Form 9m 3/01 - Taxpayer Advisory Bulletin - State Of Massachusetts Page 11

ADVERTISEMENT

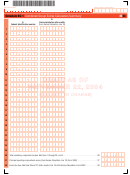

2

nd Quarter

2001 Tax Calendar*

Date**

Form

Form Title

Comments

April

7

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

17

1

Resident Income Tax Return

—

1-NR/PY

Nonresident/Part-Year Resident Income Tax Return

—

Telefile

Telefile

—

M-4868

Application for Automatic Six-Month Extension of Time to File

Six months

M-8736

Application for Extension of Time to File Fiduciary, Partnership or

Corporate Trust Return

Six months

1-ES

Personal Income Estimated Tax Payment

1st Quarter

2-ES

Estimated Tax Payment for Filers of Form 2, 3F and 3M

1st Quarter

ST-11

Individual Use Tax Return

—

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

180

Tax Return of Certain Corporations, Associations and Organizations Engaged

—

in the Sale of Alcoholic Beverages

20

ST-9Q

Quarterly Sales and Use Tax Return

$101 to $1,200

ST-9

Monthly Sales and Use Tax Return

Over $1,200

ST-MAB4

Monthly Sales Tax on Meals, Prepared Food and All Beverages Return

—

RO-2

Monthly Room Occupancy Excises Return

—

22

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

30

M-941D

Quarterly Return of Income Taxes Withheld for Employer Paying Weekly

Over $25,000

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

M-941

Employer’s Quarterly Return of Income Taxes Withheld

$101 to $1,200

M-942

Employer’s Monthly Return of Income Taxes Withheld

$1,201 to $25,000

May

7

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

15

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

M-942

Employer’s Monthly Return of Income Taxes Withheld

$1,201 to $25,000

20

ST-9

Monthly Sales and Use Tax Return

Over $1,200

ST-MAB4

Monthly Sales Tax on Meals, Prepared Food and All Beverages Return

—

RO-2

Monthly Room Occupancy Excises Return

—

22

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

31

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

June

7

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

15

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

1-ES

Personal Income Estimated Tax Payment

2nd Quarter

2-ES

Estimated Tax Payment for Filers of Form 2, 3F and 3M

2nd Quarter

355-ES

Corporation Estimated Tax Payment

2nd Quarter

(calendar year filers)

M-942

Employer’s Monthly Return of Income Taxes Withheld

$1,201 to $25,000

20

ST-9

Monthly Sales and Use Tax Return

Over $1,200

ST-MAB4

Monthly Sales Tax on Meals, Prepared Food and All Beverages Return

—

RO-2

Monthly Room Occupancy Excises Return

—

22

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

30

M-941W

Employer’s Weekly Payment of Income Taxes Withheld

Over $25,000

* For certain taxes.

** For certain business taxes, the number of days for payment after the close of each taxable period may vary — see specific forms and instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12