Form N-857 - Physician'S Or Optometrist'S Certified Report On Eye Or Hearing Examination Or Disability For Tax Exemption Purposes

ADVERTISEMENT

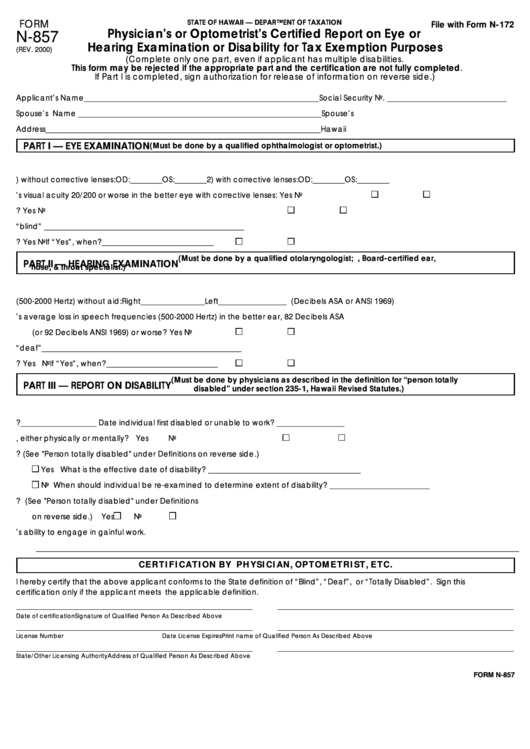

FORM

STATE OF HAWAII — DEPARTMENT OF TAXATION

File with Form N-172

Physician’s or Optometrist’s Certified Report on Eye or

N-857

Hearing Examination or Disability for Tax Exemption Purposes

(REV. 2000)

(Complete only one part, even if applicant has multiple disabilities.

This form may be rejected if the appropriate part and the certification are not fully completed.

If Part I is completed, sign authorization for release of information on reverse side.)

Applicant’s Name ___________________________________________________________

Social Security No. ______________________________

Spouse’s Name _____________________________________________________________

Spouse’s S.S.N. _________________________________

Address _____________________________________________________________________

Hawaii G.E./Use I.D. No. _________________________

PART I — EYE EXAMINATION

(Must be done by a qualified ophthalmologist or optometrist.)

a. Diagnosis ____________________________________________________________________________

b. Vision 1) without corrective lenses:

OD: ________ OS: ________

2) with corrective lenses:

OD: ________ OS: ________

c.

Is this applicant’s visual acuity 20/200 or worse in the better eye with corrective lenses:

Yes

No

d. Is the widest diameter of the field of vision less than 20 degrees?

Yes

No

e.

Date first certifiable as legally “blind” __________________________________________________

f.

Should applicant be re-examined for tax purposes?

Yes

No

If “Yes”, when? ____________________________

(Must be done by a qualified otolaryngologist; i.e., Board-certified ear,

PART II — HEARING EXAMINATION

nose, & throat specialist.)

a. Diagnosis ________________________________________________________________________________________________________________

b.

Hearing loss (500-2000 Hertz) without aid:

Right________________

Left _________________ (Decibels ASA or ANSI 1969)

c.

Is the applicant’s average loss in speech frequencies (500-2000 Hertz) in the better ear, 82 Decibels ASA

(or 92 Decibels ANSI 1969) or worse?

Yes

No

d. Date first certifiable as legally “deaf” __________________________________________________

e.

Should applicant be re-examined for tax purposes?

Yes

No

If “Yes”, when? ____________________________

(Must be done by physicians as described in the definition for “person totally

PART III — REPORT ON DISABILITY

disabled” under section 235-1, Hawaii Revised Statutes.)

a. Diagnosis ________________________________________________________________________________________________________________

b. Date individual became under your care?___________________ Date individual first disabled or unable to work? _________________

c.

Is the individual totally disabled, either physically or mentally?

Yes

No

d.

Is the disability permanent? (See "Person totally disabled" under Definitions on reverse side.)

Yes

What is the effective date of disability? ______________________________________

No

When should individual be re-examined to determine extent of disability? _________________________

e.

Is the individual able to engage in any substantial gainful business or occupation? (See "Person totally disabled" under Definitions

on reverse side.)

Yes

No

f.

Pertinent symptoms or findings that preclude the individual’s ability to engage in gainful work.

_________________________________________________________________________________________________________________________

CERTIFICATION BY PHYSICIAN, OPTOMETRIST, ETC.

I hereby certify that the above applicant conforms to the State definition of “Blind”, “Deaf”, or “Totally Disabled”. Sign this

certification only if the applicant meets the applicable definition.

Date of certification

Signature of Qualified Person As Described Above

License Number

Date License Expires

Print name of Qualified Person As Described Above

State/Other Licensing Authority

Address of Qualified Person As Described Above

FORM N-857

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1