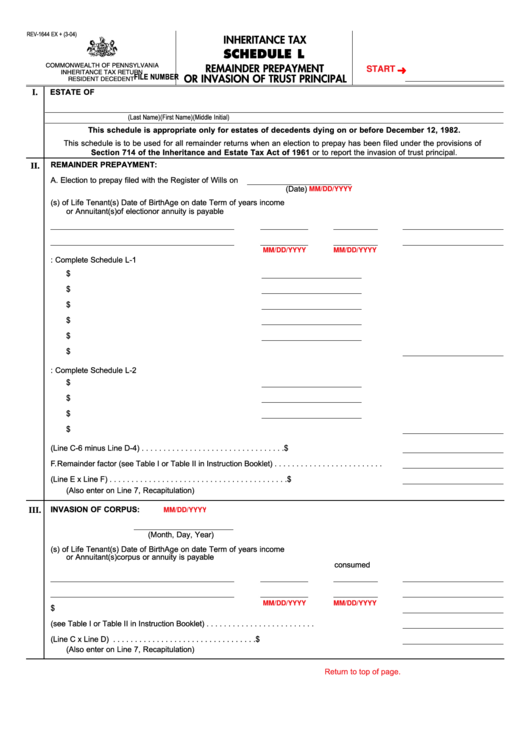

REV-1644 EX + (3-04)

INHERITANCE TAX

SCHEDULE L

COMMONWEALTH OF PENNSYLVANIA

REMAINDER PREPAYMENT

START

INHERITANCE TAX RETURN

OR INVASION OF TRUST PRINCIPAL

FILE NUMBER

RESIDENT DECEDENT

I.

ESTATE OF

(Last Name)

(First Name)

(Middle Initial)

This schedule is appropriate only for estates of decedents dying on or before December 12, 1982.

This schedule is to be used for all remainder returns when an election to prepay has been filed under the provisions of

Section 714 of the Inheritance and Estate Tax Act of 1961 or to report the invasion of trust principal.

REMAINDER PREPAYMENT:

II.

A.

Election to prepay filed with the Register of Wills on

(Date)

MM/DD/YYYY

B.

Name(s) of Life Tenant(s)

Date of Birth

Age on date

Term of years income

or Annuitant(s)

of election

or annuity is payable

MM/DD/YYYY

MM/DD/YYYY

C. Assets: Complete Schedule L-1

1. Real Estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

2. Stocks and Bonds . . . . . . . . . . . . . . . . . . . . . . . . . .$

3. Closely Held Stock/Partnership . . . . . . . . . . . . . . .$

4. Mortgages and Notes . . . . . . . . . . . . . . . . . . . . . . .$

5. Cash/Misc. Personal Property . . . . . . . . . . . . . . . .$

6. Total from Schedule L-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

D. Credits: Complete Schedule L-2

1. Unpaid Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . .$

2. Unpaid Bequests . . . . . . . . . . . . . . . . . . . . . . . . . . .$

3. Value of Unincludable Assets . . . . . . . . . . . . . . . . .$

4. Total from Schedule L-2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

E.

Total Value of trust assets (Line C-6 minus Line D-4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

F.

Remainder factor (see Table I or Table II in Instruction Booklet) . . . . . . . . . . . . . . . . . . . . . . . . .

G. Taxable Remainder value (Line E x Line F) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

(Also enter on Line 7, Recapitulation)

INVASION OF CORPUS:

III.

MM/DD/YYYY

A.

Invasion of corpus

(Month, Day, Year)

B.

Name(s) of Life Tenant(s)

Date of Birth

Age on date

Term of years income

or Annuitant(s)

corpus

or annuity is payable

consumed

MM/DD/YYYY

MM/DD/YYYY

C. Corpus consumed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

D. Remainder factor (see Table I or Table II in Instruction Booklet) . . . . . . . . . . . . . . . . . . . . . . . . .

E.

Taxable value of corpus consumed (Line C x Line D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

(Also enter on Line 7, Recapitulation)

Return to top of page.

PRINT FORM

Reset Entire Form

1

1