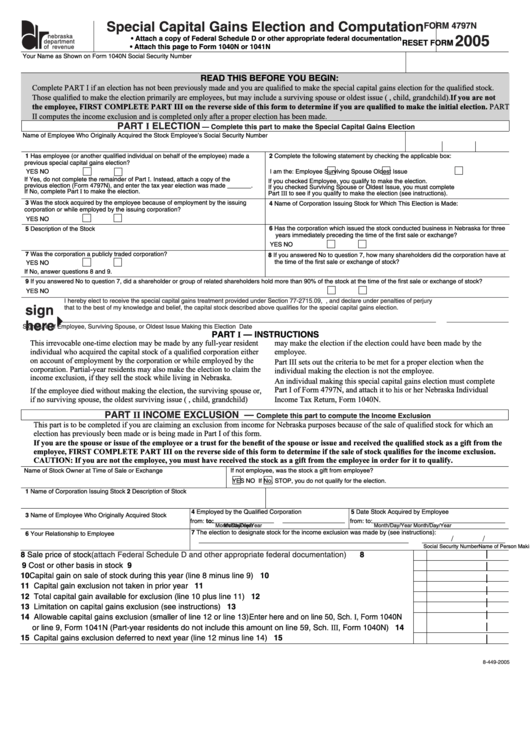

Special Capital Gains Election and Computation

FORM 4797N

2005

nebraska

• Attach a copy of Federal Schedule D or other appropriate federal documentation

department

RESET FORM

• Attach this page to Form 1040N or 1041N

of revenue

Your Name as Shown on Form 1040N

Social Security Number

READ THIS BEFORE YOU BEGIN:

Complete PART I if an election has not been previously made and you are qualified to make the special capital gains election for the qualified stock.

Those qualified to make the election primarily are employees, but may include a surviving spouse or oldest issue (e.g., child, grandchild). If you are not

the employee, FIRST COMPLETE PART III on the reverse side of this form to determine if you are qualified to make the initial election. PART

II computes the income exclusion and is completed only after a proper election has been made.

PART I ELECTION

— Complete this part to make the Special Capital Gains Election

Name of Employee Who Originally Acquired the Stock

Employee’s Social Security Number

1 Has employee (or another qualified individual on behalf of the employee) made a

2 Complete the following statement by checking the applicable box:

previous special capital gains election?

YES

NO

I am the:

Employee

Surviving Spouse

Oldest Issue

If Yes, do not complete the remainder of Part I. Instead, attach a copy of the

If you checked Employee, you qualify to make the election.

previous election (Form 4797N), and enter the tax year election was made _______.

If you checked Surviving Spouse or Oldest Issue, you must complete

If No, complete Part I to make the election.

Part III to see if you qualify to make the election (see instructions).

3 Was the stock acquired by the employee because of employment by the issuing

4 Name of Corporation Issuing Stock for Which This Election is Made:

corporation or while employed by the issuing corporation?

YES

NO

6 Has the corporation which issued the stock conducted business in Nebraska for three

5 Description of the Stock

years immediately preceding the time of the first sale or exchange?

YES

NO

7 Was the corporation a publicly traded corporation?

8 If you answered No to question 7, how many shareholders did the corporation have at

the time of the first sale or exchange of stock?

YES

NO

If No, answer questions 8 and 9.

9 If you answered No to question 7, did a shareholder or group of related shareholders hold more than 90% of the stock at the time of the first sale or exchange of stock?

YES

NO

I hereby elect to receive the special capital gains treatment provided under Section 77-2715.09, R.R.S. 2003, and declare under penalties of perjury

sign

that to the best of my knowledge and belief, the capital stock described above qualifies for the special capital gains election.

here

Signature of Employee, Surviving Spouse, or Oldest Issue Making this Election

Date

PART I — INSTRUCTIONS

This irrevocable one-time election may be made by any full-year resident

may make the election if the election could have been made by the

individual who acquired the capital stock of a qualified corporation either

employee.

on account of employment by the corporation or while employed by the

Part III sets out the criteria to be met for a proper election when the

corporation. Partial-year residents may also make the election to claim the

individual making the election is not the employee.

income exclusion, if they sell the stock while living in Nebraska.

An individual making this special capital gains election must complete

Part I of Form 4797N, and attach it to his or her Nebraska Individual

If the employee died without making the election, the surviving spouse or,

if no surviving spouse, the oldest surviving issue (e.g., child, grandchild)

Income Tax Return, Form 1040N.

PART II INCOME EXCLUSION —

Complete this part to compute the Income Exclusion

This part is to be completed if you are claiming an exclusion from income for Nebraska purposes because of the sale of qualified stock for which an

election has previously been made or is being made in Part I of this form.

If you are the spouse or issue of the employee or a trust for the benefit of the spouse or issue and received the qualified stock as a gift from the

employee, FIRST COMPLETE PART III on the reverse side of this form to determine if the sale of stock qualifies for the income exclusion.

CAUTION: If you are not the employee, you must have received the stock as a gift from the employee in order for it to qualify.

Name of Stock Owner at Time of Sale or Exchange

If not employee, was the stock a gift from employee?

YES

NO

If No, STOP, you do not qualify for the election.

1 Name of Corporation Issuing Stock

2 Description of Stock

4 Employed by the Qualified Corporation

5 Date Stock Acquired by Employee

3 Name of Employee Who Originally Acquired Stock

from:

to:

from:

to:

Month/Day/Year

Month/Day/Year

Month/Day/Year

Month/Day/Year

7 The election to designate stock for the income exclusion was made by (see instructions):

6 Your Relationship to Employee

/

/

Name of Person Making the Election or Who Previously Made the Election

Social Security Number

8 Sale price of stock

8

(attach Federal Schedule D and other appropriate federal documentation) ............................

9 Cost or other basis in stock .................................................................................................................................... 9

10 Capital gain on sale of stock during this year (line 8 minus line 9) ......................................................................... 10

11 Capital gain exclusion not taken in prior year ......................................................................................................... 11

12 Total capital gain available for exclusion (line 10 plus line 11)................................................................................ 12

13 Limitation on capital gains exclusion (see instructions).......................................................................................... 13

14 Allowable capital gains exclusion (smaller of line 12 or line 13). Enter here and on line 50, Sch. I, Form 1040N

or line 9, Form 1041N (Part-year residents do not include this amount on line 59, Sch. III, Form 1040N) ............ 14

15 Capital gains exclusion deferred to next year (line 12 minus line 14)..................................................................... 15

8-449-2005

1

1 2

2