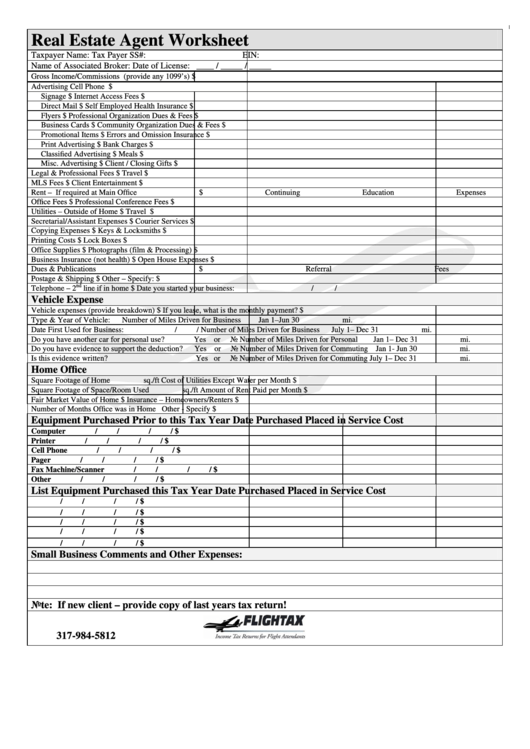

Real Estate Agent Worksheet

ADVERTISEMENT

Real Estate Agent Worksheet

Taxpayer Name:

Tax Payer SS#:

EIN:

Name of Associated Broker:

Date of License: ____ / _____ / _____

Gross Income/Commissions (provide any 1099’s)

$

Advertising

Cell Phone

$

Signage

$

Internet Access Fees

$

Direct Mail

$

Self Employed Health Insurance

$

Flyers

$

Professional Organization Dues & Fees

$

Business Cards

$

Community Organization Dues & Fees

$

Promotional Items

$

Errors and Omission Insurance

$

Print Advertising

$

Bank Charges

$

Classified Advertising

$

Meals

$

Misc. Advertising

$

Client / Closing Gifts

$

Legal & Professional Fees

$

Travel

$

MLS Fees

$

Client Entertainment

$

Rent – If required at Main Office

$

Continuing Education Expenses

$

Office Fees

$

Professional Conference Fees

$

Utilities – Outside of Home

$

Travel

$

Secretarial/Assistant Expenses

$

Courier Services

$

Copying Expenses

$

Keys & Locksmiths

$

Printing Costs

$

Lock Boxes

$

Office Supplies

$

Photographs (film & Processing)

$

Business Insurance (not health)

$

Open House Expenses

$

Dues & Publications

$

Referral Fees

$

Postage & Shipping

$

Other – Specify:

$

nd

Telephone – 2

line if in home

$

Date you started your business:

/

/

Vehicle Expense

Vehicle expenses (provide breakdown)

$

If you lease, what is the monthly payment?

$

Type & Year of Vehicle:

Number of Miles Driven for Business

Jan 1–Jun 30

mi.

Date First Used for Business:

/

/

Number of Miles Driven for Business

July 1– Dec 31

mi.

Do you have another car for personal use?

Yes or

No

Number of Miles Driven for Personal

Jan 1– Dec 31

mi.

Do you have evidence to support the deduction?

Yes or

No

Number of Miles Driven for Commuting Jan 1- Jun 30

mi.

Is this evidence written?

Yes or

No

Number of Miles Driven for Commuting July 1– Dec 31

mi.

Home Office

Square Footage of Home

sq./ft

Cost of Utilities Except Water per Month

$

Square Footage of Space/Room Used

sq./ft

Amount of Rent Paid per Month

$

Fair Market Value of Home

$

Insurance – Homeowners/Renters

$

Number of Months Office was in Home

Other - Specify

$

Equipment Purchased Prior to this Tax Year

Date Purchased

Placed in Service

Cost

Computer

/

/

/

/

$

Printer

/

/

/

/

$

Cell Phone

/

/

/

/

$

Pager

/

/

/

/

$

Fax Machine/Scanner

/

/

/

/

$

Other

/

/

/

/

$

List Equipment Purchased this Tax Year

Date Purchased

Placed in Service

Cost

/

/

/

/

$

/

/

/

/

$

/

/

/

/

$

/

/

/

/

$

/

/

/

/

$

Small Business Comments and Other Expenses:

Note: If new client – provide copy of last years tax return!

317-984-5812

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1