Form 211-22 - Application For Refund - 2014

ADVERTISEMENT

OFFICE USE ONLY

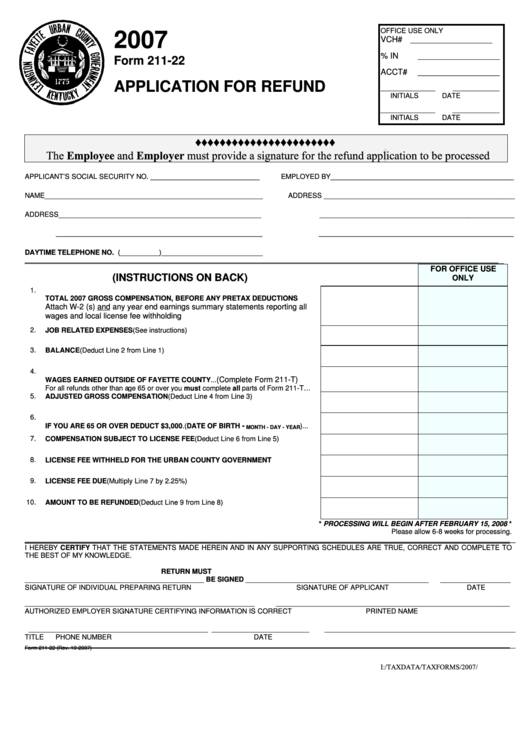

2007

VCH#

_____________________

% IN

_____________________

Form 211-22

ACCT#

_____________________

APPLICATION FOR REFUND

______________

____________

INITIALS

DATE

______________

____________

INITIALS

DATE

♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦

The Employee and Employer must provide a signature for the refund application to be processed

APPLICANT’S SOCIAL SECURITY NO. ____________________________

EMPLOYED BY_______________________________________________

NAME________________________________________________________

ADDRESS _________________________________________________

ADDRESS____________________________________________________

__________________________________________________

_____________________________________________________

__________________________________________________

DAYTIME TELEPHONE NO. (__________)__________________________

___________________________________________________________________________________________________________________________

FOR OFFICE USE

(INSTRUCTIONS ON BACK)

ONLY

1.

TOTAL 2007 GROSS COMPENSATION, BEFORE ANY PRETAX DEDUCTIONS

Attach W-2 (s) and any year end earnings summary statements reporting all

wages and local license fee withholding

...................................................................

2.

JOB RELATED EXPENSES......(See instructions)..........................................................

3.

BALANCE (Deduct Line 2 from Line 1)............................................................................

4.

(Complete Form 211-T)

WAGES EARNED OUTSIDE OF FAYETTE COUNTY...

....

For all refunds other than age 65 or over you must complete all parts of Form 211-T…

5.

ADJUSTED GROSS COMPENSATION (Deduct Line 4 from Line 3).............................

6.

-

IF YOU ARE 65 OR OVER DEDUCT $3,000.(DATE OF BIRTH

)...

MONTH - DAY - YEAR

7.

COMPENSATION SUBJECT TO LICENSE FEE (Deduct Line 6 from Line 5)...............

8.

LICENSE FEE WITHHELD FOR THE URBAN COUNTY GOVERNMENT...................

9.

LICENSE FEE DUE (Multiply Line 7 by 2.25%)................................................................

10.

AMOUNT TO BE REFUNDED (Deduct Line 9 from Line 8)..........................................

* PROCESSING WILL BEGIN AFTER FEBRUARY 15, 2008 *

Please allow 6-8 weeks for processing.

______________________________________________________________________________________________________________________________

I HEREBY CERTIFY THAT THE STATEMENTS MADE HEREIN AND IN ANY SUPPORTING SCHEDULES ARE TRUE, CORRECT AND COMPLETE TO

THE BEST OF MY KNOWLEDGE.

RETURN MUST

______________________________________________ BE SIGNED _______________________________________________

__________________

SIGNATURE OF INDIVIDUAL PREPARING RETURN

SIGNATURE OF APPLICANT

DATE

___________________________________________________________

____________________________________________________________

AUTHORIZED EMPLOYER SIGNATURE CERTIFYING INFORMATION IS CORRECT

PRINTED NAME

______________________________________________ _________________________

_________________________________________________

TITLE

PHONE NUMBER

DATE

______________________________________________________________________________________________________________________________

Form 211-22 (Rev. 10-2007)

I:/TAXDATA/TAXFORMS/2007/211-T.DOC

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1