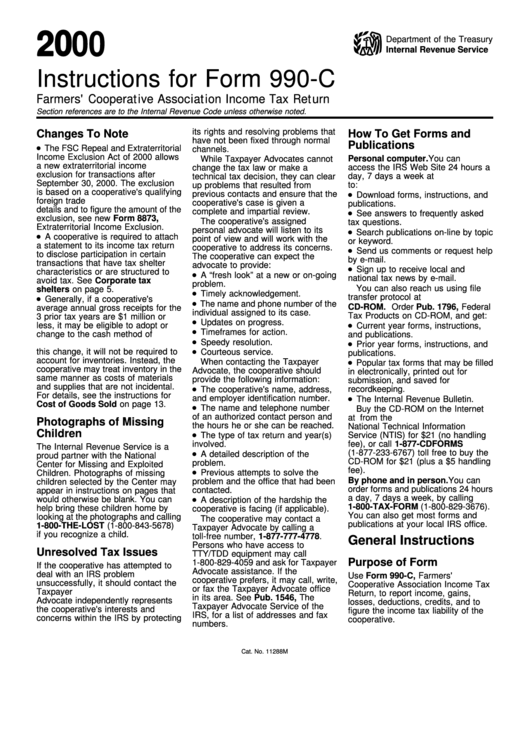

Instructions For Form 990-C - Farmers' Cooperative Association Income Tax Return - 2000

ADVERTISEMENT

2 0 00

Department of the Treasury

Internal Revenue Service

Instructions for Form 990-C

Farmers' Cooperative Association Income Tax Return

Section references are to the Internal Revenue Code unless otherwise noted.

its rights and resolving problems that

Changes To Note

How To Get Forms and

have not been fixed through normal

Publications

The FSC Repeal and Extraterritorial

channels.

Income Exclusion Act of 2000 allows

While Taxpayer Advocates cannot

Personal computer. You can

a new extraterritorial income

access the IRS Web Site 24 hours a

change the tax law or make a

exclusion for transactions after

technical tax decision, they can clear

day, 7 days a week at

September 30, 2000. The exclusion

to:

up problems that resulted from

is based on a cooperative's qualifying

previous contacts and ensure that the

Download forms, instructions, and

foreign trade income. For more

cooperative's case is given a

publications.

details and to figure the amount of the

complete and impartial review.

See answers to frequently asked

exclusion, see new Form 8873,

The cooperative's assigned

tax questions.

Extraterritorial Income Exclusion.

personal advocate will listen to its

Search publications on-line by topic

A cooperative is required to attach

point of view and will work with the

or keyword.

a statement to its income tax return

cooperative to address its concerns.

Send us comments or request help

to disclose participation in certain

The cooperative can expect the

by e-mail.

transactions that have tax shelter

advocate to provide:

Sign up to receive local and

characteristics or are structured to

A “fresh look” at a new or on-going

national tax news by e-mail.

avoid tax. See Corporate tax

problem.

You can also reach us using file

shelters on page 5.

Timely acknowledgement.

transfer protocol at ftp.irs.gov.

Generally, if a cooperative's

The name and phone number of the

CD-ROM. Order Pub. 1796, Federal

average annual gross receipts for the

individual assigned to its case.

Tax Products on CD-ROM, and get:

3 prior tax years are $1 million or

Updates on progress.

less, it may be eligible to adopt or

Current year forms, instructions,

Timeframes for action.

change to the cash method of

and publications.

Speedy resolution.

accounting. If the cooperative makes

Prior year forms, instructions, and

this change, it will not be required to

Courteous service.

publications.

account for inventories. Instead, the

When contacting the Taxpayer

Popular tax forms that may be filled

cooperative may treat inventory in the

Advocate, the cooperative should

in electronically, printed out for

same manner as costs of materials

provide the following information:

submission, and saved for

and supplies that are not incidental.

recordkeeping.

The cooperative's name, address,

For details, see the instructions for

and employer identification number.

The Internal Revenue Bulletin.

Cost of Goods Sold on page 13.

The name and telephone number

Buy the CD-ROM on the Internet

of an authorized contact person and

at /cdorders from the

Photographs of Missing

the hours he or she can be reached.

National Technical Information

Children

Service (NTIS) for $21 (no handling

The type of tax return and year(s)

involved.

fee), or call 1-877-CDFORMS

The Internal Revenue Service is a

(1-877-233-6767) toll free to buy the

A detailed description of the

proud partner with the National

CD-ROM for $21 (plus a $5 handling

problem.

Center for Missing and Exploited

fee).

Previous attempts to solve the

Children. Photographs of missing

By phone and in person. You can

problem and the office that had been

children selected by the Center may

order forms and publications 24 hours

contacted.

appear in instructions on pages that

a day, 7 days a week, by calling

would otherwise be blank. You can

A description of the hardship the

1-800-TAX-FORM (1-800-829-3676).

help bring these children home by

cooperative is facing (if applicable).

You can also get most forms and

looking at the photographs and calling

The cooperative may contact a

publications at your local IRS office.

1-800-THE-LOST (1-800-843-5678)

Taxpayer Advocate by calling a

if you recognize a child.

toll-free number, 1-877-777-4778.

General Instructions

Persons who have access to

Unresolved Tax Issues

TTY/TDD equipment may call

Purpose of Form

1-800-829-4059 and ask for Taxpayer

If the cooperative has attempted to

Advocate assistance. If the

deal with an IRS problem

Use Form 990-C, Farmers'

cooperative prefers, it may call, write,

unsuccessfully, it should contact the

Cooperative Association Income Tax

or fax the Taxpayer Advocate office

Taxpayer Advocate. The Taxpayer

Return, to report income, gains,

in its area. See Pub. 1546, The

Advocate independently represents

losses, deductions, credits, and to

Taxpayer Advocate Service of the

the cooperative's interests and

figure the income tax liability of the

IRS, for a list of addresses and fax

concerns within the IRS by protecting

cooperative.

numbers.

Cat. No. 11288M

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20