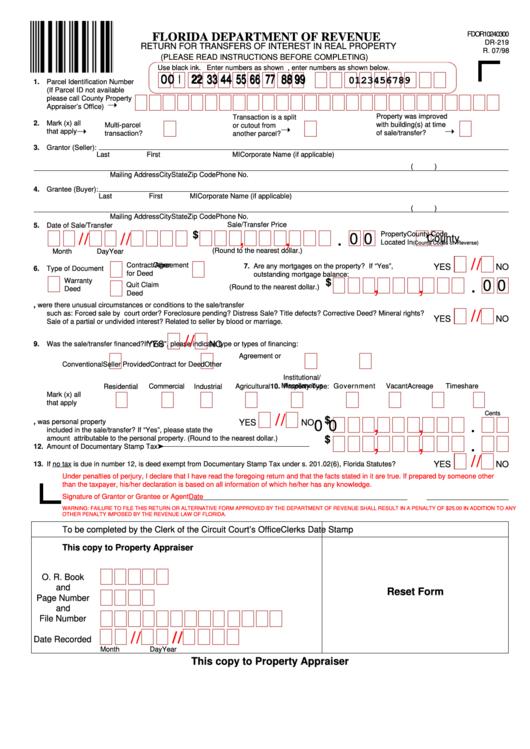

FDOR10240300

FLORIDA DEPARTMENT OF REVENUE

DR-219

RETURN FOR TRANSFERS OF INTEREST IN REAL PROPERTY

R. 07/98

(PLEASE READ INSTRUCTIONS BEFORE COMPLETING)

Use black ink. Enter numbers as shown below.

If typing, enter numbers as shown below.

0 0 0 0 0 1 1 1 1 1 2 2 2 2 2 3 3 3 3 3 4 4 4 4 4 5 5 5 5 5 6 6 6 6 6 7 7 7 7 7 8 8 8 8 8 9 9 9 9 9

0123456789

1. Parcel Identification Number

(If Parcel ID not available

please call County Property

Appraiser’s Office)

Property was improved

Transaction is a split

2. Mark (x) all

Multi-parcel

with building(s) at time

or cutout from

that apply

transaction?

of sale/transfer?

another parcel?

3. Grantor (Seller):

Last

First

MI

Corporate Name (if applicable)

(

)

Mailing Address

City

State

Zip Code

Phone No.

4. Grantee (Buyer):

Last

First

MI

Corporate Name (if applicable)

(

)

Mailing Address

City

State

Zip Code

Phone No.

Sale/Transfer Price

5. Date of Sale/Transfer

$

,

,

Property

County Code

0 0

/ / / / /

/ / / / /

County

Located In

(County Codes on Reverse)

(Round to the nearest dollar.)

Month

Day

Year

/ / / / /

Contract/Agreement

Other

7. Are any mortgages on the property? If “Yes”,

YES

NO

6. Type of Document

for Deed

outstanding mortgage balance:

Warranty

,

$

,

0 0

Quit Claim

(Round to the nearest dollar.)

Deed

Deed

8. To the best of your knowledge, were there unusual circumstances or conditions to the sale/transfer

such as: Forced sale by court order? Foreclosure pending? Distress Sale? Title defects? Corrective Deed? Mineral rights?

/ / / / /

YES

NO

Sale of a partial or undivided interest? Related to seller by blood or marriage.

/ / / / /

9. Was the sale/transfer financed?

YES

NO

If “Yes”, please indicate type or types of financing:

Agreement or

Conventional

Seller Provided

Contract for Deed

Other

Institutional/

10. Property Type:

Commercial

Agricultural

Miscellaneous

Government

Vacant

Acreage

Timeshare

Residential

Industrial

Mark (x) all

that apply

Cents

/ / / / /

$

,

,

11. To the best of your knowledge, was personal property

YES

NO

0 0

included in the sale/transfer? If “Yes”, please state the

$

amount attributable to the personal property. (Round to the nearest dollar.)

,

,

12. Amount of Documentary Stamp Tax

/ / / / /

13. If no tax is due in number 12, is deed exempt from Documentary Stamp Tax under s. 201.02(6), Florida Statutes?

YES

NO

Under penalties of perjury, I declare that I have read the foregoing return and that the facts stated in it are true. If prepared by someone other

than the taxpayer, his/her declaration is based on all information of which he/her has any knowledge.

Signature of Grantor or Grantee or Agent

Date

WARNING: FAILURE TO FILE THIS RETURN OR ALTERNATIVE FORM APPROVED BY THE DEPARTMENT OF REVENUE SHALL RESULT IN A PENALTY OF $25.00 IN ADDITION TO ANY

OTHER PENALTY IMPOSED BY THE REVENUE LAW OF FLORIDA.

To be completed by the Clerk of the Circuit Court’s Office

Clerks Date Stamp

This copy to Property Appraiser

O. R. Book

and

Reset Form

Page Number

and

File Number

/ / / / /

/ / / / /

Date Recorded

Month

Day

Year

This copy to Property Appraiser

1

1 2

2