Tax Increment Financing Economic Activity Tax (Eats) Summary Form - Edc - Tif Commission - Kansas City, Missouri

ADVERTISEMENT

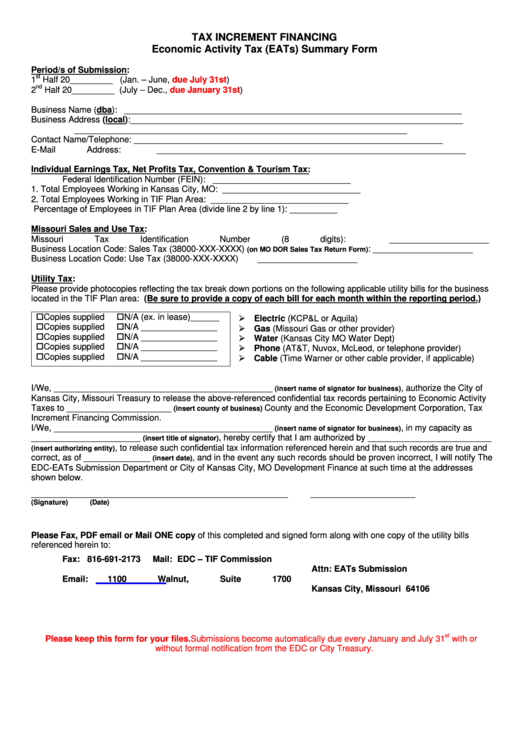

TAX INCREMENT FINANCING

Economic Activity Tax (EATs) Summary Form

Period/s of Submission:

st

1

Half 20_________ (Jan. – June,

due July

31st)

nd

2

Half 20_________ (July – Dec.,

due January

31st)

Business Name (dba): _______________________________________________________________________

Business Address (local):______________________________________________________________________

______________________________________________________________________

Contact Name/Telephone:

_________________________________________________________________

E-Mail Address:

_________________________________________________________________

Individual Earnings Tax, Net Profits Tax, Convention & Tourism Tax:

Federal Identification Number (FEIN):

_____________________________

1.

Total Employees Working in Kansas City, MO:

_____________________________

2.

Total Employees Working in TIF Plan Area:

_____________________________

Percentage of Employees in TIF Plan Area (divide line 2 by line 1):

__________

Missouri Sales and Use Tax:

Missouri Tax Identification Number (8 digits):

_____________________

Business Location Code: Sales Tax (38000-XXX-XXXX)

: _____________________

(on MO DOR Sales Tax Return Form)

Business Location Code: Use Tax (38000-XXX-XXXX)

_____________________

Utility Tax:

Please provide photocopies reflecting the tax break down portions on the following applicable utility bills for the business

located in the TIF Plan area: (Be sure to provide a copy of each bill for each month within the reporting period.)

Copies supplied

N/A (ex. in lease)______

Electric (KCP&L or Aquila)

Copies supplied

N/A ________________

Gas (Missouri Gas or other provider)

Copies supplied

N/A ________________

Water (Kansas City MO Water Dept)

Copies supplied

N/A ________________

Phone (AT&T, Nuvox, McLeod, or telephone provider)

Copies supplied

N/A ________________

Cable (Time Warner or other cable provider, if applicable)

I/We, ______________________________________________

, authorize the City of

(insert name of signator for business)

Kansas City, Missouri Treasury to release the above-referenced confidential tax records pertaining to Economic Activity

Taxes to ______________________

County and the Economic Development Corporation, Tax

(insert county of business)

Increment Financing Commission.

I/We, ______________________________________________

, in my capacity as

(insert name of signator for business)

_______________________

, hereby certify that I am authorized by __________________________

(insert title of signator)

, to release such confidential tax information referenced herein and that such records are true and

(insert authorizing entity)

correct, as of ______________

, and in the event any such records should be proven incorrect, I will notify The

(insert date)

EDC-EATs Submission Department or City of Kansas City, MO Development Finance at such time at the addresses

shown below.

______________________________________________________

______________________

(Signature)

(Date)

Please Fax, PDF email or Mail ONE copy of this completed and signed form along with one copy of the utility bills

referenced herein to:

Fax: 816-691-2173

Mail:

EDC – TIF Commission

Attn: EATs Submission

Email:

1100 Walnut, Suite 1700

Kansas City, Missouri 64106

st

Please keep this form for your files. Submissions become automatically due every January and July 31

with or

without formal notification from the EDC or City Treasury.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1