Form Fr-119 - Claim For Refund Of Income Or Franchise Tax - 2000

ADVERTISEMENT

0000650100

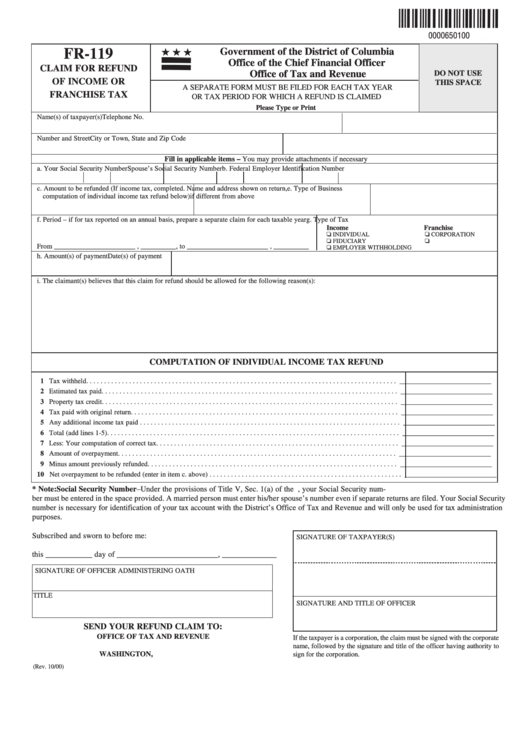

Government of the District of Columbia

FR-119

Office of the Chief Financial Officer

CLAIM FOR REFUND

Office of Tax and Revenue

DO NOT USE

OF INCOME OR

THIS SPACE

A SEPARATE FORM MUST BE FILED FOR EACH TAX YEAR

FRANCHISE TAX

OR TAX PERIOD FOR WHICH A REFUND IS CLAIMED

Please Type or Print

Name(s) of taxpayer(s)

Telephone No.

Number and Street

City or Town, State and Zip Code

Fill in applicable items – You may provide attachments if necessary

a. Your Social Security Number

Spouse’s Social Security Number

b. Federal Employer Identification Number

c. Amount to be refunded (If income tax, complete

d. Name and address shown on return,

e. Type of Business

computation of individual income tax refund below)

if different from above

f. Period – if for tax reported on an annual basis, prepare a separate claim for each taxable year

g. Type of Tax

Income

Franchise

INDIVIDUAL

CORPORATION

FIDUCIARY

UNINC.BUS.TAX

From _______________________ , __________, to _______________________ , __________

EMPLOYER WITHHOLDING

h. Amount(s) of payment

Date(s) of payment

i. The claimant(s) believes that this claim for refund should be allowed for the following reason(s):

COMPUTATION OF INDIVIDUAL INCOME TAX REFUND

1 Tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . __________________________

2 Estimated tax paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . __________________________

3 Property tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . __________________________

4 Tax paid with original return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . __________________________

5 Any additional income tax paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . __________________________

6 Total (add lines 1-5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . __________________________

7 Less: Your computation of correct tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . __________________________

8 Amount of overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . __________________________

9 Minus amount previously refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . __________________________

10 Net overpayment to be refunded (enter in item c. above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . __________________________

* Note: Social Security Number–Under the provisions of Title V, Sec. 1(a) of the D. C. Income and Franchise Tax Act, your Social Security num-

ber must be entered in the space provided. A married person must enter his/her spouse’s number even if separate returns are filed. Your Social Security

number is necessary for identification of your tax account with the District’s Office of Tax and Revenue and will only be used for tax administration

purposes.

Subscribed and sworn to before me:

SIGNATURE OF TAXPAYER(S)

this ____________ day of __________________________, ______________

SIGNATURE OF OFFICER ADMINISTERING OATH

TITLE

SIGNATURE AND TITLE OF OFFICER

SEND YOUR REFUND CLAIM TO:

OFFICE OF TAX AND REVENUE

If the taxpayer is a corporation, the claim must be signed with the corporate

P.O. BOX 556

name, followed by the signature and title of the officer having authority to

WASHINGTON, D.C. 20044-0556

sign for the corporation.

(Rev. 10/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1