Form Cbs-1 - Notice Of Sale Or Purchase Of Business Assets

ADVERTISEMENT

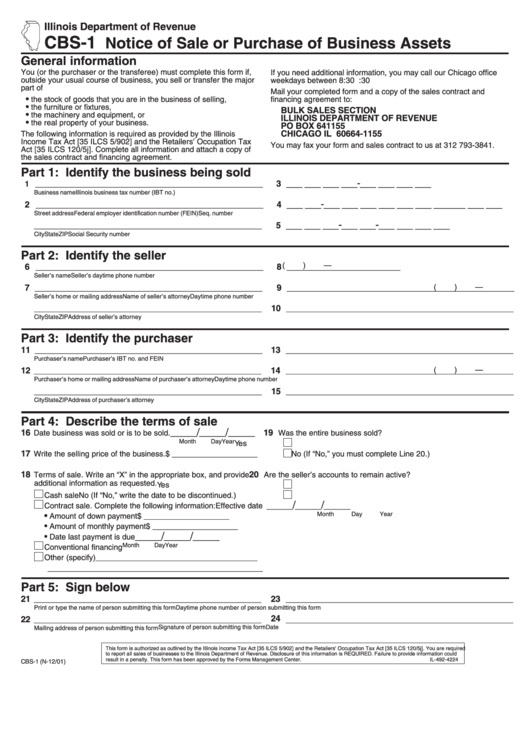

Illinois Department of Revenue

CBS-1

Notice of Sale or Purchase of Business Assets

General information

You (or the purchaser or the transferee) must complete this form if,

If you need additional information, you may call our Chicago office

outside your usual course of business, you sell or transfer the major

weekdays between 8:30 a.m. and 4:30 p.m. at 312 814-3063.

part of

Mail your completed form and a copy of the sales contract and

•

the stock of goods that you are in the business of selling,

financing agreement to:

•

the furniture or fixtures,

BULK SALES SECTION

•

the machinery and equipment, or

ILLINOIS DEPARTMENT OF REVENUE

•

the real property of your business.

PO BOX 641155

The following information is required as provided by the Illinois

CHICAGO IL 60664-1155

Income Tax Act [35 ILCS 5/902] and the Retailers’ Occupation Tax

You may fax your form and sales contract to us at 312 793-3841.

Act [35 ILCS 120/5j]. Complete all information and attach a copy of

the sales contract and financing agreement.

Part 1: Identify the business being sold

___ ___ ___ ___-___ ___ ___ ___

3

1 ____________________________________________________

Business name

Illinois business tax number (IBT no.)

___ ___-___ ___ ___ ___ ___ ___ ___ ___ ___ ___

2

4

____________________________________________________

Street address

Federal employer identification number (FEIN)

Seq. number

___ ___ ___-___ ___-___ ___ ___ ___

5

____________________________________________________

City

State

ZIP

Social Security number

Part 2: Identify the seller

(

)

—

6

8

____________________________________________________

__________________________

Seller’s name

Seller’s daytime phone number

7

9

(

)

—

____________________________________________________

____________________________________________________

Seller’s home or mailing address

Name of seller’s attorney

Daytime phone number

10

____________________________________________________

____________________________________________________

City

State

ZIP

Address of seller’s attorney

Part 3: Identify the purchaser

11

13

____________________________________________________

____________________________________________________

Purchaser’s name

Purchaser’s IBT no. and FEIN

(

)

—

12

14

____________________________________________________

____________________________________________________

Purchaser’s home or mailing address

Name of purchaser’s attorney

Daytime phone number

15

____________________________________________________

____________________________________________________

City

State

ZIP

Address of purchaser’s attorney

Part 4: Describe the terms of sale

_____/_____/_____

16

19

Date business was sold or is to be sold.

Was the entire business sold?

Month

Day

Year

Yes

17

Write the selling price of the business. $ ____________________

No (If “No,” you must complete Line 20.)

18

20

Terms of sale. Write an “X” in the appropriate box, and provide

Are the seller’s accounts to remain active?

additional information as requested.

Yes

Cash sale

No (If “No,” write the date to be discontinued.)

_____/_____/_____

Contract sale. Complete the following information:

Effective date

Month

Day

Year

•

Amount of down payment

$ ____________________

•

Amount of monthly payment

$ ____________________

_____/_____/_____

•

Date last payment is due

Month

Day

Year

Conventional financing

Other (specify) _____________________________________

__________________________________________________

Part 5: Sign below

21

23

____________________________________________________

____________________________________________________

Print or type the name of person submitting this form

Daytime phone number of person submitting this form

24

22

____________________________________________________

____________________________________________________

Signature of person submitting this form

Date

Mailing address of person submitting this form

This form is authorized as outlined by the Illinois Income Tax Act [35 ILCS 5/902] and the Retailers' Occupation Tax Act [35 ILCS 120/5j]. You are required

to report all sales of businesses to the Illinois Department of Revenue. Disclosure of this information is REQUIRED. Failure to provide information could

result in a penalty. This form has been approved by the Forms Management Center.

IL-492-4224

CBS-1 (N-12/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1