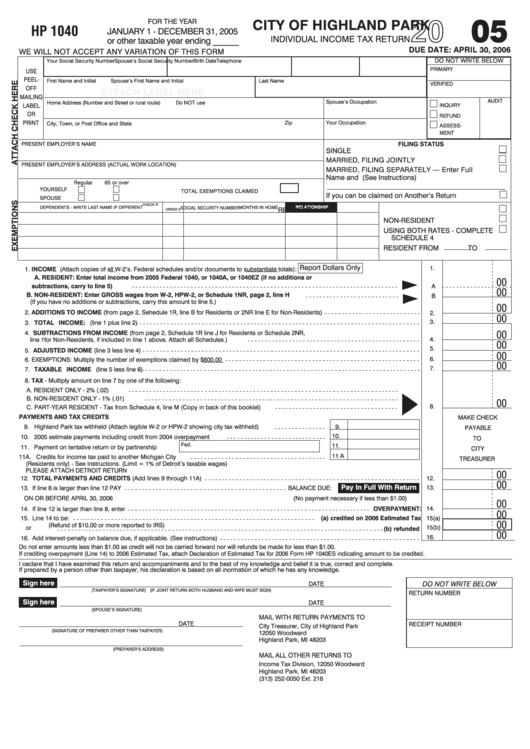

Form Hp 1040 - Individual Income Tax Return - City Of Highland Park - 2005

ADVERTISEMENT

2005

CITY OF HIGHLAND PARK

FOR THE YEAR

HP 1040

JANUARY 1 - DECEMBER 31, 2005

INDIVIDUAL INCOME TAX RETURN

or other taxable year ending ______

DUE DATE: APRIL 30, 2006

WE WILL NOT ACCEPT ANY VARIATION OF THIS FORM

DO NOT WRITE BELOW

Your Social Security Number

Spouse’s Social Security Number

Birth Date

Telephone

PRIMARY

USE

PEEL-

First Name and Initial

Spouse’s First Name and Initial

Last Name

VERIFIED

OFF

ATTACH LABEL HERE

MAILING

AUDIT

Spouse’s Occupation

Home Address (Number and Street or rural route)

Do NOT use P .O. Box

LABEL

INQUIRY

OR

REFUND

PRINT

Zip

Your Occupation

City, Town, or Post Office and State

ASSESS-

MENT

PRESENT EMPLOYER’S NAME

FILING STATUS

SINGLE

MARRIED, FILING JOINTLY

PRESENT EMPLOYER’S ADDRESS (ACTUAL WORK LOCATION)

MARRIED, FILING SEPARATELY — Enter Full

Name and S.S. No. of Spouse (See Instructions)

Regular

65 or over

YOURSELF

TOTAL EXEMPTIONS CLAIMED

If you can be claimed on Another’s Return

SPOUSE

CHECK IF

RELATIONSHIP

MONTHS IN HOME

DEPENDENTS - WRITE LAST NAME IF DIFFERENT

SOCIAL SECURITY NUMBER

RESIDENT

UNDER 2

NON-RESIDENT

USING BOTH RATES - COMPLETE

SCHEDULE 4

RESIDENT FROM

TO

Report Dollars Only

1.

1. INCOME (Attach copies of all W-2’s. Federal schedules and/or documents to substantiate totals):

A.

RESIDENT: Enter total income from 2005 Federal 1040, or 1040A, or 1040EZ (if no additions or

00

subtractions, carry to line 5)

A

00

B.

NON-RESIDENT: Enter GROSS wages from W-2, HPW-2, or Schedule 1NR, page 2, line H

B

(If you have no additions or subtractions, carry this amount to line 5.)

00

2. ADDITIONS TO INCOME (from page 2, Sehedule 1R, line B for Residents or 2NR line E for Non-Residents)

2.

00

3.

3. TOTAL INCOME: (line 1 plus line 2)

00

4. SUBTRACTIONS FROM INCOME (from page 2, Schedule 1R line J for Residents or Schedule 2NR,

4.

line 1for Non-Residents, if included in line 1 above. Attach all Schedules.)

00

5.

5. ADJUSTED INCOME (line 3 less line 4)

00

6.

6. EXEMPTIONS: Multiply the number of exemptions claimed by $600.00

00

7.

7. TAXABLE INCOME (line 5 less line 6)

8. TAX - Multiply amount on line 7 by one of the following:

A.

RESIDENT ONLY - 2% (.02)

B.

NON-RESIDENT ONLY - 1% (.01)

00

8.

C.

PART-YEAR RESIDENT - Tax from Schedule 4, line M (Copy in back of this booklet)

PAYMENTS AND TAX CREDITS

MAKE CHECK

9.

Highland Park tax withheld (Attach legible W-2 or HPW-2 showing city tax withheld)

9.

PAYABLE

10.

10.

2005 estimate payments including credit from 2004 overpayment

TO

Fed. I.D. Partnership No.

11.

11.

Payment on tentative return or by partnership

CITY

11.A

11A.

Credits for income tax paid to another Michgan City

TREASURER

(Residents only) - See Instructions. (Limit = 1% of Detroit’s taxable wages)

PLEASE ATTACH DETROIT RETURN

00

12. TOTAL PAYMENTS AND CREDITS (Add lines 9 through 11A)

12.

00

Pay In Full With Return

13. If line 8 is larger than line 12 PAY

BALANCE DUE:

13.

ON OR BEFORE APRIL 30, 2006

(No payment necessary if less than $1.00)

00

14. If line 12 is larger than line 8, enter

OVERPAYMENT:

14.

00

15(a)

15. Line 14 to be:

(a) credited on 2006 Estimated Tax

00

(Refund of $10.00 or more reported to IRS)

15(b)

or

(b) refunded

00

16.

16. Add interest-penalty on balance due, if applicable. (See instructions)

Do not enter amounts less than $1.00 as credit will not be carried forward nor will refunds be made for less than $1.00.

If crediting overpayment (Line 14) to 2006 Estimated Tax, attach Declaration of Estimated Tax for 2006 Form HP 1040ES indicating amount to be credited.

I ceclare that I have examined this return and accompaniments and to the best of my knowledge and belief it is true, correct and complete.

If prepared by a person other than taxpayer, his declaration is based on all inormation of which he has any knowledge.

Sign here

DATE

DO NOT WRITE BELOW

(TAXPAYER’S SIGNATURE)

(IF JOINT RETURN BOTH HUSBAND AND WIFE MUST SIGN)

RETURN NUMBER

Sign here

DATE

(SPOUSE’S SIGNATURE)

MAIL WITH RETURN PAYMENTS TO

DATE

RECEIPT NUMBER

City Treasurer, City of Highland Park

(SIGNATURE OF PREPARER OTHER THAN TAXPAYER)

12050 Woodward

Highland Park, MI 48203

(PREPARER’S ADDRESS)

MAIL ALL OTHER RETURNS TO

Income Tax Division, 12050 Woodward

Highland Park, MI 48203

(313) 252-0050 Ext. 216

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4