Form It-20 - Schedule 8-D - Consolidated Income Tax Schedule For Indiana Affiliated Group

ADVERTISEMENT

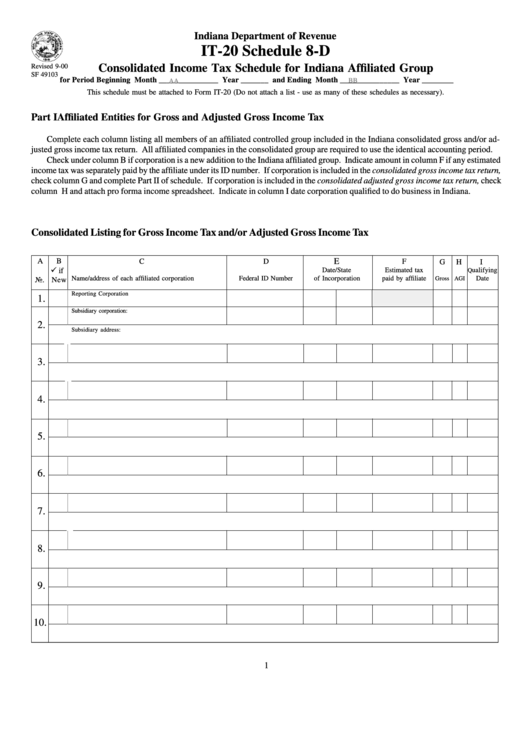

Indiana Department of Revenue

IT-20 Schedule 8-D

Consolidated Income Tax Schedule for Indiana Affiliated Group

Revised 9-00

SF 49103

for Period Beginning Month _______________ Year _______ and Ending Month _______________ Year ________

AA

BB

This schedule must be attached to Form IT-20 (Do not attach a list - use as many of these schedules as necessary).

Part I Affiliated Entities for Gross and Adjusted Gross Income Tax

Complete each column listing all members of an affiliated controlled group included in the Indiana consolidated gross and/or ad-

justed gross income tax return. All affiliated companies in the consolidated group are required to use the identical accounting period.

Check under column B if corporation is a new addition to the Indiana affiliated group. Indicate amount in column F if any estimated

income tax was separately paid by the affiliate under its ID number. If corporation is included in the consolidated gross income tax return,

check column G and complete Part II of schedule. If corporation is included in the consolidated adjusted gross income tax return, check

column H and attach pro forma income spreadsheet. Indicate in column I date corporation qualified to do business in Indiana.

Consolidated Listing for Gross Income Tax and/or Adjusted Gross Income Tax

E

A

B

C

D

F

G

H

I

ü if

Date/State

Estimated tax

ualifying

Q

Name/address of each affiliated corporation

Federal ID Number

of Incorporation

paid by affiliate

Date

Gross AGI

No.

New

Reporting Corporation

1.

Subsidiary corporation:

2.

Subsidiary address:

3.

4.

5.

6.

7.

8.

9.

10.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3