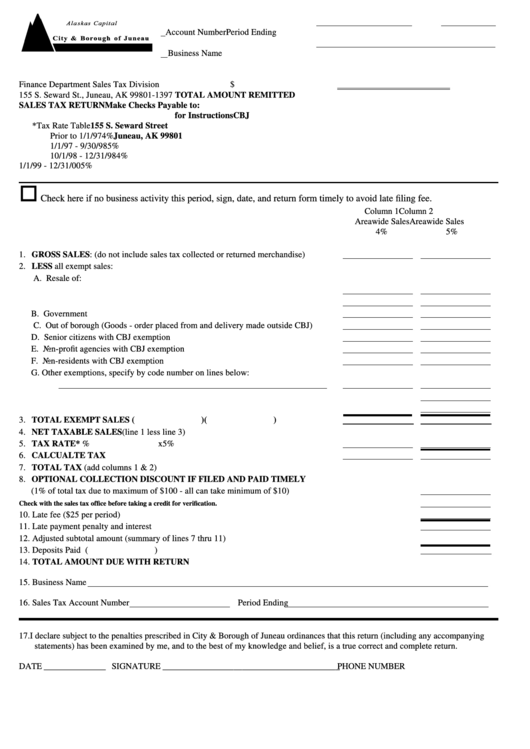

Sales Tax Return Sheet

ADVERTISEMENT

Account Number

Period Ending

Business Name

Finance Department Sales Tax Division

$

155 S. Seward St., Juneau, AK 99801-1397

TOTAL AMOUNT REMITTED

SALES TAX RETURN

Make Checks Payable to:

Click Here for Instructions

CBJ

*Tax Rate Table

155 S. Seward Street

Prior to 1/1/97

4%

Juneau, AK 99801

1/1/97 - 9/30/98

5%

10/1/98 - 12/31/98

4%

1/1/99 - 12/31/00 5%

Check here if no business activity this period, sign, date, and return form timely to avoid late filing fee.

Column 1

Column 2

Areawide Sales

Areawide Sales

4%

5%

1. GROSS SALES: (do not include sales tax collected or returned merchandise) ..................

2. LESS all exempt sales:

A. Resale of:

-Goods......................................................................................................................

-Services...................................................................................................................

B. Government agencies.....................................................................................................

C. Out of borough (Goods - order placed from and delivery made outside CBJ)...............

D. Senior citizens with CBJ exemption cards.....................................................................

E. Non-profit agencies with CBJ exemption cards .............................................................

F. Non-residents with CBJ exemption cards.......................................................................

G. Other exemptions, specify by code number on lines below:...........................................

......

3. TOTAL EXEMPT SALES ................................................................................................ (

) (

)

4. NET TAXABLE SALES (line 1 less line 3).......................................................................

5. TAX RATE* .......................................................................................................................

x4%

x5%

6. CALCUALTE TAX............................................................................................................

7. TOTAL TAX (add columns 1 & 2).....................................................................................

8. OPTIONAL COLLECTION DISCOUNT IF FILED AND PAID TIMELY

(1% of total tax due to maximum of $100 - all can take minimum of $10) ..........................

9. Credits from prior periods.

......

Check with the sales tax office before taking a credit for verification.

10. Late fee ($25 per period)......................................................................................................

11. Late payment penalty and interest .......................................................................................

12. Adjusted subtotal amount (summary of lines 7 thru 11).......................................................

13. Deposits Paid .......................................................................................................................

(

)

14. TOTAL AMOUNT DUE WITH RETURN .....................................................................

15. Business Name

16. Sales Tax Account Number

Period Ending

17. I declare subject to the penalties prescribed in City & Borough of Juneau ordinances that this return (including any accompanying

statements) has been examined by me, and to the best of my knowledge and belief, is a true correct and complete return.

DATE ______________ SIGNATURE ________________________________________PHONE NUMBER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1