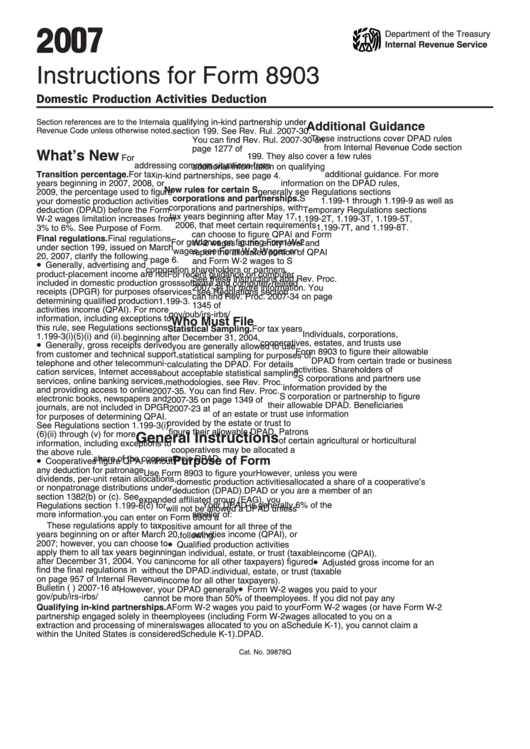

Instructions For Form 8903 - Domestic Production Activities Deduction - 2007

ADVERTISEMENT

2 0 07

Department of the Treasury

Internal Revenue Service

Instructions for Form 8903

Domestic Production Activities Deduction

Section references are to the Internal

a qualifying in-kind partnership under

Additional Guidance

Revenue Code unless otherwise noted.

section 199. See Rev. Rul. 2007-30.

These instructions cover DPAD rules

You can find Rev. Rul. 2007-30 on

from Internal Revenue Code section

page 1277 of I.R.B. 2007-21 at www.

What’s New

199. They also cover a few rules

irs.gov/pub/irs-irbs/irb07-21.pdf. For

addressing common situations from

additional information on qualifying

additional guidance. For more

Transition percentage. For tax

in-kind partnerships, see page 4.

years beginning in 2007, 2008, or

information on the DPAD rules,

New rules for certain S

2009, the percentage used to figure

generally see Regulations sections

corporations and partnerships. S

1.199-1 through 1.199-9 as well as

your domestic production activities

corporations and partnerships, with

deduction (DPAD) before the Form

Temporary Regulations sections

tax years beginning after May 17,

W-2 wages limitation increases from

1.199-2T, 1.199-3T, 1.199-5T,

2006, that meet certain requirements

3% to 6%. See Purpose of Form.

1.199-7T, and 1.199-8T.

can choose to figure QPAI and Form

Final regulations. Final regulations

For guidance on figuring Form W-2

W-2 wages at the entity level and

under section 199, issued on March

wages, see Form W-2 Wages on

report the allocated portion of QPAI

20, 2007, clarify the following.

page 6.

and Form W-2 wages to S

•

Generally, advertising and

corporation shareholders or partners.

product-placement income are not

For recent guidance on computer

See these instructions and Rev. Proc.

included in domestic production gross

software and computer-related

2007-34 for more information. You

receipts (DPGR) for purposes of

services, see Regulations section

can find Rev. Proc. 2007-34 on page

determining qualified production

1.199-3.

1345 of I.R.B. 2007-23 at

activities income (QPAI). For more

gov/pub/irs-irbs/irb07-23.pdf.

information, including exceptions to

Who Must File

this rule, see Regulations sections

Statistical Sampling. For tax years

Individuals, corporations,

1.199-3(i)(5)(i) and (ii).

beginning after December 31, 2004,

•

cooperatives, estates, and trusts use

Generally, gross receipts derived

you are generally allowed to use

Form 8903 to figure their allowable

from customer and technical support,

statistical sampling for purposes of

DPAD from certain trade or business

telephone and other telecommuni-

calculating the DPAD. For details

activities. Shareholders of

cation services, Internet access

about acceptable statistical sampling

S corporations and partners use

services, online banking services,

methodologies, see Rev. Proc.

information provided by the

and providing access to online

2007-35. You can find Rev. Proc.

S corporation or partnership to figure

electronic books, newspapers and

2007-35 on page 1349 of I.R.B.

their allowable DPAD. Beneficiaries

journals, are not included in DPGR

2007-23 at gov/pub/irs-irbs/

of an estate or trust use information

for purposes of determining QPAI.

irb07-23.pdf.

provided by the estate or trust to

See Regulations section 1.199-3(i)

figure their allowable DPAD. Patrons

(6)(ii) through (v) for more

General Instructions

of certain agricultural or horticultural

information, including exceptions to

cooperatives may be allocated a

the above rule.

•

share of the cooperative’s DPAD.

Purpose of Form

Cooperatives figure QPAI without

any deduction for patronage

Use Form 8903 to figure your

However, unless you were

dividends, per-unit retain allocations,

domestic production activities

allocated a share of a cooperative’s

or nonpatronage distributions under

deduction (DPAD).

DPAD or you are a member of an

section 1382(b) or (c). See

expanded affiliated group (EAG), you

Your DPAD is generally 6% of the

Regulations section 1.199-6(c) for

will not be allowed a DPAD unless

more information.

smaller of:

you can enter on Form 8903 a

1. Your qualified production

These regulations apply to tax

positive amount for all three of the

years beginning on or after March 20,

activities income (QPAI), or

following.

•

2007; however, you can choose to

2. Your adjusted gross income for

Qualified production activities

apply them to all tax years beginning

an individual, estate, or trust (taxable

income (QPAI).

•

after December 31, 2004. You can

income for all other taxpayers) figured

Adjusted gross income for an

find the final regulations in T.D. 9317

without the DPAD.

individual, estate, or trust (taxable

on page 957 of Internal Revenue

income for all other taxpayers).

•

Bulletin (I.R.B.) 2007-16 at

However, your DPAD generally

Form W-2 wages you paid to your

gov/pub/irs-irbs/irb07-16.pdf.

cannot be more than 50% of the

employees. If you did not pay any

Qualifying in-kind partnerships. A

Form W-2 wages you paid to your

Form W-2 wages (or have Form W-2

partnership engaged solely in the

employees (including Form W-2

wages allocated to you on a

extraction and processing of minerals

wages allocated to you on a

Schedule K-1), you cannot claim a

within the United States is considered

Schedule K-1).

DPAD.

Cat. No. 39878Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10