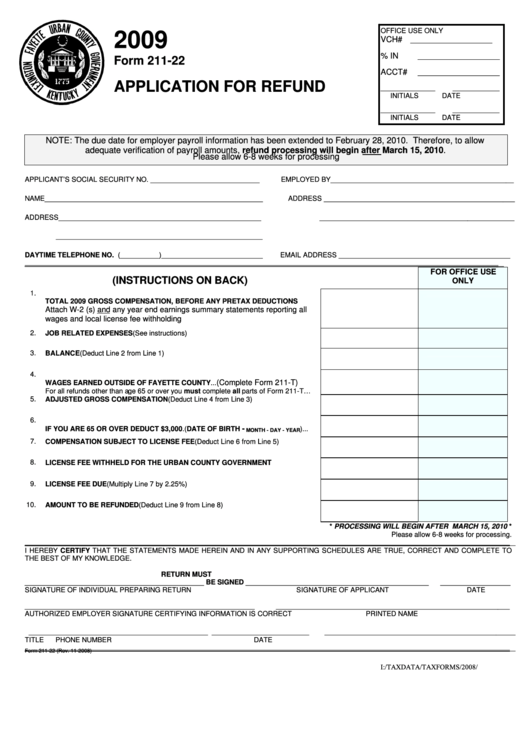

Form 211-22 - Application For Refund - 2009

ADVERTISEMENT

OFFICE USE ONLY

2009

VCH#

_____________________

% IN

_____________________

Form 211-22

ACCT#

_____________________

APPLICATION FOR REFUND

______________

____________

INITIALS

DATE

______________

____________

INITIALS

DATE

NOTE: The due date for employer payroll information has been extended to February 28, 2010. Therefore, to allow

adequate verification of payroll amounts, refund processing will begin after March 15, 2010.

Please allow 6-8 weeks for processing

APPLICANT’S SOCIAL SECURITY NO. ____________________________

EMPLOYED BY_______________________________________________

NAME________________________________________________________

ADDRESS _________________________________________________

ADDRESS____________________________________________________

__________________________________________________

_____________________________________________________

DAYTIME TELEPHONE NO. (__________)__________________________

EMAIL ADDRESS ____________________________________________

___________________________________________________________________________________________________________________________

FOR OFFICE USE

(INSTRUCTIONS ON BACK)

ONLY

1.

TOTAL 2009 GROSS COMPENSATION, BEFORE ANY PRETAX DEDUCTIONS

Attach W-2 (s) and any year end earnings summary statements reporting all

wages and local license fee withholding

...................................................................

2.

JOB RELATED EXPENSES......(See instructions)..........................................................

3.

BALANCE (Deduct Line 2 from Line 1)............................................................................

4.

(Complete Form 211-T)

WAGES EARNED OUTSIDE OF FAYETTE COUNTY...

....

For all refunds other than age 65 or over you must complete all parts of Form 211-T…

5.

ADJUSTED GROSS COMPENSATION (Deduct Line 4 from Line 3).............................

6.

-

IF YOU ARE 65 OR OVER DEDUCT $3,000.(DATE OF BIRTH

)...

MONTH - DAY - YEAR

7.

COMPENSATION SUBJECT TO LICENSE FEE (Deduct Line 6 from Line 5)...............

8.

LICENSE FEE WITHHELD FOR THE URBAN COUNTY GOVERNMENT...................

9.

LICENSE FEE DUE (Multiply Line 7 by 2.25%)................................................................

10.

AMOUNT TO BE REFUNDED (Deduct Line 9 from Line 8)..........................................

* PROCESSING WILL BEGIN AFTER MARCH 15, 2010 *

Please allow 6-8 weeks for processing.

______________________________________________________________________________________________________________________________

I HEREBY CERTIFY THAT THE STATEMENTS MADE HEREIN AND IN ANY SUPPORTING SCHEDULES ARE TRUE, CORRECT AND COMPLETE TO

THE BEST OF MY KNOWLEDGE.

RETURN MUST

______________________________________________ BE SIGNED _______________________________________________

__________________

SIGNATURE OF INDIVIDUAL PREPARING RETURN

SIGNATURE OF APPLICANT

DATE

___________________________________________________________

____________________________________________________________

AUTHORIZED EMPLOYER SIGNATURE CERTIFYING INFORMATION IS CORRECT

PRINTED NAME

______________________________________________ _________________________

_________________________________________________

TITLE

PHONE NUMBER

DATE

______________________________________________________________________________________________________________________________

Form 211-22 (Rev. 11-2008)

I:/TAXDATA/TAXFORMS/2008/211-T.DOC

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1