Form 73a420 - Instructions For Monthly Report Of Cigarette Wholesaler - 2012 Page 2

ADVERTISEMENT

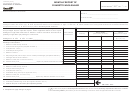

Schedule A

On page 2 of the form under Schedule A, resident wholesalers itemize all receipts of cigarettes. All columns must be

filled in. Attach a separate sheet if space does not permit the listing of all individual receipts. Identify the receipt of stamped

cigarettes with the symbol “S” after the entry including the name of the state for which the cigarettes had previously been

stamped. Nonresident wholesalers may omit Schedule A.

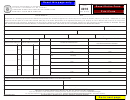

Schedule B

List under Schedule B the names and addresses of all persons to whom Kentucky stamped cigarettes were sold

on a “wholesaler” price basis during the month. List the name only once regardless of the times sales were made to that

person.

Schedule C

List under Schedule C the names and addresses of all agencies and institutions to whom tax-exempt cigarettes

were sold. Transfer the total of Schedule C to line 6, unstamped packages column on the front of the report.

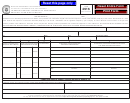

Report of “Nonparticipating Manufacturer”

Cigarettes Stamped for Kentucky

This section is used to report the number of packages of cigarettes stamped for Kentucky during the month from

Nonparticipating Manufacturers of the Master Settlement Agreement.

The report is required to be filed by the 20th of the month along with pages 1, 2, and 3 of Form 73A420. Even if you

did not stamp any cigarettes to report, you are still required to file this report with “NONE” listed.

List the name and address of the manufacturer and brand name along with the total number of individual cigarettes

(sticks) stamped from packages affixed with a Kentucky Excise Tax Stamp.

Copies of invoices covering these shipments to you should be attached to the report.

Additional instructions are located on the form.

DOR mails a quarterly list of participating manufacturers to the wholesalers.

General Information

Records must be maintained by the wholesaler or unclassified acquirer to substantiate: (1) all receipts of cigarettes;

(2) all purchases of tax evidence; and (3) all sales of both stamped and tax-exempt cigarettes.

The Monthly Report of Cigarette Wholesaler, Revenue Form 73A420, must be filed within 20 days following the end

of each monthly reporting period. Failure to file all required portions, including page 4 will cause your report to be incomplete

and you will incur late penalties and interest, until all required portions are completed.

IMPORTANT: This report shall include cigarettes in one size package. Different size packages require separate

reports. Check applicable block for this report. Packages of £ 20’s £ 25’s £ Other __________.

Reports must be signed and dated by an authorized party on the bottom of page 3.

If you need assistance call (502) 564-6823.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2