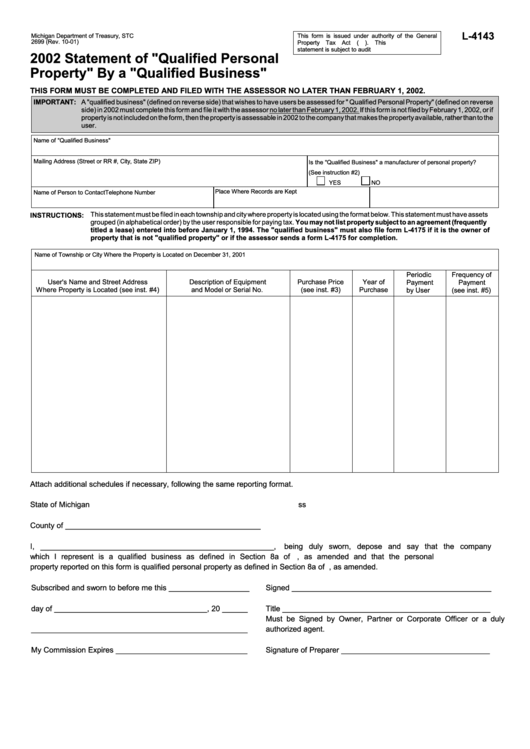

Form L-4143 - Statement Of "Qualified Personal Property" By A "Qualified Business" - 2002

ADVERTISEMENT

L-4143

Michigan Department of Treasury, STC

This form is issued under authority of the General

2699 (Rev. 10-01)

Property Tax Act (P.A. 206 of 1893). This

statement is subject to audit

2002 Statement of "Qualified Personal

Property" By a "Qualified Business"

THIS FORM MUST BE COMPLETED AND FILED WITH THE ASSESSOR NO LATER THAN FEBRUARY 1, 2002.

IMPORTANT:

A "qualified business" (defined on reverse side) that wishes to have users be assessed for " Qualified Personal Property" (defined on reverse

side) in 2002 must complete this form and file it with the assessor no later than February 1, 2002. If this form is not filed by February 1, 2002, or if

property is not included on the form, then the property is assessable in 2002 to the company that makes the property available, rather than to the

user.

Name of "Qualified Business"

Mailing Address (Street or RR #, City, State ZIP)

Is the "Qualified Business" a manufacturer of personal property?

(See instruction #2)

YES

NO

Place Where Records are Kept

Name of Person to Contact

Telephone Number

This statement must be filed in each township and city where property is located using the format below. This statement must have assets

INSTRUCTIONS:

grouped (in alphabetical order) by the user responsible for paying tax. You may not list property subject to an agreement (frequently

titled a lease) entered into before January 1, 1994. The "qualified business" must also file form L-4175 if it is the owner of

property that is not "qualified property" or if the assessor sends a form L-4175 for completion.

Name of Township or City Where the Property is Located on December 31, 2001

Periodic

Frequency of

User's Name and Street Address

Description of Equipment

Purchase Price

Year of

Payment

Payment

Where Property is Located (see inst. #4)

and Model or Serial No.

(see inst. #3)

Purchase

by User

(see inst. #5)

Attach additional schedules if necessary, following the same reporting format.

State of Michigan

ss

County of ______________________________________________

I, _______________________________________________________,

being duly sworn, depose and say that the company

which I represent is a qualified business as defined in Section 8a of P.A. 206 of 1893, as amended and that the personal

property reported on this form is qualified personal property as defined in Section 8a of P.A. 206 of 1893, as amended.

Subscribed and sworn to before me this ___________________

Signed _______________________________________________

day of ____________________________________, 20 ______

Title _________________________________________________

Must be Signed by Owner, Partner or Corporate Officer or a duly

___________________________________________________

authorized agent.

My Commission Expires _______________________________

Signature of Preparer ___________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1