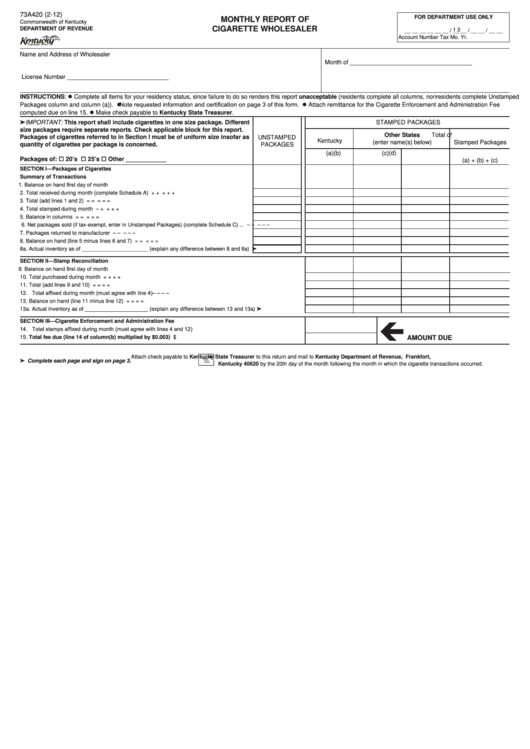

73A420 (2-12)

FOR DEPARTMENT USE ONLY

MONTHLY REPORT OF

Commonwealth of Kentucky

CIGARETTE WHOLESALER

DEPARTMENT OF REVENUE

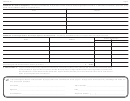

1 2

__ __ __ __ __ __ / __ __ / __ __ / __ __

Account Number

Tax

Mo.

Yr.

Name and Address of Wholesaler

Month of ____________________________________

License Number ______________________________

INSTRUCTIONS: Complete all items for your residency status, since failure to do so renders this report unacceptable (residents complete all columns, nonresidents complete Unstamped

Packages column and column (a)). Note requested information and certification on page 3 of this form. Attach remittance for the Cigarette Enforcement and Administration Fee

computed due on line 15. Make check payable to Kentucky State Treasurer.

➤IMPORTANT: This report shall include cigarettes in one size package. Different

STAMPED PACKAGES

size packages require separate reports. Check applicable block for this report.

Other States

Total of

Packages of cigarettes referred to in Section I must be of uniform size insofar as

UNSTAMPED

Kentucky

(enter name(s) below)

Stamped Packages

quantity of cigarettes per package is concerned.

PACKAGES

(d)

(a)

(b)

(c)

Packages of: 20’s

25’s Other ____________

(a) + (b) + (c)

SECTION I—Packages of Cigarettes

Summary of Transactions

1. Balance on hand first day of month .........................................................................................

2. Total received during month (complete Schedule A) ...............................................................

+

+

+

+

+

3. Total (add lines 1 and 2) ..........................................................................................................

=

=

=

=

=

4. Total stamped during month ....................................................................................................

–

+

+

+

+

5. Balance in columns .................................................................................................................

=

=

=

=

=

6. Net packages sold (if tax-exempt, enter in Unstamped Packages) (complete Schedule C) ...

–

–

–

–

–

7. Packages returned to manufacturer ........................................................................................

–

–

–

–

–

8. Balance on hand (line 5 minus lines 6 and 7) .........................................................................

=

=

=

=

=

8a. Actual inventory as of ______________________ (explain any difference between 8 and 8a) ➤

SECTION II—Stamp Reconciliation

9. Balance on hand first day of month .............................................................................................................................

10. Total purchased during month .....................................................................................................................................

+

+

+

+

11. Total (add lines 9 and 10) ............................................................................................................................................

=

=

=

=

12. Total affixed during month (must agree with line 4) .....................................................................................................

–

–

–

–

13. Balance on hand (line 11 minus line 12) .....................................................................................................................

=

=

=

=

13a. Actual inventory as of _____________________ (explain any difference between 13 and 13a) ➤

SECTION III—Cigarette Enforcement and Administration Fee

14. Total stamps affixed during month (must agree with lines 4 and 12) ..........................................................................

15. Total fee due (line 14 of column(b) multiplied by $0.003) .....................................................................................

$

AMOUNT DUE

Attach check payable to Kentucky State Treasurer to this return and mail to Kentucky Department of Revenue, Frankfort,

➤ Complete each page and sign on page 3.

Kentucky 40620 by the 20th day of the month following the month in which the cigarette transactions occurred.

1

1 2

2 3

3 4

4