Form Ct-3911 - Taxpayer Statement Regarding State Of Connecticut Tax Refund - Connecticut Department Of Revenue

ADVERTISEMENT

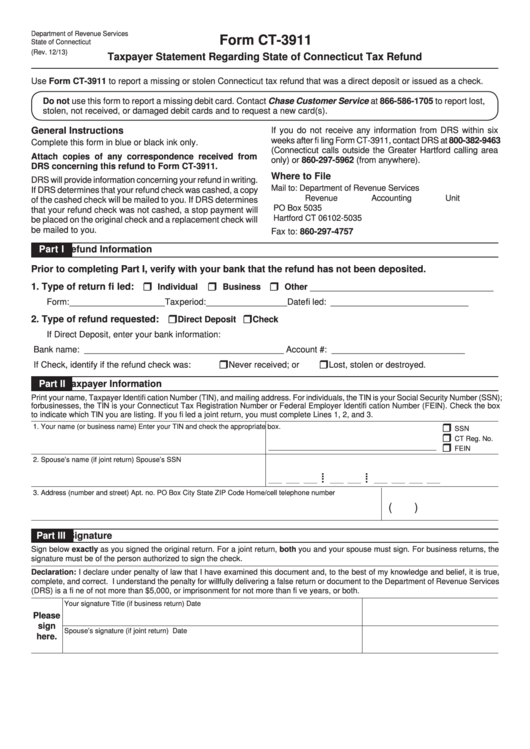

Department of Revenue Services

Form CT-3911

State of Connecticut

(Rev. 12/13)

Taxpayer Statement Regarding State of Connecticut Tax Refund

Use Form CT-3911 to report a missing or stolen Connecticut tax refund that was a direct deposit or issued as a check.

Do not use this form to report a missing debit card. Contact Chase Customer Service at 866-586-1705 to report lost,

stolen, not received, or damaged debit cards and to request a new card(s).

General Instructions

If you do not receive any information from DRS within six

weeks after fi ling Form CT-3911, contact DRS at 800-382-9463

Complete this form in blue or black ink only.

(Connecticut calls outside the Greater Hartford calling area

Attach copies of any correspondence received from

only) or 860-297-5962 (from anywhere).

DRS concerning this refund to Form CT-3911.

Where to File

DRS will provide information concerning your refund in writing.

Mail to: Department of Revenue Services

If DRS determines that your refund check was cashed, a copy

Revenue Accounting Unit

of the cashed check will be mailed to you. If DRS determines

PO Box 5035

that your refund check was not cashed, a stop payment will

Hartford CT 06102-5035

be placed on the original check and a replacement check will

be mailed to you.

Fax to: 860-297-4757

Part I

Refund Information

Prior to completing Part I, verify with your bank that the refund has not been deposited.

1. Type of return fi led:

___________________________________

Individual

Business

Other

Form: ____________________

Tax period: _________________

Date fi led: _____________________________

2. Type of refund requested:

Direct Deposit

Check

If Direct Deposit, enter your bank information:

Bank name: __________________________________________

Account #: ____________________________

If Check, identify if the refund check was:

Never received; or

Lost, stolen or destroyed.

Part II

Taxpayer Information

Print your name, Taxpayer Identifi cation Number (TIN), and mailing address. For individuals, the TIN is your Social Security Number (SSN);

for businesses, the TIN is your Connecticut Tax Registration Number or Federal Employer Identifi cation Number (FEIN). Check the box

to indicate which TIN you are listing. If you fi led a joint return, you must complete Lines 1, 2, and 3.

1. Your name (or business name)

Enter your TIN and check the appropriate box.

SSN

CT Reg. No.

FEIN

2. Spouse’s name (if joint return)

Spouse’s SSN

• •

• •

• •

• •

___ ___ ___

___ ___

___ ___ ___ ___

3. Address (number and street)

Apt. no.

PO Box

City

State

ZIP Code

Home/cell telephone number

(

)

Part III

Signature

Sign below exactly as you signed the original return. For a joint return, both you and your spouse must sign. For business returns, the

signature must be of the person authorized to sign the check.

Declaration: I declare under penalty of law that I have examined this document and, to the best of my knowledge and belief, it is true,

complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of Revenue Services

(DRS) is a fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both.

Your signature

Title (if business return)

Date

Please

sign

Spouse’s signature (if joint return)

Date

here.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1