Form Oes-1 - Oklahoma Employment Security Commission - Employer Status Report

ADVERTISEMENT

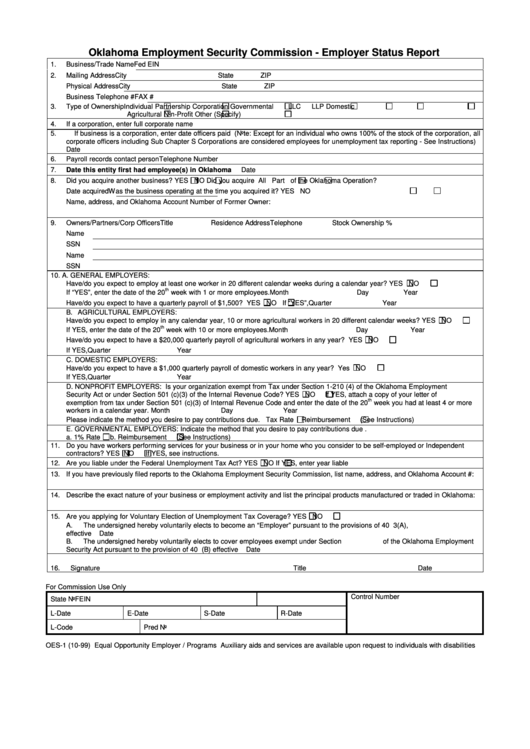

Oklahoma Employment Security Commission - Employer Status Report

1.

Business/Trade Name

Fed EIN

2.

Mailing Address

City

State

ZIP

Physical Address

City

State

ZIP

Business Telephone #

FAX #

3.

Type of Ownership

Individual

Partnership

Corporation

Governmental

LLC

LLP

Domestic

Agricultural

Non-Profit

Other (Specify)

4.

If a corporation, enter full corporate name

5.

If business is a corporation, enter date officers paid (Note: Except for an individual who owns 100% of the stock of the corporation, all

corporate officers including Sub Chapter S Corporations are considered employees for unemployment tax reporting - See Instructions)

Date

6.

Payroll records contact person

Telephone Number

7.

Date this entity first had employee(s) in Oklahoma

Date

8.

Did you acquire another business? YES

NO

Did you acquire All

Part

of the Oklahoma Operation?

Date acquired

Was the business operating at the time you acquired it? YES

NO

Name, address, and Oklahoma Account Number of Former Owner:

9.

Owners/Partners/Corp Officers

Title

Residence Address

Telephone

Stock Ownership %

Name

SSN

Name

SSN

10. A. GENERAL EMPLOYERS:

Have/do you expect to employ at least one worker in 20 different calendar weeks during a calendar year? YES

NO

th

If “YES”, enter the date of the 20

week with 1 or more employees.

Month

Day

Year

Have/do you expect to have a quarterly payroll of $1,500? YES

NO

If “YES”,

Quarter

Year

B. AGRICULTURAL EMPLOYERS:

Have/do you expect to employ in any calendar year, 10 or more agricultural workers in 20 different calendar weeks? YES

NO

th

If YES, enter the date of the 20

week with 10 or more employees.

Month

Day

Year

Have/do you expect to have a $20,000 quarterly payroll of agricultural workers in any year? YES

NO

If YES,

Quarter

Year

C. DOMESTIC EMPLOYERS:

Have/do you expect to have a $1,000 quarterly payroll of domestic workers in any year? Yes

NO

If YES,

Quarter

Year

D. NONPROFIT EMPLOYERS: Is your organization exempt from Tax under Section 1-210 (4) of the Oklahoma Employment

Security Act or under Section 501 (c)(3) of the Internal Revenue Code? YES

NO

If YES, attach a copy of your letter of

th

exemption from tax under Section 501 (c)(3) of Internal Revenue Code and enter the date of the 20

week you had at least 4 or more

workers in a calendar year.

Month

Day

Year

Please indicate the method you desire to pay contributions due. Tax Rate

Reimbursement

(See Instructions)

E. GOVERNMENTAL EMPLOYERS: Indicate the method that you desire to pay contributions due .

a. 1% Rate

b. Reimbursement

(See Instructions)

11. Do you have workers performing services for your business or in your home who you consider to be self-employed or Independent

contractors? YES

NO

If YES, see instructions.

12. Are you liable under the Federal Unemployment Tax Act? YES

NO

If YES, enter year liable

13. If you have previously filed reports to the Oklahoma Employment Security Commission, list name, address, and Oklahoma Account #:

14. Describe the exact nature of your business or employment activity and list the principal products manufactured or traded in Oklahoma:

15. Are you applying for Voluntary Election of Unemployment Tax Coverage? YES

NO

A.

The undersigned hereby voluntarily elects to become an “Employer” pursuant to the provisions of 40 O.S. Section 3-203(A),

effective

Date

B.

The undersigned hereby voluntarily elects to cover employees exempt under Section

of the Oklahoma Employment

Security Act pursuant to the provision of 40 O.S. Section 3-203(B) effective

Date

16. Signature

Title

Date

For Commission Use Only

Control Number

State No

FEIN

L-Date

E-Date

S-Date

R-Date

L-Code

Pred No

OES-1 (10-99) Equal Opportunity Employer / Programs Auxiliary aids and services are available upon request to individuals with disabilities

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1