Form Ir-2005 - Tax Return

ADVERTISEMENT

2005

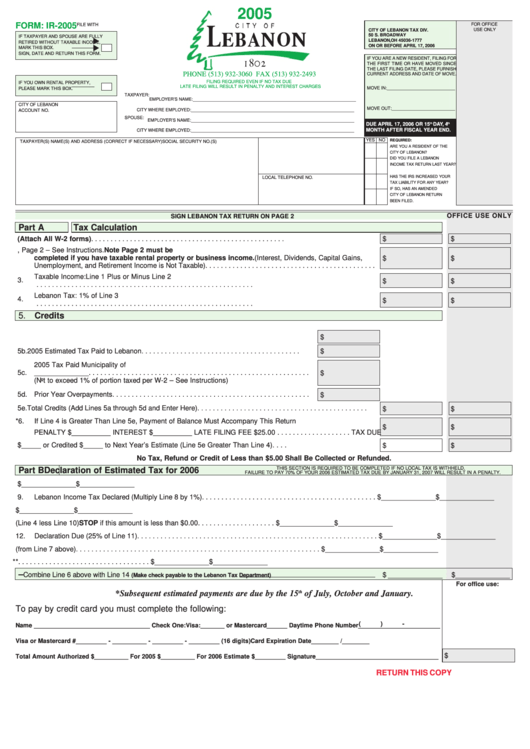

FORM: IR-2005

FOR OFFICE

FILE WITH

CITY OF LEBANON TAX DIV.

USE ONLY

50 S. BROADWAY

IF TAXPAYER AND SPOUSE ARE FULLY

LEBANON, OH 45036-1777

RETIRED WITHOUT TAXABLE INCOME,

ON OR BEFORE APRIL 17, 2006

MARK THIS BOX.

SIGN, DATE AND RETURN THIS FORM.

IF YOU ARE A NEW RESIDENT, FILING FOR

THE FIRST TIME OR HAVE MOVED SINCE

THE LAST FILING DATE, PLEASE FURNISH

PHONE (513) 932-3060 FAX (513) 932-2493

CURRENT ADDRESS AND DATE OF MOVE.

FILING REQUIRED EVEN IF NO TAX DUE

IF YOU OWN RENTAL PROPERTY,

LATE FILING WILL RESULT IN PENALTY AND INTEREST CHARGES

MOVE IN:____________________________

PLEASE MARK THIS BOX.

TAXPAYER:

EMPLOYER’S NAME: ___________________________________________________________________

CITY OF LEBANON

MOVE OUT:__________________________

CITY WHERE EMPLOYED: ___________________________________________________________________

ACCOUNT NO.

SPOUSE:

EMPLOYER’S NAME: ___________________________________________________________________

DUE APRIL 17, 2006 OR 15

th

DAY, 4

th

MONTH AFTER FISCAL YEAR END.

CITY WHERE EMPLOYED: ___________________________________________________________________

YES NO

REQUIRED:

TAXPAYER(S) NAME(S) AND ADDRESS (CORRECT IF NECESSARY)

SOCIAL SECURITY NO.(S)

ARE YOU A RESIDENT OF THE

CITY OF LEBANON?

DID YOU FILE A LEBANON

INCOME TAX RETURN LAST YEAR?

HAS THE IRS INCREASED YOUR

LOCAL TELEPHONE NO.

TAX LIABILITY FOR ANY YEAR?

IF SO, HAS AN AMENDED

CITY OF LEBANON RETURN

BEEN FILED.

OFFICE USE ONLY

SIGN LEBANON TAX RETURN ON PAGE 2

Part A

Tax Calculation

1.

Total Qualifying Wages (Attach All W-2 forms) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

2.

Other Taxable Income and/or Deductions from Line 19 or 21, Page 2 – See Instructions. Note Page 2 must be

completed if you have taxable rental property or business income. (Interest, Dividends, Capital Gains,

$

$

Unemployment, and Retirement Income is Not Taxable). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxable Income: Line 1 Plus or Minus Line 2

3.

$

$

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Lebanon Tax: 1% of Line 3

4.

$

$

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Credits

5a. Lebanon Tax Withheld Per W-2s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

5b. 2005 Estimated Tax Paid to Lebanon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

2005 Tax Paid Municipality of

5c.

______________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

(Not to exceed 1% of portion taxed per W-2 – See Instructions)

5d. Prior Year Overpayments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

5e. Total Credits (Add Lines 5a through 5d and Enter Here) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

*6.

If Line 4 is Greater Than Line 5e, Payment of Balance Must Accompany This Return

$

$

PENALTY $__________ INTEREST $__________ LATE FILING FEE $25.00 . . . . . . . . . . . . . . . . . . . TAX DUE

7.

Overpayment Refunded $_____ or Credited $_____ to Next Year’s Estimate (Line 5e Greater Than Line 4). . . .

$

$

No Tax, Refund or Credit of Less than $5.00 Shall Be Collected or Refunded.

THIS SECTION IS REQUIRED TO BE COMPLETED IF NO LOCAL TAX IS WITHHELD.

Part B

Declaration of Estimated Tax for 2006

FAILURE TO PAY 70% OF YOUR 2006 ESTIMATED TAX DUE BY JANUARY 31, 2007 WILL RESULT IN A PENALTY.

8.

Total estimated income subject to tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

$ ______________

9.

Lebanon Income Tax Declared (Multiply Line 8 by 1%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

$ ______________

10.

Estimated Taxes Withheld from Wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

$ ______________

11.

Tax due after Withholding (Line 4 less Line 10) STOP if this amount is less than $0.00 . . . . . . . . . . . . . . . . . . . .

$ ______________

$ ______________

12.

Declaration Due (25% of Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

$ ______________

13.

Less credits (from Line 7 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

$ ______________

*

14.

Net estimated tax due if Line 12 minus Line 13 is greater than zero* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ______________

$ ______________

15. TOTAL AMOUNT DUE –

Combine Line 6 above with Line 14

$ ______________

$ ______________

(Make check payable to the Lebanon Tax Department)

For office use:

*Subsequent estimated payments are due by the 15

th

of July, October and January.

To pay by credit card you must complete the following:

(

)

-

Name __________________________________ Check One: Visa:_______ or Mastercard ______ Daytime Phone Number________________________

Visa or Mastercard # _________ - __________ - _________ - _________ (16 digits)

Card Expiration Date ________ / ________

$

Total Amount Authorized $ __________ For 2005 $__________ For 2006 Estimate $ _________ Signature____________________________________

RETURN THIS COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3