Application For Business License Form

ADVERTISEMENT

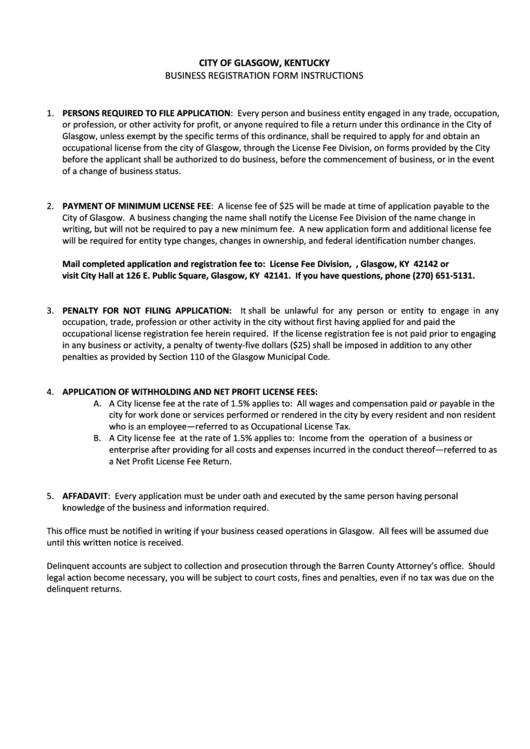

CITY OF GLASGOW, KENTUCKY

BUSINESS REGISTRATION FORM INSTRUCTIONS

1. PERSONS REQUIRED TO FILE APPLICATION: Every person and business entity engaged in any trade, occupation,

or profession, or other activity for profit, or anyone required to file a return under this ordinance in the City of

Glasgow, unless exempt by the specific terms of this ordinance, shall be required to apply for and obtain an

occupational license from the city of Glasgow, through the License Fee Division, on forms provided by the City

before the applicant shall be authorized to do business, before the commencement of business, or in the event

of a change of business status.

2. PAYMENT OF MINIMUM LICENSE FEE: A license fee of $25 will be made at time of application payable to the

City of Glasgow. A business changing the name shall notify the License Fee Division of the name change in

writing, but will not be required to pay a new minimum fee. A new application form and additional license fee

will be required for entity type changes, changes in ownership, and federal identification number changes.

Mail completed application and registration fee to: License Fee Division, P.O. Box 278, Glasgow, KY 42142 or

visit City Hall at 126 E. Public Square, Glasgow, KY 42141. If you have questions, phone (270) 651-5131.

3. PENALTY FOR NOT FILING APPLICATION: It shall be unlawful for any person or entity to engage in any

occupation, trade, profession or other activity in the city without first having applied for and paid the

occupational license registration fee herein required. If the license registration fee is not paid prior to engaging

in any business or activity, a penalty of twenty-five dollars ($25) shall be imposed in addition to any other

penalties as provided by Section 110 of the Glasgow Municipal Code.

4. APPLICATION OF WITHHOLDING AND NET PROFIT LICENSE FEES:

A. A City license fee at the rate of 1.5% applies to: All wages and compensation paid or payable in the

city for work done or services performed or rendered in the city by every resident and non resident

who is an employee—referred to as Occupational License Tax.

B. A City license fee at the rate of 1.5% applies to: Income from the operation of a business or

enterprise after providing for all costs and expenses incurred in the conduct thereof—referred to as

a Net Profit License Fee Return.

5. AFFADAVIT: Every application must be under oath and executed by the same person having personal

knowledge of the business and information required.

This office must be notified in writing if your business ceased operations in Glasgow. All fees will be assumed due

until this written notice is received.

Delinquent accounts are subject to collection and prosecution through the Barren County Attorney’s office. Should

legal action become necessary, you will be subject to court costs, fines and penalties, even if no tax was due on the

delinquent returns.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2