Sellers Use / Sales Tax / Consumers Use Tax Form - City Of Montgomery, Alabama Page 2

ADVERTISEMENT

DEFINITIONS

SELLERS USE / SALES TAX

a. Automotive / Agricultural: Include new and used automotive vehicles, semi-trailers, truck trailers, house trailers and agricultural machinery.

b. Manufacturing: Machines and replacement parts used in manufacturing, etc.

c. General: Includes retail price of food products sold for human consumption through vending machines, gross receipts from places of

amusement; cost of property purchased at wholesale withdrawn for use; collections during month on credit sales previously claimed as deductions; and all

other sales of tangible personal property not previously claimed.

CONSUMER'S USE TAX

a. Automotive / Agricultural: Total purchase price of automotive vehicles, truck trailers, semi-trailers, house trailers and agricultural machinery, both new

and used purchased for storage, use or other consumption in Montgomery on which seller has not collected Montgomery City Sales and/or Use Tax.

b. Manufacturing: Total purchase price of machines and replacement parts used in compounding, mining, quarrying, manufacturing of tangible property.

c. General: Total purchase price of tangible personal property purchased outside of Montgomery City or in Interstate Commerce for storage, use or

consumption in this city on which seller has not collected use tax from you except purchases of automotive vehicles, truck trailers, semi-trailers, house

trailers, agricultural machinery and machines and replacement parts.

Use Tax is the counterpart of sales tax and should be paid by individuals or businesses when making purchases outside the City of Montgomery on

taxable items for which a sales tax was not collected by the seller.

Police Jurisdiction Tax

a. Sales or deliveries made within the City Limits of Montgomery (City) and / or within the Police Jurisdiction

Levy of Tax in Police Jurisdiction.

(P/J) must be itemized and remitted on separate forms between CITY (Form 1) and P/J (Form 2). Police Jurisdiction is defined as three (3)

miles outside the city limits of Montgomery.

INSTRUCTIONS & INFORMATION CONCERNING THE COMPLETION OF THIS REPORT

To avoid the application of penalty and / or interest amounts, this report must be filed on or before the 20th of the month, following the period for which the

report is submitted, even though zero tax is due.

Cancellation postmark will determine timely filing.

A remittance for the total amount due made payable to the "City of Montgomery" must be submitted with this report.

This report should be submitted on a MONTHLY basis unless you have requested and been approved for a different filing frequency by this taxing jurisdiction.

Any credit for prior overpayment must be approved in advance by the taxing jurisdiction and accompanied by a letter of credit from the taxing jurisdiction.

No duplication or replicated forms are acceptable except with the prior approval of the taxing jurisdiction.

Remittance of Seller's Use / Sales Tax and Consumers Use Tax,within City Limits of Montgomery,must use separate Tax Form 1 and mailed to Compass Bank B'ham AL.

Remittance of Seller's Use / Sales Tax and Consumers Use Tax, within Police Jurisdiction, must use separate Tax Form 2 and mailed to City of Montgomery.

Remittance of Rental Tax, within City Limits of Montgomery and / or Police Jurisdiction, must be consolidated onto Tax Form 3 and mailed to City of Montgomery.

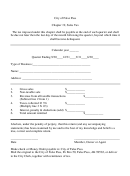

STANDARD DEDUCTION SUMMARY TABLE

(SUMMARY BELOW MUST BE COMPLETED TO CORRESPOND WITH TOTAL DEDUCTIONS ON FRONT OF TAX REPORT)

SELLERS USE SALES

SELLERS USE SALES

SELLERS USE SALES

CONSUMERS USE TAX

CONSUMERS USE TAX

CONSUMERS USE TAX

TOTAL

TAX

TAX

TAX

DEDUCTIONS

AUTO / AGRICULTURAL

MANUFACT

GENERAL

AUTO / AGRICULTURAL

MANUFACT

GENERAL

WHOLESALE

P/J

SALES

AUTO/MACH

P/J

TRADE-INS

LABOR/NON

P/J

TAXABLE SER

SALES DELIV

P/J

OUTSIDE JURIS

SALES TO GOVT

P/J

OR ITS AGENCIES

SALES OF GAS

P/J

OR LUBE OILS

OTHER ALLOWED

P/J

DEDUCTIONS

TOTAL

P/J

DEDUCTIONS

INDICATE ANY CHANGE OF BUSINESS INFORMATION BELOW - Sign and Date front of return

Business Name:

Phone:

Physical Address:

Fax:

Mailing Address:

Email:

City/State/Zip:

Contact:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2