Sellers Use / Sales Tax / Consumers Use Tax Form - City Of Montgomery, Alabama

ADVERTISEMENT

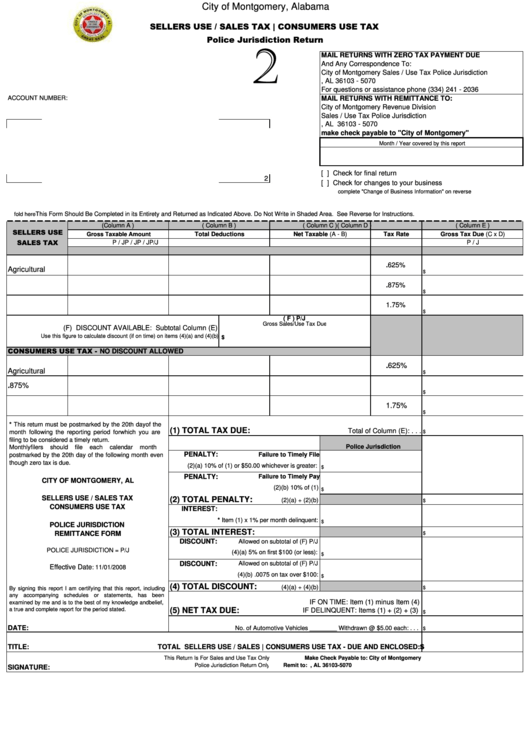

City of Montgomery, Alabama

SELLERS USE / SALES TAX | CONSUMERS USE TAX

Police Jurisdiction Return

2

MAIL RETURNS WITH ZERO TAX PAYMENT DUE

And Any Correspondence To:

City of Montgomery Sales / Use Tax Police Jurisdiction

P.O. Box 5070 Montgomery, AL 36103 - 5070

For questions or assistance phone (334) 241 - 2036

MAIL RETURNS WITH REMITTANCE TO:

ACCOUNT NUMBER:

City of Montgomery Revenue Division

Sales / Use Tax Police Jurisdiction

P.O. Box 5070 Montgomery, AL 36103 - 5070

make check payable to "City of Montgomery"

Month / Year covered by this report

[ ] Check for final return

2

[ ] Check for changes to your business

complete "Change of Business Information" on reverse

fold here

This Form Should Be Completed in its Entirety and Returned as Indicated Above. Do Not Write in Shaded Area. See Reverse for Instructions.

(Column A )

( Column B )

( Column C )

( Column D )

( Column E )

SELLERS USE

Gross Taxable Amount

Total Deductions

Net Taxable (A - B)

Tax Rate

Gross Tax Due (C x D)

SALES TAX

P / J

P / J

P / J

P/J

P / J

i.Automotive /

.625%

Agricultural

$

ii.Manufacturing

.875%

$

iii.General

1.75%

$

( F ) P/J

Gross Sales/Use Tax Due

(F) DISCOUNT AVAILABLE: Subtotal Column (E)

Use this figure to calculate discount (if on time) on items (4)(a) and (4)(b)

$

CONSUMERS USE TAX - NO DISCOUNT ALLOWED

i.Automotive /

.625%

Agricultural

$

ii.Manufacturing

.875%

$

iii.General

1.75%

$

* This return must be postmarked by the 20th day of the

(1) TOTAL TAX DUE:

Total of Column (E): . . .

month following the reporting period for which you are

$

filing to be considered a timely return.

Police Jurisdiction

Monthly

filers

should

file

each

calendar

month

PENALTY:

Failure to Timely File

postmarked by the 20th day of the following month even

though zero tax is due.

(2)(a) 10% of (1) or $50.00 whichever is greater:

$

PENALTY:

Failure to Timely Pay

CITY OF MONTGOMERY, AL

(2)(b) 10% of (1)

$

SELLERS USE / SALES TAX

(2) TOTAL PENALTY:

(2)(a) + (2)(b)

$

CONSUMERS USE TAX

INTEREST:

* Item (1) x 1% per month delinquent:

$

POLICE JURISDICTION

(3) TOTAL INTEREST:

REMITTANCE FORM

$

DISCOUNT:

Allowed on subtotal of (F) P/J

POLICE JURISDICTION = P/J

(4)(a) 5% on first $100 (or less):

$

DISCOUNT:

Allowed on subtotal of (F) P/J

Effective Date

: 11/01/2008

(4)(b) .0075 on tax over $100:

$

(4) TOTAL DISCOUNT:

(4)(a) + (4)(b)

$

By signing this report I am certifying that this report, including

any accompanying schedules or statements, has been

IF ON TIME: Item (1) minus Item (4)

examined by me and is to the best of my knowledge and belief,

a true and complete report for the period stated.

(5) NET TAX DUE:

IF DELINQUENT: Items (1) + (2) + (3)

$

DATE:

No. of Automotive Vehicles ________ Withdrawn @ $5.00 each: . . .

$

TITLE:

TOTAL SELLERS USE / SALES | CONSUMERS USE TAX - DUE AND ENCLOSED: $

This Return Is For Sales and Use Tax Only

Make Check Payable to: City of Montgomery

Police Jurisdiction Return Only

Remit to: P.O. Box 5070 Montgomery, AL 36103-5070

SIGNATURE:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2