Form 7520 - Hotel Accommodations Tax

ADVERTISEMENT

•

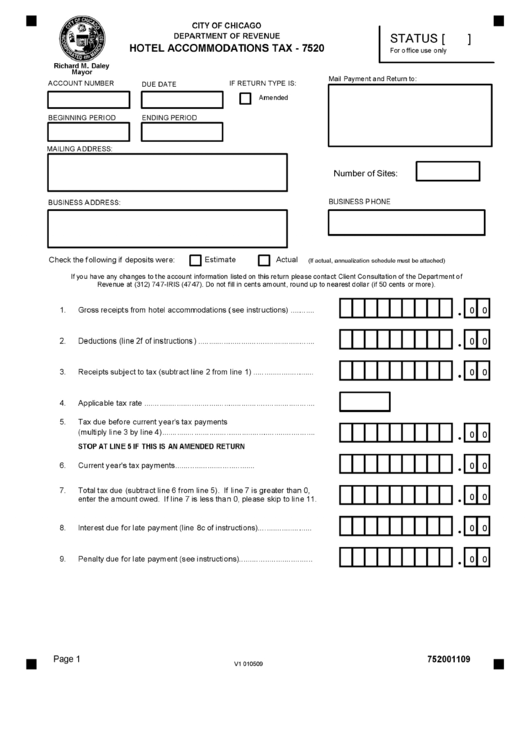

CITY OF CHICAGO

DEPARTMENT OF REVENUE

HOTEL ACCOMMODATIONS TAX -7520

STATUS [

For office use only

•

11000..--_1 1""---_

BEGINNING PERIOD

ENDING PERIOD

1

I 1""'---""'---

MAILING ADDRESS:

Richard M. Daley

Mayor

ACCOUNT NUMBER

DUE DATE

IF RETURN TYPE IS:

o

Amended

Mail Payment and Return to:

11.....---_-

Number of Sites:

BUSINESS ADDRESS:

BUSINESS PHONE

Check the following if deposits were:

o

Estimate

o

Actual

(If actual, annualization schedule rrust be attached)

If you have any changes to the accou nt information listed on this return please contact Client Consultation of the Department of

Revenue at (312) 747-IRIS (4747). Do not fill in cents amount, round up to nearest dollar (if 50 cents or more).

1.

Gross receipts from hotel accommodations (see instructions)

..

2.

Deductions (Ii ne 2f of instructions)

..

3.

Recei pts subject to tax (subtract line 2 from line 1)

..

4.

Applicable tax rate

..

.GG]

.GG]

.GG]

.GG]

.GG]

9.

Penalty due for late payment (see instructions)

..

8.

Interest due for late payment (line 8c of instructions)

..

5.

Tax due before current year's tax payments

(multiply line 3 by line 4)

..

STOP AT LINE 51F THIS IS AN AMENDED RETURN

7.

Total tax due (subtract line 6 from line 5). If line 7 is greater than 0,

enter the amount owed. If line 7 is less than 0, please skip to Ii ne 11.

6.

Current year's tax payments

.

•

Page 1

V1 010509

752001109

•

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5