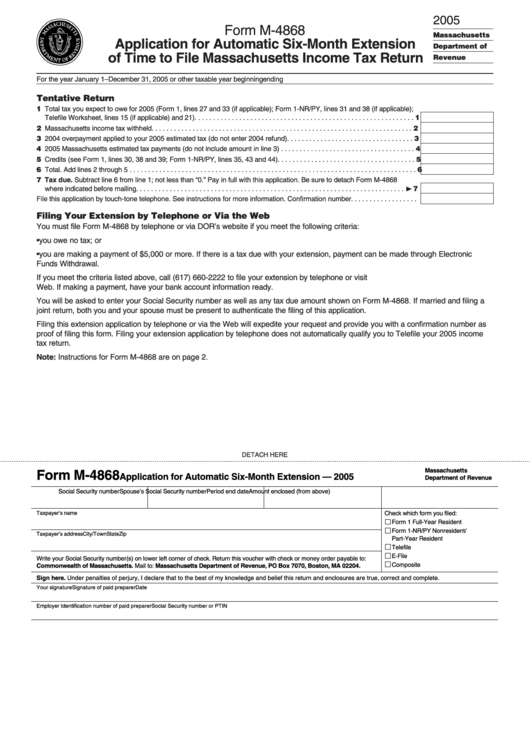

Form M-4868 - Application For Automatic Six-Month Extension Of Time To File Massachusetts Income Tax Return

ADVERTISEMENT

2005

Form M-4868

Massachusetts

Application for Automatic Six-Month Extension

Department of

of Time to File Massachusetts Income Tax Return

Revenue

For the year January 1–December 31, 2005 or other taxable year beginning

ending

Tentative Return

1 Total tax you expect to owe for 2005 (Form 1, lines 27 and 33 (if applicable); Form 1-NR/PY, lines 31 and 38 (if applicable);

Telefile Worksheet, lines 15 (if applicable) and 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Massachusetts income tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 2004 overpayment applied to your 2005 estimated tax (do not enter 2004 refund) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 2005 Massachusetts estimated tax payments (do not include amount in line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Credits (see Form 1, lines 30, 38 and 39; Form 1-NR/PY, lines 35, 43 and 44) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Total. Add lines 2 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Tax due. Subtract line 6 from line 1; not less than “0.” Pay in full with this application. Be sure to detach Form M-4868

where indicated before mailing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹ 7

File this application by touch-tone telephone. See instructions for more information. Confirmation number . . . . . . . . . . . . . . . . . .

Filing Your Extension by Telephone or Via the Web

You must file Form M-4868 by telephone or via DOR’s website if you meet the following criteria:

• you owe no tax; or

• you are making a payment of $5,000 or more. If there is a tax due with your extension, payment can be made through Electronic

Funds Withdrawal.

If you meet the criteria listed above, call (617) 660-2222 to file your extension by telephone or visit to file via the

Web. If making a payment, have your bank account information ready.

You will be asked to enter your Social Security number as well as any tax due amount shown on Form M-4868. If married and filing a

joint return, both you and your spouse must be present to authenticate the filing of this application.

Filing this extension application by telephone or via the Web will expedite your request and provide you with a confirmation number as

proof of filing this form. Filing your extension application by telephone does not automatically qualify you to Telefile your 2005 income

tax return.

Note: Instructions for Form M-4868 are on page 2.

DETACH HERE

Massachusetts

Form M-4868

Application for Automatic Six-Month Extension — 2005

Department of Revenue

Social Security number

Spouse’s Social Security number

Period end date

Amount enclosed (from above)

Taxpayer’s name

Check which form you filed:

Form 1 Full-Year Resident

Form 1-NR/PY Nonresident/

Taxpayer’s address

City/Town

State

Zip

Part-Year Resident

Telefile

E-File

Write your Social Security number(s) on lower left corner of check. Return this voucher with check or money order payable to:

Composite

Commonwealth of Massachusetts. Mail to: Massachusetts Department of Revenue, PO Box 7070, Boston, MA 02204.

Sign here. Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

Your signature

Signature of paid preparer

Date

Employer Identification number of paid preparer

Social Security number or PTIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1