Employer'S Quarterly Wage And Contribution Report

ADVERTISEMENT

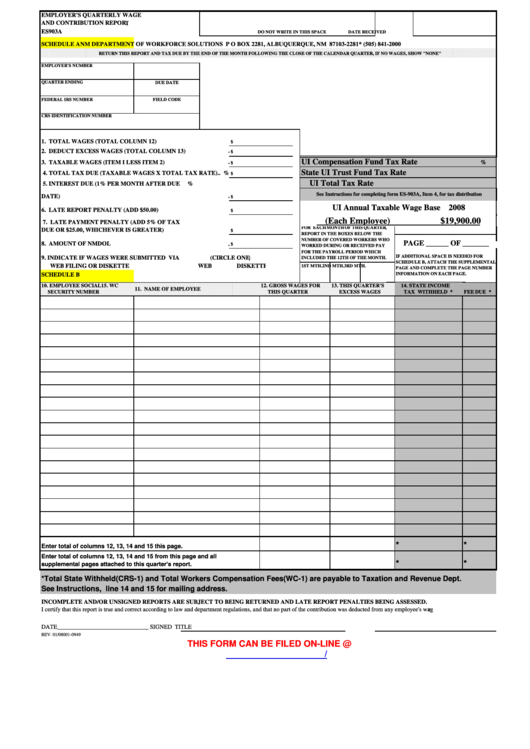

EMPLOYER'S QUARTERLY WAGE

AND CONTRIBUTION REPORT

ES903A

DO NOT WRITE IN THIS SPACE

DATE RECEIVED

SCHEDULE A

NM DEPARTMENT OF WORKFORCE SOLUTIONS P O BOX 2281, ALBUQUERQUE, NM 87103-2281* (505) 841-2000

RETURN THIS REPORT AND TAX DUE BY THE END OF THE MONTH FOLLOWING THE CLOSE OF THE CALENDAR QUARTER, IF NO WAGES, SHOW "NONE"

EMPLOYER'S NUMBER

QUARTER ENDING

DUE DATE

FEDERAL IRS NUMBER

FIELD CODE

CRS IDENTIFICATION NUMBER

1. TOTAL WAGES (TOTAL COLUMN 12).................................................

$

2. DEDUCT EXCESS WAGES (TOTAL COLUMN 13)..............................

$

UI Compensation Fund Tax Rate

3. TAXABLE WAGES (ITEM I LESS ITEM 2)............................................

%

$

State UI Trust Fund Tax Rate

4. TOTAL TAX DUE (TAXABLE WAGES X TOTAL TAX RATE)..

%

$

UI Total Tax Rate

5. INTEREST DUE (1% PER MONTH AFTER DUE

%

See Instructions for completing form ES-903A, Item 4, for tax distribution

DATE)..............................................................................................................

$

UI Annual Taxable Wage Base 2008

6. LATE REPORT PENALTY (ADD $50.00)................................................

$

(Each Employee)

$19,900.00

7. LATE PAYMENT PENALTY (ADD 5% OF TAX

FOR EACH MONTH OF THIS QUARTER,

DUE OR $25.00, WHICHEVER IS GREATER).......................................

$

REPORT IN THE BOXES BELOW THE

NUMBER OF COVERED WORKERS WHO

PAGE ______ OF _______

8. AMOUNT OF NMDOL REMITTANCE....................................................

$

WORKED DURING OR RECEIVED PAY

FOR THE PAYROLL PERIOD WHICH

IF ADDITIONAL SPACE IS NEEDED FOR

9. INDICATE IF WAGES WERE SUBMITTED VIA

(CIRCLE ONE)

INCLUDED THE 12TH OF THE MONTH.

SCHEDULE B, ATTACH THE SUPPLEMENTAL

WEB FILING OR DISKETTE

WEB

DISKETTE

1ST MTH.

2ND MTH.

3RD MTH.

PAGE AND COMPLETE THE PAGE NUMBER

INFORMATION ON EACH PAGE.

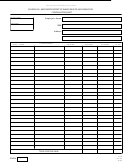

SCHEDULE B

10. EMPLOYEE SOCIAL

12. GROSS WAGES FOR

13. THIS QUARTER'S

14. STATE INCOME

15. WC

11. NAME OF EMPLOYEE

SECURITY NUMBER

THIS QUARTER

EXCESS WAGES

TAX WITHHELD *

FEE DUE *

*

*

Enter total of columns 12, 13, 14 and 15 this page.

Enter total of columns 12, 13, 14 and 15 from this page and all

*

*

supplemental pages attached to this quarter's report.

*Total State Withheld(CRS-1) and Total Workers Compensation Fees(WC-1) are payable to Taxation and Revenue Dept.

See Instructions, line 14 and 15 for mailing address.

INCOMPLETE AND/OR UNSIGNED REPORTS ARE SUBJECT TO BEING RETURNED AND LATE REPORT PENALTIES BEING ASSESSED.

I certify that this report is true and correct according to law and department regulations, and that no part of the contribution was deducted from any employee's wage

DATE_______________________________ SIGNED

TITLE

REV. 01/08

001-0949

THIS FORM CAN BE FILED ON-LINE @

https://efile.state.nm.us/

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2