Form 7520 - Hotel Accommodations Tax Return - Instructions - City Of Chicago

ADVERTISEMENT

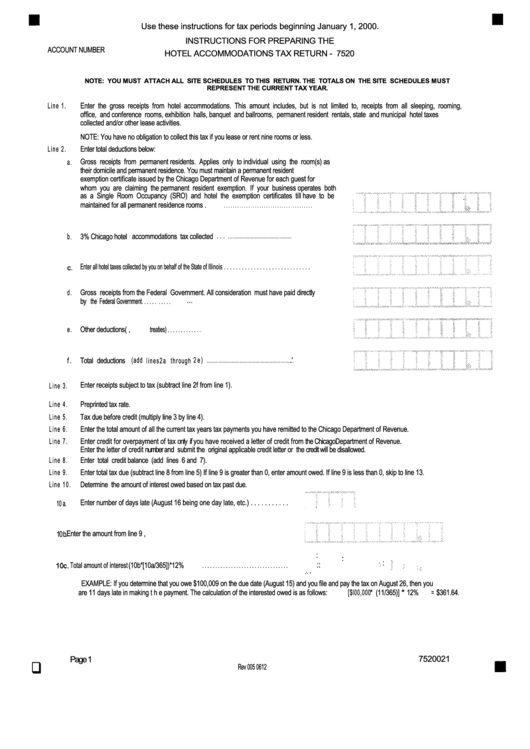

Use these instructions for tax periods beginning January 1, 2000.

INSTRUCTIONS FOR PREPARING THE

ACCOUNT

NUMBER

HOTEL ACCOMMODATIONS TAX RETURN - 7520

NOTE: YOU MUST ATTACH ALL SITE SCHEDULES TO THIS RETURN. THE TOTALS ON THE SITE SCHEDULES MUST

REPRESENT THE CURRENT TAX YEAR.

Line 1.

Enter the gross receipts from hotel accommodations. This amount includes, but is not limited to, receipts from all sleeping, rooming,

office, and conference rooms, exhibition halls, banquet and ballrooms, permanent resident rentals, state and municipal hotel taxes

collected and/or other lease activities.

NOTE: You have no obligation to collect this tax if you lease or rent nine rooms or less.

Line 2.

Enter total deductions below:

Gross receipts from permanent residents. Applies only to individual using the room(s) as

a.

their domicile and permanent residence. You must maintain a permanent resident

exemption certificate issued by the Chicago Department of Revenue for each guest for

whom you are claiming the permanent resident exemption. If your business operates both

as a Single Room Occupancy (SRO) and hotel the exemption certificates till have to be

maintained for all permanent residence rooms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

...................

b. 3 % Chicago hotel accommodations tax collected . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter all hotel taxes collected by you on behalf of the State of lllinois . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C.

d.

Gross receipts from the Federal Government. All consideration must have paid directly

by the Federal Government. . . . . . . . . . . ... ...................................................................

Other deductions (e.g., treaties) . . . . . . . . . . . . . .....................................................................

e.

Total deductions (add l i n e s 2a through 2 e ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . “ .

f .

Enter receipts subject to tax (subtract line 2f from line 1).

Line 3.

Line 4.

Preprinted tax rate.

Line 5.

Tax due before credit (multiply line 3 by line 4).

Line 6.

Enter the total amount of all the current tax years tax payments you have remitted to the Chicago Department of Revenue.

Line 7.

Enter credit for overpayment of tax only if you have received a letter of credit from the Chicago Department of Revenue.

Enter the letter of credit number and submit the original applicable credit letter or the credit will be disallowed.

Line 8.

Enter total credit balance (add lines 6 and 7).

Line 9.

Enter total tax due (subtract line 8 from line 5) If line 9 is greater than 0, enter amount owed. If line 9 is less than 0, skip to line 13.

Line 10.

Determine the amount of interest owed based on tax past due.

Enter number of days late (August 16 being one day late, etc.) . . . . . . . . . . .

10 a.

Enter the amount from line 9 .................................................,............

10 b.

:

:

:

::

Total amount of interest (10b*[10a/365])*12%

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

EXAMPLE: If you determine that you owe $100,009 on the due date (August 15) and you file and pay the tax on August 26, then you

are 11 days late in making t h e payment. The calculation of the interested owed is as follows: [$l00,000 * (11/365)] ** 12%

= $361.64.

7520021

Page 1

"

Rev 005 0612

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2