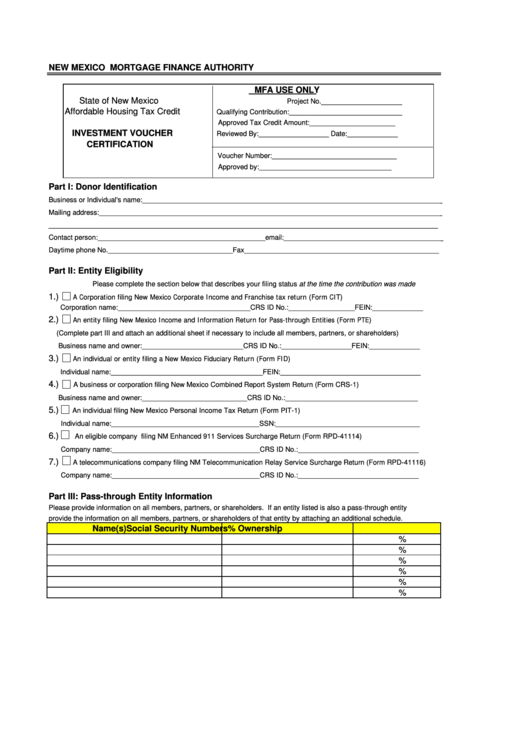

NEW MEXICO MORTGAGE FINANCE AUTHORITY

MFA USE ONLY

State of New Mexico

_________________

Project No.

Affordable Housing Tax Credit

Qualifying Contribution:_____________________________

Approved Tax Credit Amount:______________________

INVESTMENT VOUCHER

Reviewed By:__________________ Date:_____________

CERTIFICATION

Voucher Number:________________________________

Approved by:__________________________________

Part I: Donor Identification

Business or Individual's name:______________________________________________________________________________

Mailing address:_________________________________________________________________________________________

__________________________________________________________________________________

Contact person:___________________________________________email:__________________________________________

Daytime phone No.________________________________Fax__________________________________________________

Part II: Entity Eligibility

Please complete the section below that describes your filing status at the time the contribution was made

A Corporation filing New Mexico Corporate Income and Franchise tax return (Form CIT)

1.)

Corporation name:__________________________________CRS ID No.:_________________FEIN:_____________

An entity filing New Mexico Income and Information Return for Pass-through Entities (Form PTE)

2.)

(Complete part III and attach an additional sheet if necessary to include all members, partners, or shareholders)

Business name and owner:__________________________CRS ID No.:__________________FEIN:_____________

An individual or entity filing a New Mexico Fiduciary Return (Form FID)

3.)

Individual name:_______________________________________FEIN:____________________________________

4.)

A business or corporation filing New Mexico Combined Report System Return (Form CRS-1)

Business name and owner:___________________________CRS ID No.:__________________________________

5.)

An individual filing New Mexico Personal Income Tax Return (Form PIT-1)

Individual name:______________________________________SSN:_____________________________________

6.)

An eligible company filing NM Enhanced 911 Services Surcharge Return (Form RPD-41114)

Company name:______________________________________CRS ID No.:_______________________________

7.)

A telecommunications company filing NM Telecommunication Relay Service Surcharge Return (Form RPD-41116)

Company name:______________________________________CRS ID No.:_______________________________

Part III: Pass-through Entity Information

Please provide information on all members, partners, or shareholders. If an entity listed is also a pass-through entity

provide the information on all members, partners, or shareholders of that entity by attaching an additional schedule.

Name(s)

Social Security Numbers

% Ownership

%

%

%

%

%

%

1

1 2

2