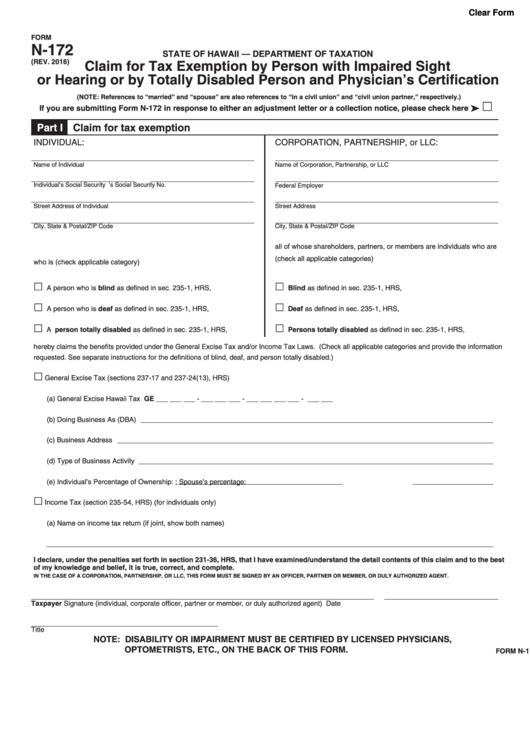

Clear Form

FORM

N-172

STATE OF HAWAII — DEPARTMENT OF TAXATION

(REV. 2016)

Claim for Tax Exemption by Person with Impaired Sight

or Hearing or by Totally Disabled Person and Physician’s Certification

(NOTE: References to “married” and “spouse” are also references to “in a civil union” and “civil union partner,” respectively.)

If you are submitting Form N-172 in response to either an adjustment letter or a collection notice, please check here

ä

Part I

Claim for tax exemption

INDIVIDUAL:

CORPORATION, PARTNERSHIP, or LLC:

Name of Individual

Name of Corporation, Partnership, or LLC

Individual’s Social Security No.

Spouse’s Social Security No.

Federal Employer I.D. No.

Street Address of Individual

Street Address

City, State & Postal/ZIP Code

City, State & Postal/ZIP Code

all of whose shareholders, partners, or members are individuals who are

(check all applicable categories)

who is (check applicable category)

A person who is blind as defined in sec. 235-1, HRS,

Blind as defined in sec. 235-1, HRS,

A person who is deaf as defined in sec. 235-1, HRS,

Deaf as defined in sec. 235-1, HRS,

A person totally disabled as defined in sec. 235-1, HRS,

Persons totally disabled as defined in sec. 235-1, HRS,

hereby claims the benefits provided under the General Excise Tax and/or Income Tax Laws. (Check all applicable categories and provide the information

requested. See separate instructions for the definitions of blind, deaf, and person totally disabled.)

General Excise Tax (sections 237-17 and 237-24(13), HRS)

(a) General Excise Hawaii Tax I.D. No. GE ___ ___ ___ - ___ ___ ___ - ___ ___ ___ ___ - ___ ___

(b) Doing Business As (DBA)

(c)

Business Address

(d) Type of Business Activity

(e) Individual’s Percentage of Ownership:

; Spouse’s percentage:

Income Tax (section 235-54, HRS) (for individuals only)

(a) Name on income tax return (if joint, show both names)

I declare, under the penalties set forth in section 231-36, HRS, that I have examined/understand the detail contents of this claim and to the best

of my knowledge and belief, it is true, correct, and complete.

IN THE CASE OF A CORPORATION, PARTNERSHIP, OR LLC, THIS FORM MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT.

Taxpayer Signature (individual, corporate officer, partner or member, or duly authorized agent)

Date

Title

NOTE: DISABILITY OR IMPAIRMENT MUST BE CERTIFIED BY LICENSED PHYSICIANS,

OPTOMETRISTS, ETC., ON THE BACK OF THIS FORM.

FORM N-172

1

1 2

2